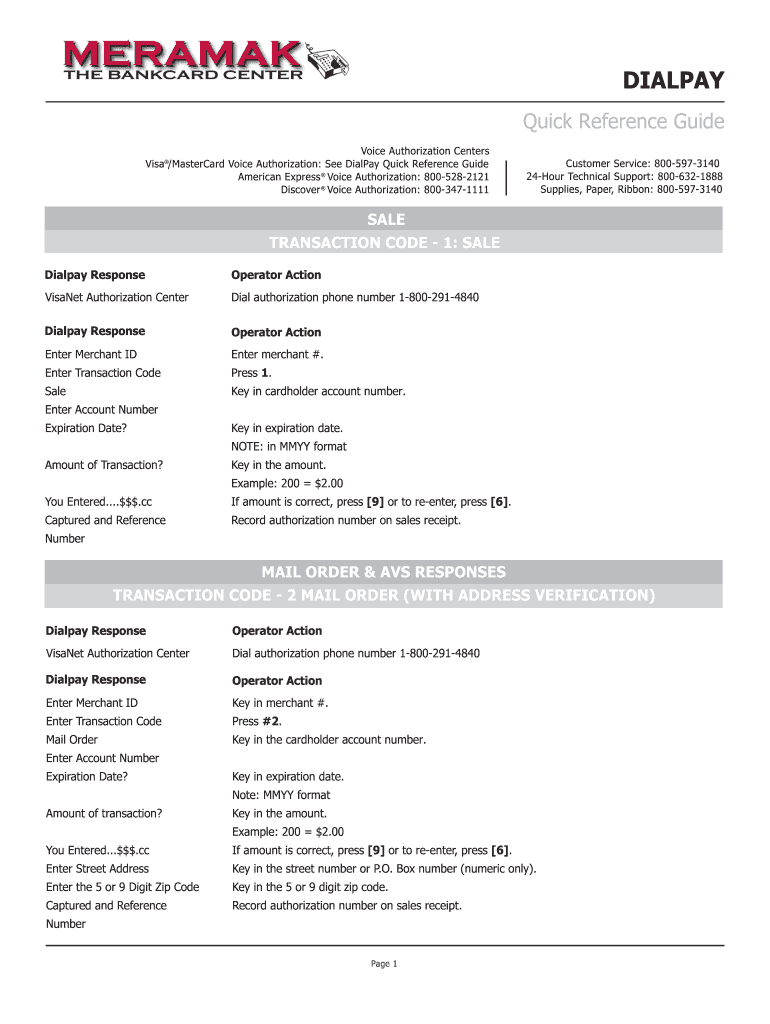

Get the free SALE TRANSACTION CODE - 1 SALE

Show details

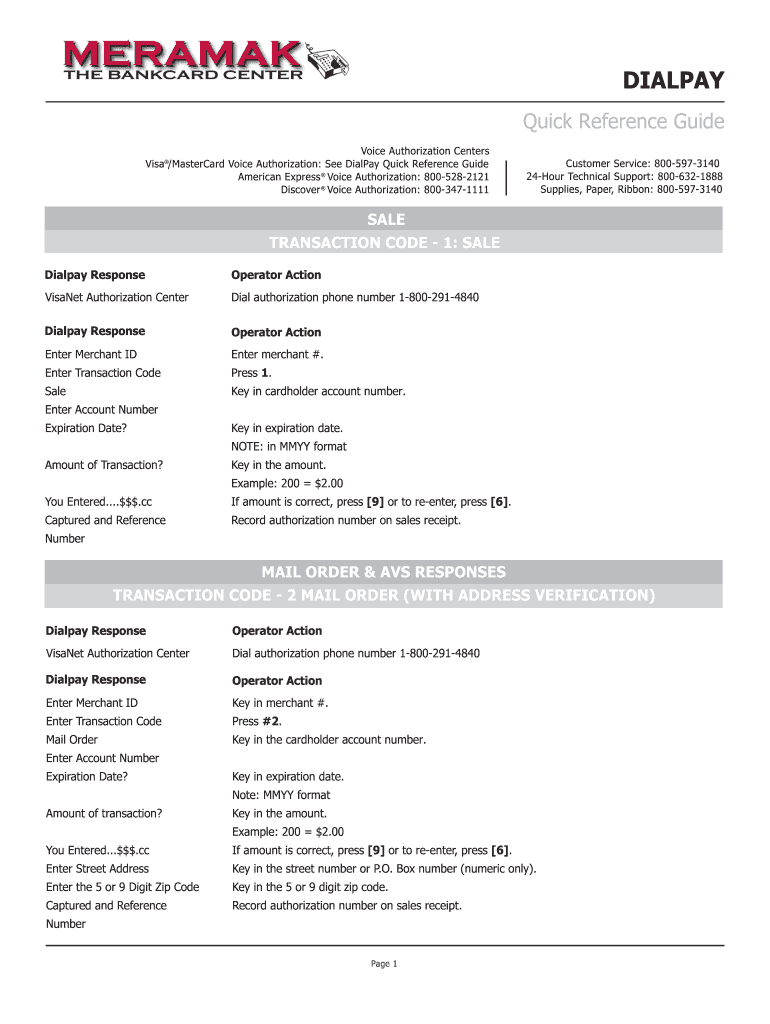

DISPLAY Quick Reference Guide Voice Authorization Centers Visa×MasterCard Voice Authorization: See Railway Quick Reference Guide American Express Voice Authorization: 8005282121 Discover Voice Authorization:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale transaction code

Edit your sale transaction code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale transaction code form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sale transaction code online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sale transaction code. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sale transaction code

How to fill out a sale transaction code:

01

Start by obtaining the necessary information for the sale transaction. This includes the product or service being sold, the quantity or duration, and any applicable discounts or promotions.

02

Identify the customer or client who is making the purchase. Gather their contact information, such as name, address, and phone number. If the sale is being made to an organization, note down the company name and relevant details.

03

Determine the payment method that will be used for the sale. This can be cash, credit card, check, or any other accepted form of payment. If it is a credit card transaction, ensure that the card details are accurately recorded.

04

Assign a unique sale transaction code to the transaction. This code is typically generated by the point-of-sale (POS) system or the accounting software being used. Make sure to follow any specific guidelines or formats provided by your organization.

05

Record the sale transaction code, along with all the relevant details, in your sales or accounting system. This ensures proper tracking and documentation of the transaction for future reference or auditing purposes.

Who needs a sale transaction code:

01

Retail businesses: Sale transaction codes are crucial for retail businesses to track and monitor their sales activities. These codes help identify individual transactions, which can then be used for inventory management, sales analysis, and reporting purposes.

02

