Get the free pl Zwrot Podatku S

Show details

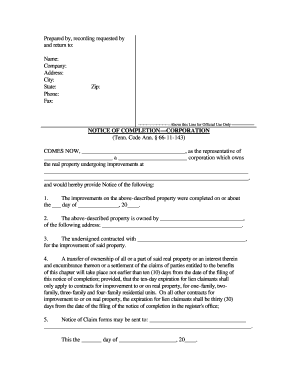

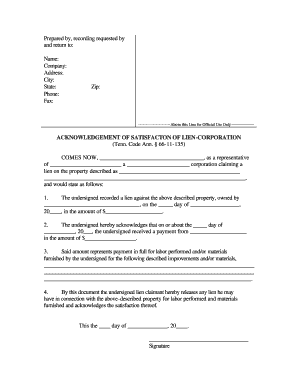

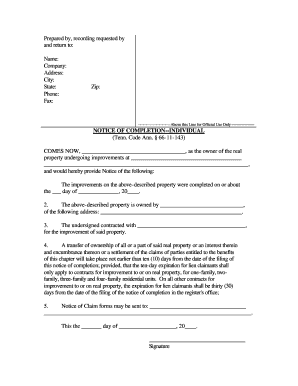

A FORMULARY ZGOSZENIOWY Odpowiedz Na made plane Zidane w formularize zgoszeniowym EuroTax.pl Wrote Potato S.A. UL. W. Sikorskiego 28, OK. 1 53659 Wrocław NIP: Region: MRS: 1080009959 142746896 0000480703

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pl zwrot podatku s

Edit your pl zwrot podatku s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pl zwrot podatku s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pl zwrot podatku s online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pl zwrot podatku s. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pl zwrot podatku s

How to fill out "PL zwrot podatku S"?

Gather all necessary documentation:

01

Personal identification documents

02

Tax-related documents (such as invoices, receipts, and financial statements)

Determine your eligibility for claiming a tax refund:

01

Ensure that you meet all the criteria for claiming a tax refund in Poland.

02

Check your income level, employment status, and other relevant factors.

Access the official tax refund website or obtain the required forms:

01

Visit the official website of the Polish tax authority to download the necessary forms.

02

Alternatively, you can obtain the forms from a local tax office.

Complete the forms accurately and comprehensively:

01

Provide your personal information, including your full name, address, and tax identification number.

02

Fill in the income-related fields, including details of your employment or other sources of income.

03

Include all relevant deductions and expenses that you are eligible to claim.

Attach copies of supporting documents:

Make sure to attach copies of all relevant invoices, receipts, and any other documentation required to support your claims.

Double-check your filled form and attached documents:

01

Review the completed forms and ensure that all information is accurate.

02

Verify that you have included all the necessary supporting documents.

Submit the completed form:

01

Send the completed form and all supporting documents through the appropriate channels.

02

This can be done online, through mail, or by visiting a local tax office.

Monitor the progress of your tax refund:

01

Keep track of the status of your tax refund application.

02

You can check the progress online or contact the tax authority for any updates.

Who needs "PL zwrot podatku S"?

01

Individuals working in Poland: Any person who is employed in Poland and has paid income tax can potentially apply for a tax refund.

02

Self-employed individuals: Entrepreneurs or freelancers who operate their own business in Poland can also claim a tax refund.

03

Expatriates: Foreigners working in Poland are also eligible to apply for a tax refund if they meet the required criteria.

04

Students: Students who work part-time or have income in Poland may be eligible for a tax refund.

05

Individuals with special circumstances: People who have been made redundant, have taken parental leave, or experienced other significant life events that affect their income may also be eligible for a tax refund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pl zwrot podatku s?

Pl zwrot podatku s is a tax return form used in Poland for claiming tax refunds.

Who is required to file pl zwrot podatku s?

Individuals who have overpaid taxes in Poland are required to file pl zwrot podatku s to claim a refund.

How to fill out pl zwrot podatku s?

Pl zwrot podatku s can be filled out online on the official tax authority website or submitted in person at a tax office.

What is the purpose of pl zwrot podatku s?

The purpose of pl zwrot podatku s is to allow individuals to claim refunds for overpaid taxes.

What information must be reported on pl zwrot podatku s?

The pl zwrot podatku s form requires information such as income details, tax deductions, and any tax credits claimed.

How do I edit pl zwrot podatku s online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pl zwrot podatku s to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit pl zwrot podatku s in Chrome?

pl zwrot podatku s can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the pl zwrot podatku s form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign pl zwrot podatku s and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your pl zwrot podatku s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pl Zwrot Podatku S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.