Get the free Motor Vehicle Property Tax Exemption Application - eastwindsor-ct

Show details

This document is an application form for active members of the armed forces to claim a motor vehicle property tax exemption in the Town of East Windsor, Connecticut. It collects necessary military

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle property tax

Edit your motor vehicle property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor vehicle property tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor vehicle property tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle property tax

How to fill out Motor Vehicle Property Tax Exemption Application

01

Obtain the Motor Vehicle Property Tax Exemption Application form from your local tax office or website.

02

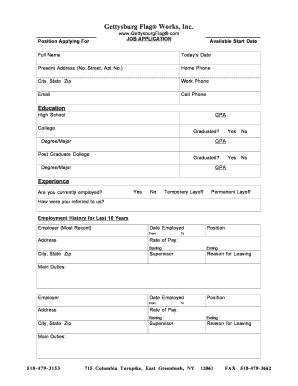

Fill out the applicant’s name and contact information at the top of the form.

03

Provide information about the motor vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose for applying for the exemption, such as disability, nonprofit status, or any other qualifying reason.

05

Attach any necessary documentation that supports your eligibility for the exemption (e.g., proof of disability, nonprofit status documents).

06

Review the application for accuracy and completeness.

07

Sign and date the application before submission.

08

Submit the completed application to the appropriate local tax office by the specified deadline.

Who needs Motor Vehicle Property Tax Exemption Application?

01

Individuals with disabilities seeking relief from property tax on their vehicle.

02

Nonprofit organizations that own vehicles and seek an exemption from property taxes.

03

Residents who qualify under specific state or local regulations for motor vehicle tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for property tax exemption in California?

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

What is 100% property tax exemption in California?

This bill would exempt from taxation, property owned by, and that constitutes the principal place of residence of, a veteran, the veterans spouse, or the veteran and the veterans spouse jointly, if the veteran is 100% disabled.

What is the property tax exemption in Los Angeles?

If you own a home and it is your principal place of residence on January 1, you may apply for an exemption of $7,000 from your assessed value.

What are the requirements for homestead exemption in California?

Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new 2021 law, $300,000–$600,000 of a home's equity cannot be touched by judgment creditors.

At what age do you stop paying property tax in California?

Age Requirements for Property Tax Relief in California For the Property Tax Postponement Program, applicants must be at least 62 years old, blind, or disabled. Other programs, such as Proposition 19, require homeowners to be at least 55 years old.

What is the loophole in California Prop 19?

Prop. 19 also raises taxes on certain inherited and gifted family properties by closing a Prop. 13. That loophole allowed children and grandchildren who inherited property to also inherit the old property tax base, even if the current market value had increased significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Vehicle Property Tax Exemption Application?

The Motor Vehicle Property Tax Exemption Application is a form that individuals or businesses can fill out to request an exemption from property taxes on specific motor vehicles.

Who is required to file Motor Vehicle Property Tax Exemption Application?

Typically, individuals or organizations that own vehicles eligible for tax exemption, such as non-profit organizations or certain government entities, are required to file this application.

How to fill out Motor Vehicle Property Tax Exemption Application?

To fill out the Motor Vehicle Property Tax Exemption Application, you need to provide details such as your personal information, vehicle identification number (VIN), the type of exemption you are applying for, and any supporting documentation as required by your local tax authority.

What is the purpose of Motor Vehicle Property Tax Exemption Application?

The purpose of the Motor Vehicle Property Tax Exemption Application is to allow eligible vehicle owners to officially request a reduction or waiver of property taxes on their vehicles based on certain qualifying criteria.

What information must be reported on Motor Vehicle Property Tax Exemption Application?

The application generally requires information such as the owner's name, contact details, the vehicle's make, model, year, VIN, the reason for the exemption, and any necessary documentation proving eligibility.

Fill out your motor vehicle property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.