Service providers: Professionals or businesses offering services, such as consultants, freelancers, or contractors, may also need sale transaction codes. This enables them to accurately record and bill their clients for the services rendered, ensuring proper accounting and invoicing.

03

E-commerce platforms: Online retailers rely on sale transaction codes to enable seamless and secure transactions on their websites. These codes are essential for processing online payments, managing order fulfillment, and providing customers with purchase confirmations.

In conclusion, knowing how to fill out a sale transaction code and understanding who needs them is essential for businesses and service providers alike. By following the steps outlined above, you can ensure accurate record-keeping and efficient management of your sales activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sale transaction code?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific sale transaction code and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete sale transaction code online?

Easy online sale transaction code completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the sale transaction code electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your sale transaction code in seconds.

What is sale transaction code?

Sale transaction code is a unique code assigned to each sale transaction for tracking purposes.

Who is required to file sale transaction code?

Businesses and individuals involved in the sale of goods or services are required to file a sale transaction code.

How to fill out sale transaction code?

Sale transaction code can be filled out online through the designated platform provided by the tax authorities.

What is the purpose of sale transaction code?

The purpose of sale transaction code is to track and monitor sales transactions for tax compliance and reporting.

What information must be reported on sale transaction code?

Information such as date of sale, description of goods or services, sale amount, and buyer details must be reported on sale transaction code.

Fill out your sale transaction code online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Transaction Code is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.