Get the free Business Banking offers loans and finance, business cards ... - ...

Show details

PENNANT CREDO EUROPEAN PROPERTY TRUST Equity Arranger and Lead Manager National Australia Bank Limited ACN 004 044 937 IMPORTANT NOTICE & DISCLAIMER Pennant Capital Ltd (ABN 30 103 800 568) (ADSL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business banking offers loans

Edit your business banking offers loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business banking offers loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business banking offers loans online

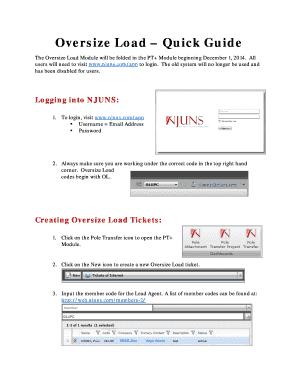

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business banking offers loans. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

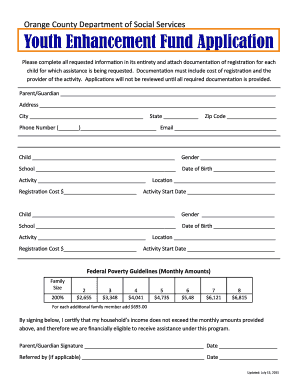

How to fill out business banking offers loans

How to fill out business banking offers loans?

01

Start by gathering all necessary documents, such as your financial statements, business plan, and personal identification.

02

Research different banks and financial institutions that offer business loans and compare their interest rates, terms, and eligibility criteria.

03

Visit the bank's website or contact their customer service to inquire about the loan application process and requirements.

04

Fill out the loan application form accurately and provide all requested information, including business details, financial information, and loan purpose.

05

Attach any required supporting documents, such as tax returns, bank statements, and legal documents.

06

Double-check all information provided before submitting the application. Make sure there are no errors or omissions.

07

Submit the completed application along with the supporting documents to the bank through their preferred method, such as online submission, in-person visit, or mail.

08

Wait for the bank's response. They may ask for additional information or documentation during the review process.

09

Be prepared for a thorough evaluation of your business and financials. The bank may assess your credit score, business viability, and ability to repay the loan.

10

If approved, carefully review the loan offer, including the interest rate, repayment terms, and any additional fees. Seek clarification if needed before accepting the loan.

Who needs business banking offers loans?

01

Entrepreneurs and small business owners who need capital to fund their business operations, expansion, or start-up.

02

Companies facing temporary cash flow problems or unexpected expenses that require immediate financial assistance.

03

Businesses looking to invest in new equipment, technology, or infrastructure to enhance their productivity and competitiveness.

04

Enterprises planning to acquire another business or merge with a competitor.

05

Start-ups in need of seed funding or early-stage financing to transform their business idea into a viable venture.

06

Seasonal businesses seeking financial support to manage fluctuating revenues throughout the year.

07

Industries that require significant upfront investment, such as construction, manufacturing, and healthcare.

08

Businesses that want to consolidate their existing debts into a single loan with better terms and lower interest rates.

09

Start-ups in innovative sectors, such as technology or renewable energy, that require funds for research and development.

10

Companies that aim to establish a line of credit to have access to funds whenever necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business banking offers loans?

Business banking offers loans to businesses to provide them with financial support for various purposes such as expansion, investment, working capital, or purchasing assets.

Who is required to file business banking offers loans?

Businesses seeking loans from banks or other financial institutions are required to file business banking offers loans applications.

How to fill out business banking offers loans?

To fill out business banking offers loans, businesses need to submit a loan application form provided by the bank or financial institution. This form requires detailed information about the business's financials, purpose of the loan, collateral, and repayment plan.

What is the purpose of business banking offers loans?

The purpose of business banking offers loans is to provide businesses with the necessary funds to support their operations, growth, and investment strategies.

What information must be reported on business banking offers loans?

Businesses are required to report detailed information about their financials, including income statements, balance sheets, cash flow statements, and information about their business operations and credit history.

How can I manage my business banking offers loans directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your business banking offers loans along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit business banking offers loans straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit business banking offers loans.

How do I edit business banking offers loans on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as business banking offers loans. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your business banking offers loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Banking Offers Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.