Get the free Employer deductions - hhnetnz - hh net

Show details

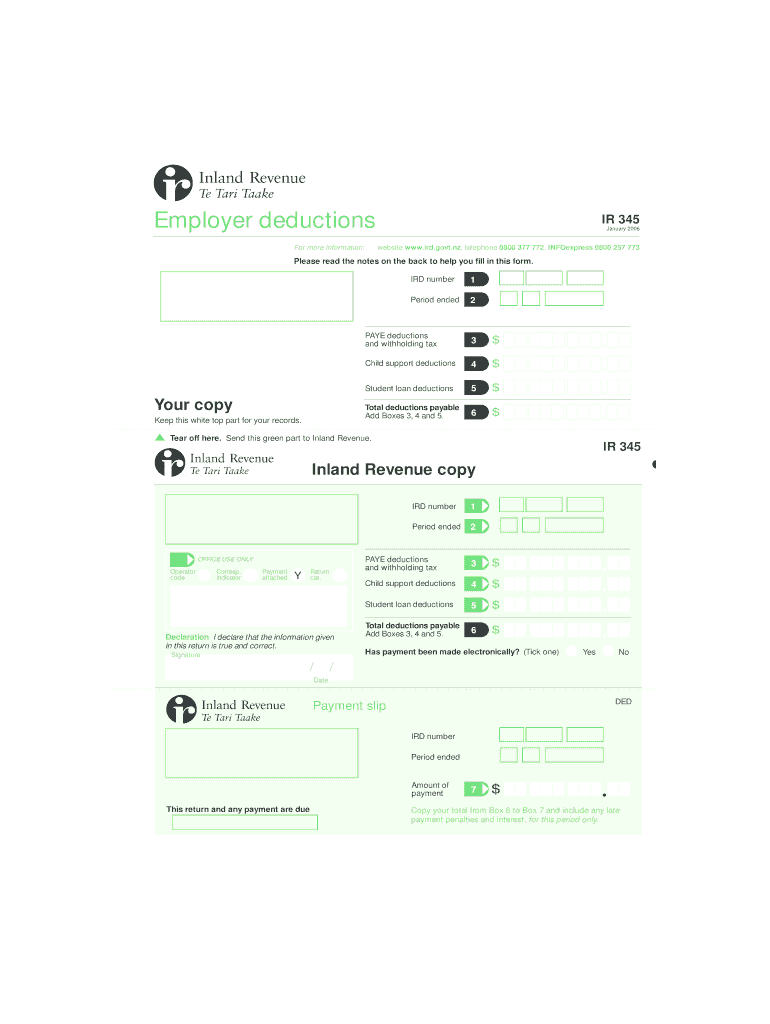

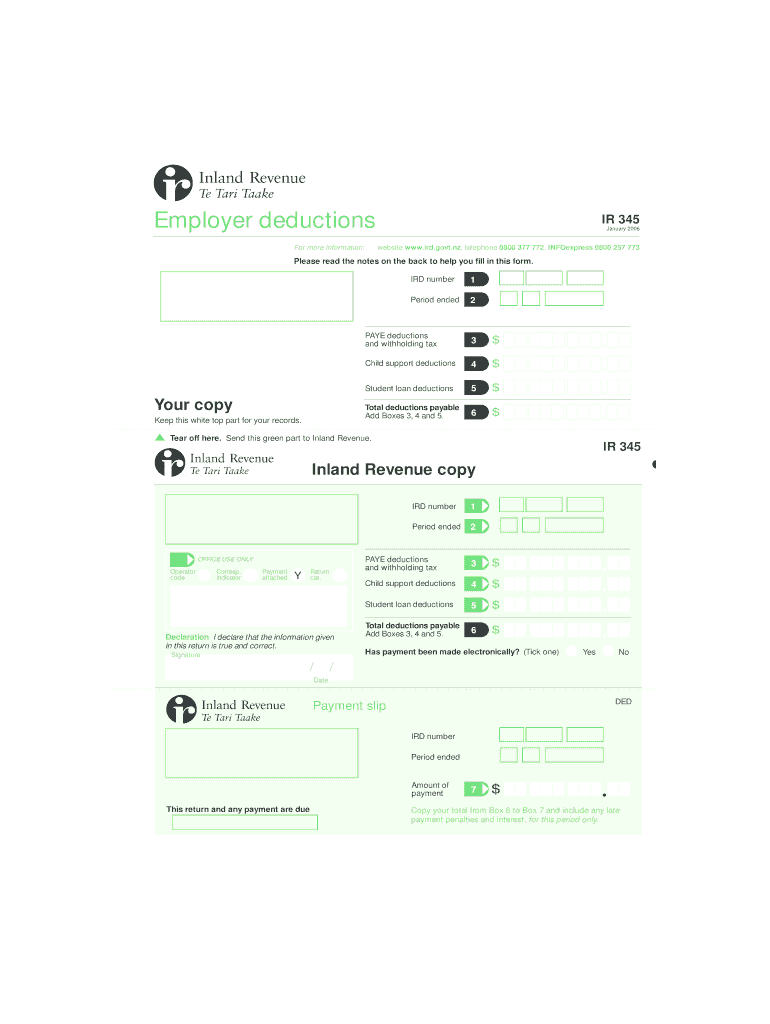

Employer deductions For more information: IR 345 January 2006 website www.ird.govt.nz, telephone 0800 377 772, INFO express 0800 257 773 Please read the notes on the back to help you fill in this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer deductions - hhnetnz

Edit your employer deductions - hhnetnz form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer deductions - hhnetnz form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer deductions - hhnetnz online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employer deductions - hhnetnz. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer deductions - hhnetnz

How to fill out employer deductions - hhnetnz:

01

Gather necessary information: Before filling out employer deductions on hhnetnz, make sure you have all the required information handy. This can include details about your employees, their wages, and any other relevant information needed for accurate calculations.

02

Access the hhnetnz website: Log in to the hhnetnz website using your credentials. If you don't have an account, create one to access the employer deductions section.

03

Navigate to the employer deductions section: Once logged in, find the employer deductions tab or section on the hhnetnz website. It is usually located in the payroll or tax-related area.

04

Input employee details: Enter the necessary employee details in the employer deductions section. This may include their names, tax codes, and other relevant information required for calculating deductions accurately.

05

Enter wage information: Provide the wage information for each employee. This includes their gross wages and any additional income or allowances they may be eligible for. Ensure the correct amounts are entered to avoid any discrepancies.

06

Calculate deductions: hhnetnz will automatically calculate deductions based on the information provided. This may include tax deductions, KiwiSaver contributions, student loan repayments, and any other applicable deductions based on the employee's circumstances.

07

Review and confirm: Double-check all the entered information to ensure its accuracy. Review the calculated deductions and ensure they align with the employee's requirements and relevant tax laws.

08

Submit and save: Once you are satisfied with the entered information and calculated deductions, submit the form or save it as required by the hhnetnz system. This will finalize the employer deductions process.

Who needs employer deductions - hhnetnz?

01

