Get the free Board of Tax Appeals Exemption Application - gwedc

Show details

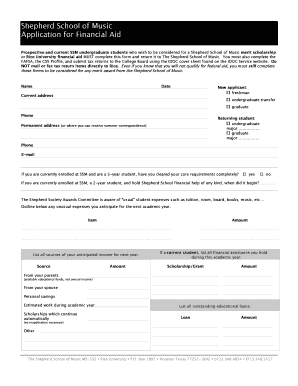

BEFORE THE BOARD OF TAX APPEALS OF THE STATE OF KANSAS IN THE MATTER OF THE APPLICATION OF FOR EXEMPTION OF PROPERTY LOCATED IN DOCKET NO. IRB COUNTY, KANSAS. APPLICATION FOR EXEMPTION FROM AD VALOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign board of tax appeals

Edit your board of tax appeals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your board of tax appeals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit board of tax appeals online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit board of tax appeals. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out board of tax appeals

How to fill out board of tax appeals:

01

Research the requirements: Start by gathering information about the specific rules and regulations of your jurisdiction's board of tax appeals. This may include the necessary forms, supporting documentation, and any deadlines that need to be met.

02

Collect the relevant documentation: Compile all the necessary documents required to support your appeal. This may include tax returns, notices of assessment, financial statements, and any other relevant evidence to support your case.

03

Complete the appeal form: Fill out the appeal form provided by the board of tax appeals. Ensure that you provide accurate and detailed information, including your contact details, the tax year(s) in question, and a clear explanation of the grounds for your appeal.

04

Attach supporting documentation: Make sure to attach all the relevant supporting documentation and evidence to your appeal form. This may include copies of tax returns, assessments, receipts, or any other documentation that supports your case.

05

Review and double-check: Before submitting your appeal, carefully review all the information and documents you have provided. Check for any errors or omissions, and ensure that your appeal is complete and well-prepared.

06

Submit the appeal: Once you are confident that your appeal is complete, submit it to the board of tax appeals according to their guidelines. This may involve sending it by mail, courier, or electronic submission, depending on the requirements of your jurisdiction.

Who needs the board of tax appeals:

01

Taxpayers disputing tax assessments: The board of tax appeals is typically sought after by individuals or businesses who disagree with their tax assessments. These taxpayers may believe that their assessments are incorrect, excessive, or inconsistent with relevant tax laws.

02

Those seeking a fair resolution: The board of tax appeals provides taxpayers with an independent and impartial venue to present their case and have their tax disputes resolved. It offers an opportunity to present evidence, argue their position, and receive a fair and objective decision.

03

Individuals wanting to exercise their rights: The board of tax appeals serves as a forum for taxpayers to exercise their legal rights. It allows taxpayers to challenge decisions made by tax authorities and provides an avenue for appealing adverse decisions.

04

Taxpayers seeking to save money: By appealing their tax assessments through the board of tax appeals, individuals and businesses may be able to save money by reducing their tax liability. A successful appeal can result in a lower tax assessment, potentially leading to significant savings.

05

Individuals with legitimate grievances: The board of tax appeals is designed to address legitimate grievances of taxpayers who believe they have been treated unfairly or unjustly by tax authorities. It provides a platform for taxpayers to voice their concerns and seek a resolution to their tax disputes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit board of tax appeals on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share board of tax appeals from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out board of tax appeals on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your board of tax appeals, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit board of tax appeals on an Android device?

You can make any changes to PDF files, like board of tax appeals, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is board of tax appeals?

The Board of Tax Appeals is a government entity responsible for resolving tax disputes between taxpayers and taxing authorities.

Who is required to file board of tax appeals?

Taxpayers who disagree with a decision made by a taxing authority can file an appeal with the Board of Tax Appeals.

How to fill out board of tax appeals?

To fill out a Board of Tax Appeals form, taxpayers must provide their personal information, details of the dispute, and any supporting documentation.

What is the purpose of board of tax appeals?

The purpose of the Board of Tax Appeals is to provide taxpayers with an impartial forum to resolve disputes over tax matters.

What information must be reported on board of tax appeals?

Taxpayers must report their personal information, details of the tax dispute, any supporting documentation, and their desired outcome.

Fill out your board of tax appeals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Board Of Tax Appeals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.