Get the free Automatic Payment Deduction Form - kirtlandfcuorg

Show details

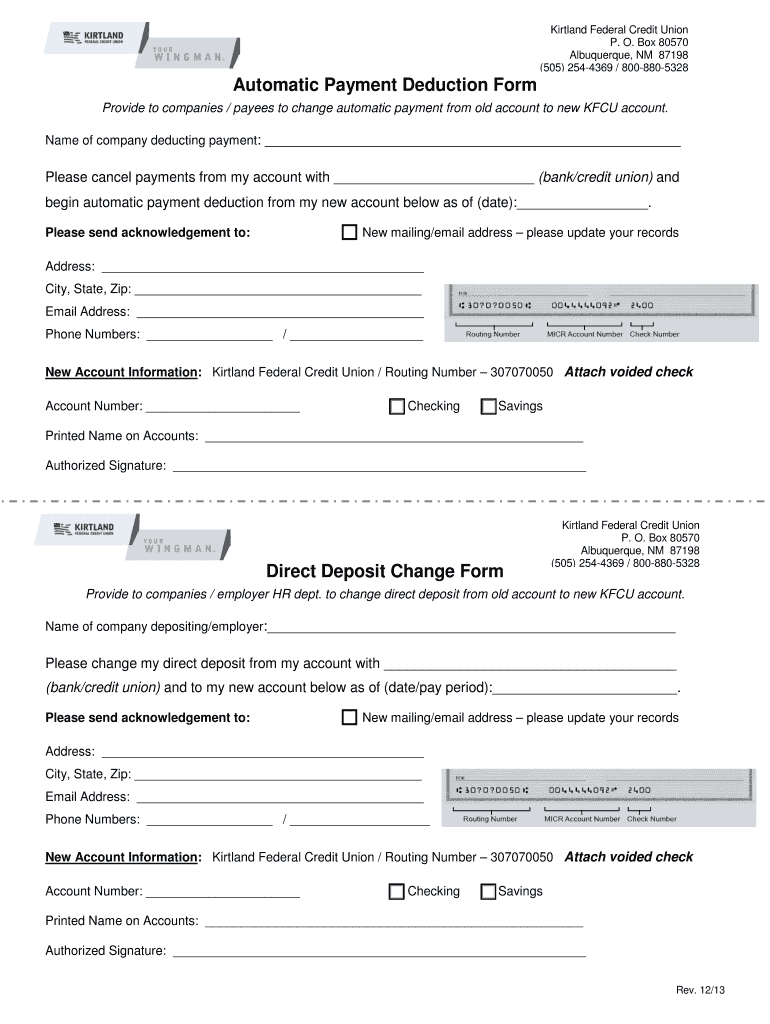

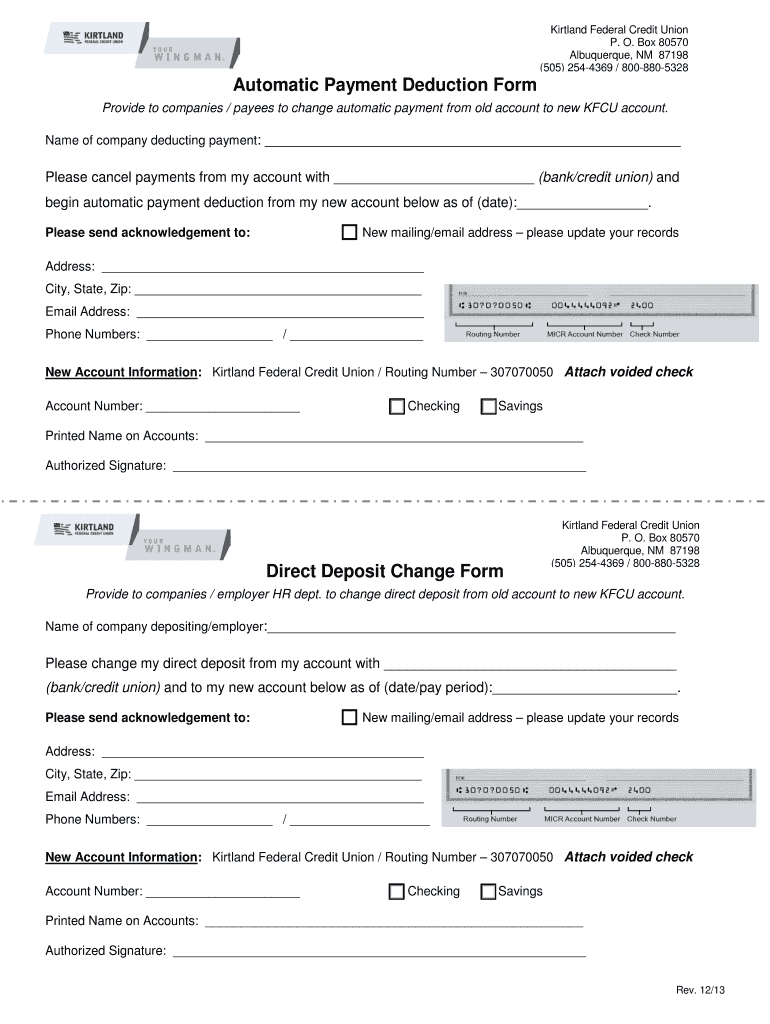

Kirtland Federal Credit Union P. O. Box 80570 Albuquerque, NM 87198 ×505× 2544369 × 8008805328 Automatic Payment Deduction Form Provide to companies / payees to change automatic payment from old

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic payment deduction form

Edit your automatic payment deduction form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic payment deduction form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic payment deduction form online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic payment deduction form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic payment deduction form

How to fill out automatic payment deduction form:

01

Gather necessary information: Before starting to fill out the automatic payment deduction form, make sure you have all the relevant information handy. This may include your bank account details, authorization code, payment amount, and any other required information.

02

Read the instructions: Carefully read through the instructions provided on the form. This will help you understand the process better and ensure that you provide all the necessary information accurately.

03

Personal information: Begin by filling out your personal information such as your name, address, contact number, and email address. Ensure that these details are entered correctly to avoid any issues with the deduction process.

04

Bank account details: Provide your bank account information, including the bank name, account number, and routing number. Double-check the account details to prevent any errors that may result in failed payment deductions.

05

Payment authorization: Fill out the payment authorization section, where you may need to specify the payment frequency (e.g., monthly, weekly), the start date, and the payment amount. Be clear and accurate while specifying this information to ensure that payments are deducted correctly and on time.

06

Signature: Once you have completed filling in all the necessary details, sign the form as required. Make sure to date your signature as well.

Who needs automatic payment deduction form:

01

Individuals with recurring bills: Anyone who has recurring bills or payments to make, such as monthly rent, utility bills, or loan repayments, can benefit from utilizing automatic payment deduction forms. This form allows the person to automate their payments, ensuring timely deductions without the need for manual intervention each month.

02

