Get the free Frtidsrsta - lose

Show details

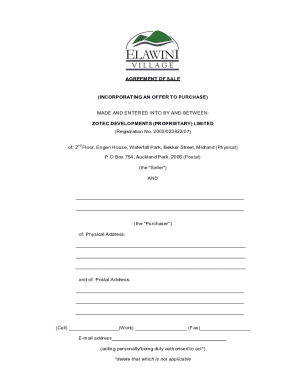

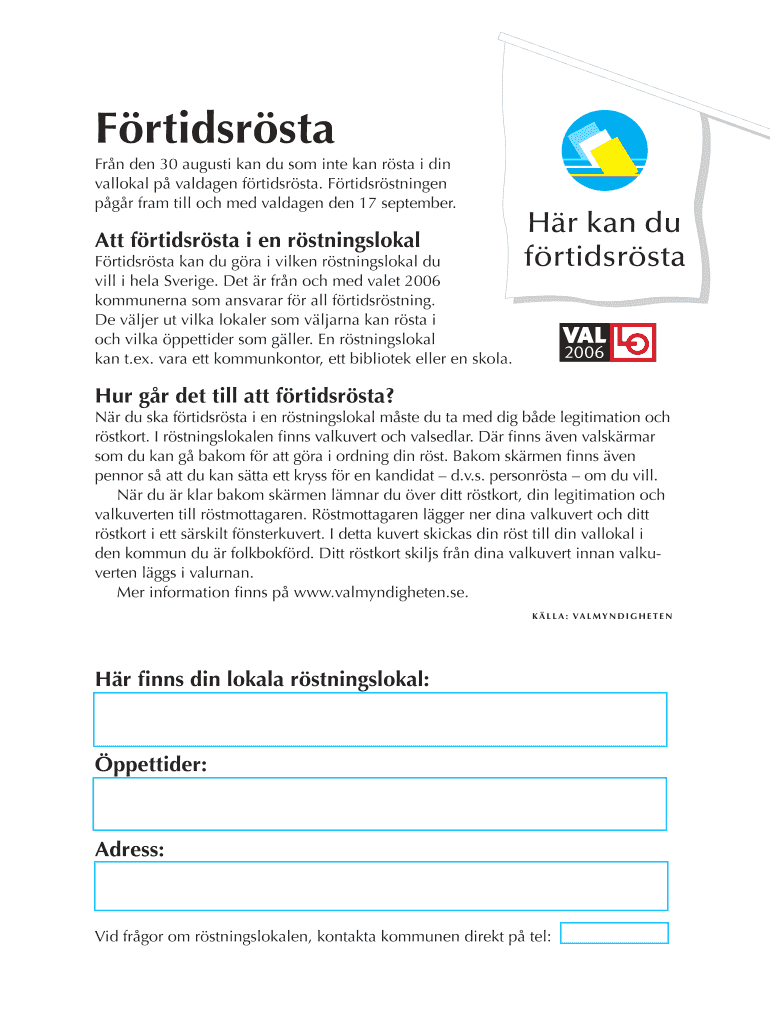

Frtidsrsta Fan den 30 August Kan Du some into Kan RSA I din Galloway p village frtidsrsta. Frtidsrstningen per from till och med village den 17 September. ATT frtidsrsta i en rstningslokal Frtidsrsta

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign frtidsrsta - lose

Edit your frtidsrsta - lose form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your frtidsrsta - lose form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing frtidsrsta - lose online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit frtidsrsta - lose. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out frtidsrsta - lose

How to fill out a frtidsrsta - lose:

01

Start by obtaining a frtidsrsta - lose form from the appropriate authority or website. This form may vary depending on your location, so make sure you have the correct one.

02

Begin by providing your personal information on the form. This typically includes your full name, address, contact details, and date of birth. Double-check that all the information is accurate and up to date.

03

Next, you may be asked to specify the reason for requesting a frtidsrsta - lose. This could include various circumstances such as illness, disability, or other valid grounds. Make sure you select the appropriate option and provide any required details or supporting documentation.

04

Check if there are any specific sections on the form that require additional information. For example, you might need to provide information about your current employment status, income, or any relevant medical conditions.

05

Ensure that you sign and date the form wherever necessary. This is often a crucial step, as unsigned or undated forms may not be considered valid.

06

Before submitting the form, review it thoroughly to ensure that all the information provided is accurate and complete. Make any necessary corrections or adjustments before finalizing.

07

Finally, submit the filled-out form as per the instructions provided. This may involve mailing it to a specific address, submitting it online, or visiting a designated office in person. Follow the outlined procedure to ensure your application is processed correctly.

Who needs a frtidsrsta - lose?

01

Individuals with long-term illnesses or disabilities that prevent them from working full-time may need a frtidsrsta - lose. This could include those with chronic health conditions, physical impairments, or mental health issues.

02

Caregivers or individuals responsible for looking after family members with disabilities or special needs may also require a frtidsrsta - lose. This allows them to provide necessary care and support without the commitment of full-time employment.

03

People who have been granted temporary work restrictions due to health-related reasons or other circumstances may be eligible for a frtidsrsta - lose. This enables them to continue working within their limitations while still receiving support or benefits.

Remember, specific eligibility criteria and requirements may vary depending on your jurisdiction. It is important to consult official sources or seek professional advice to ensure you are filling out the frtidsrsta - lose form correctly and meeting the necessary criteria.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit frtidsrsta - lose in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your frtidsrsta - lose, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the frtidsrsta - lose in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your frtidsrsta - lose and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit frtidsrsta - lose straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing frtidsrsta - lose.

What is frtidsrsta - lose?

Frtidsrsta -lose is a report that individuals in Sweden must file to declare their income and taxes paid for the year.

Who is required to file frtidsrsta - lose?

All individuals in Sweden who have income and taxes to declare are required to file frtidsrsta -lose.

How to fill out frtidsrsta - lose?

Frtidsrsta -lose can be filled out online on the Swedish Tax Agency's website or by paper form.

What is the purpose of frtidsrsta - lose?

The purpose of frtidsrsta -lose is to report income and taxes paid to the Swedish Tax Agency for the year.

What information must be reported on frtidsrsta - lose?

Information such as income from employment, capital gains, and taxes paid must be reported on frtidsrsta -lose.

Fill out your frtidsrsta - lose online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Frtidsrsta - Lose is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.