Employers: Employers who need to comply with New Zealand tax laws are the primary users of employer deductions on hhnetnz. They use this platform to calculate and deduct taxes, KiwiSaver contributions, and other applicable deductions from their employees' wages accurately.

02

Payroll administrators: Payroll administrators who manage payroll processes for businesses and organizations also utilize employer deductions on hhnetnz. They ensure that the correct deductions are made and accurately reflect each employee's individual circumstances.

03

Accountants and tax advisors: Accountants and tax advisors who assist employers in managing their finances and complying with tax regulations often rely on the hhnetnz platform for calculating and processing employer deductions. They ensure that employers meet their legal obligations while maximizing tax benefits.

Note: It's important to consult official sources and seek professional advice if you have specific questions or concerns regarding employer deductions on hhnetnz.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit employer deductions - hhnetnz from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your employer deductions - hhnetnz into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in employer deductions - hhnetnz without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing employer deductions - hhnetnz and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the employer deductions - hhnetnz in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is employer deductions - hhnetnz?

Employer deductions - hhnetnz are deductions made from an employee's wages by their employer, such as taxes, retirement contributions, and insurance premiums.

Who is required to file employer deductions - hhnetnz?

Employers are required to file employer deductions - hhnetnz for each of their employees.

How to fill out employer deductions - hhnetnz?

Employers can fill out employer deductions - hhnetnz using the prescribed forms provided by the relevant tax authorities, making sure to accurately report all deductions for each employee.

What is the purpose of employer deductions - hhnetnz?

The purpose of employer deductions - hhnetnz is to ensure that employees' contributions towards taxes, retirement funds, and other benefits are accurately recorded and deducted from their pay.

What information must be reported on employer deductions - hhnetnz?

Employer deductions - hhnetnz must include details of each employee's wages, deductions for taxes, retirement contributions, insurance premiums, and any other relevant information.

Fill out your employer deductions - hhnetnz online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Deductions - Hhnetnz is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.