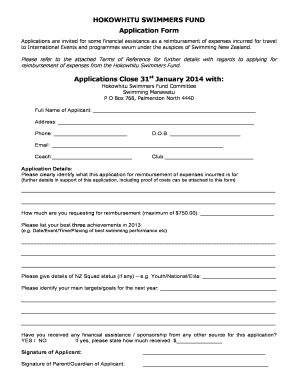

Get the free Real Property Tax Service Receipt

Show details

This document serves as a receipt for fees authorized by Real Property Tax Law Section 503, indicating that necessary fees for property updates have been paid.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real property tax service

Edit your real property tax service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property tax service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real property tax service online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit real property tax service. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real property tax service

How to fill out Real Property Tax Service Receipt

01

Obtain the Real Property Tax Service Receipt form either online or from your local tax office.

02

Fill in your personal information, including name and address, in the designated fields.

03

Enter the property identification number or tax map number associated with the property.

04

Provide the tax year for which you are paying property taxes.

05

Specify the amount being paid towards the real property tax.

06

Indicate the payment method (cash, check, or online payment) in the appropriate section.

07

Include any additional notes or information required, such as your contact number.

08

Review the completed receipt for accuracy before submission.

09

Submit the receipt to the appropriate tax authority either in person or via mail.

Who needs Real Property Tax Service Receipt?

01

Property owners who are required to pay real property taxes.

02

Individuals applying for property tax exemptions or adjustments.

03

Real estate agents and tax advisors assisting clients with tax matters.

04

Financial institutions during property appraisals.

Fill

form

: Try Risk Free

People Also Ask about

How much is D.C. property tax?

Overview of District of Columbia Taxes In Washington, D.C., the average effective property tax rate is 0.56%. However, the median real estate property tax payment is $3,957, which is higher than the national average. Not in District of Columbia?

What is the real estate property tax in California?

California property tax is low due to Proposition 13 which limits general property taxes to 1% of a property's market value and restricts increases in assessed value to 2% per year, alongside other contributing factors.

How much is property tax in Washington?

Washington State's Constitution limits the regular (non- voted) combined property tax rate that applies to an individual's property to 1% of market value ($10 per $1,000). Voter approved special levies, such as special levies for schools, are in addition to this amount.

What is the DC real property tax?

Class 1A – Residential real property, including multifamily: $0.85 per $100 of assessed value. Class 1B – Residential real property with no more than two dwelling units: The first $2.5 million of assessed value is taxed at $0.85 per $100. Any amount above $2.5 million is taxed at $1.00 per $100.

What is D.C. real property tax?

Class 1A – Residential real property, including multifamily: $0.85 per $100 of assessed value. Class 1B – Residential real property with no more than two dwelling units: The first $2.5 million of assessed value is taxed at $0.85 per $100. Any amount above $2.5 million is taxed at $1.00 per $100.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Real Property Tax Service Receipt?

Real Property Tax Service Receipt is a document that acknowledges payment of property taxes and serves as proof that the property owner has fulfilled their tax obligation for the assessment period.

Who is required to file Real Property Tax Service Receipt?

Property owners who have paid their real property taxes are typically required to file a Real Property Tax Service Receipt to confirm the payment with the relevant tax authority.

How to fill out Real Property Tax Service Receipt?

To fill out a Real Property Tax Service Receipt, property owners need to provide their property address, tax identification number, the amount paid, payment date, and any other required information as specified by the local tax authority.

What is the purpose of Real Property Tax Service Receipt?

The purpose of the Real Property Tax Service Receipt is to serve as an official record of tax payment, to confirm compliance with tax obligations, and to facilitate any future property transactions or disputes regarding tax status.

What information must be reported on Real Property Tax Service Receipt?

The information that must be reported on a Real Property Tax Service Receipt includes the property owner's name, property address, tax identification number, amount of taxes paid, payment date, and the payment method, along with any applicable reference numbers.

Fill out your real property tax service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Property Tax Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.