Businesses: Businesses that collect regular payments from their customers, such as subscription-based services or membership fees, can also make use of automatic payment deduction forms. It streamlines the payment process, reduces administrative tasks, and ensures a seamless payment experience for both the business and its customers.

03

Employers and employees: Employers may require employees to fill out automatic payment deduction forms to efficiently deduct necessary payments, such as health insurance premiums or retirement contributions, directly from an employee's paycheck. This process enables easy and accurate deductions, avoiding any delays or errors.

In conclusion, filling out an automatic payment deduction form requires gathering the necessary information, carefully reading the instructions, providing personal and bank account details accurately, specifying the payment details, and signing the form. This form can be beneficial for individuals with recurring bills, businesses collecting regular payments, and employers requiring deductions from employee paychecks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get automatic payment deduction form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific automatic payment deduction form and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit automatic payment deduction form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit automatic payment deduction form.

Can I edit automatic payment deduction form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign automatic payment deduction form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is automatic payment deduction form?

Automatic payment deduction form is a document that allows an individual or organization to authorize a payment to be deducted automatically from their bank account.

Who is required to file automatic payment deduction form?

Anyone who wishes to set up automatic payments from their bank account is required to file an automatic payment deduction form.

How to fill out automatic payment deduction form?

To fill out an automatic payment deduction form, one must provide their bank account information, the payment amount, the payment frequency, and their authorization for the deduction.

What is the purpose of automatic payment deduction form?

The purpose of automatic payment deduction form is to streamline the payment process and ensure timely payments without the need for manual intervention each time a payment is due.

What information must be reported on automatic payment deduction form?

The automatic payment deduction form must include the bank account number, the bank routing number, the payment amount, the payment frequency, and the authorization signature.

Fill out your automatic payment deduction form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Payment Deduction Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.