Get the free CHECK CASHING BOND - dbr state ri

Show details

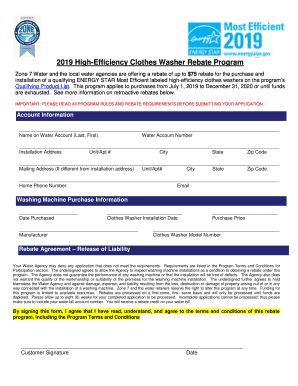

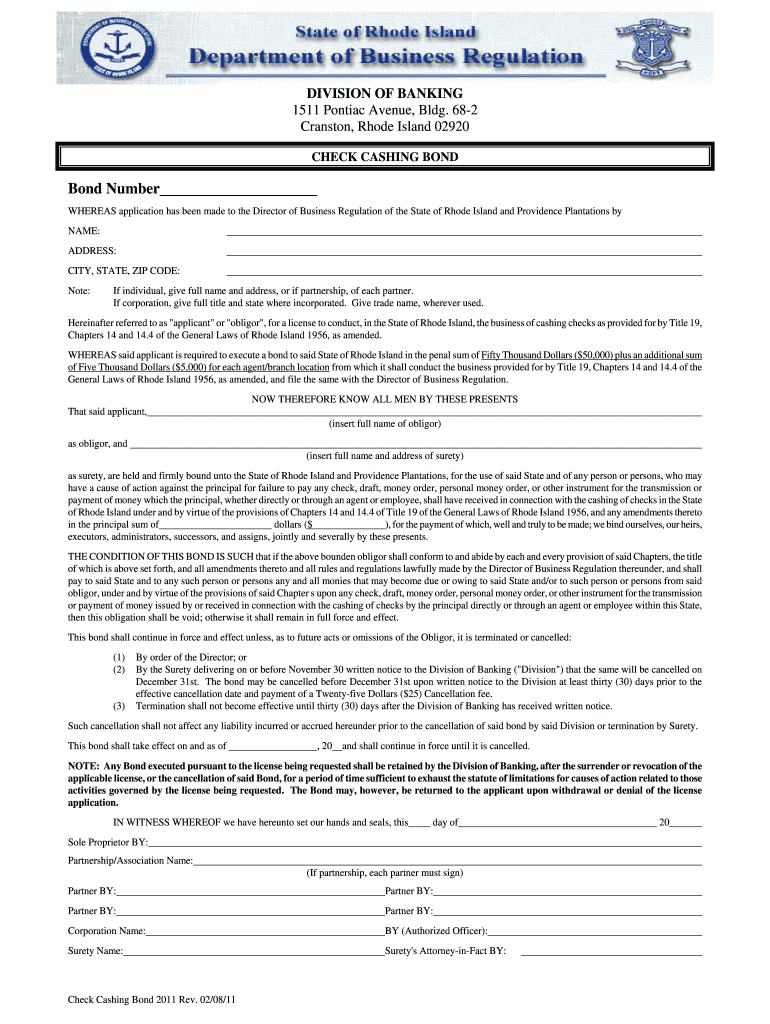

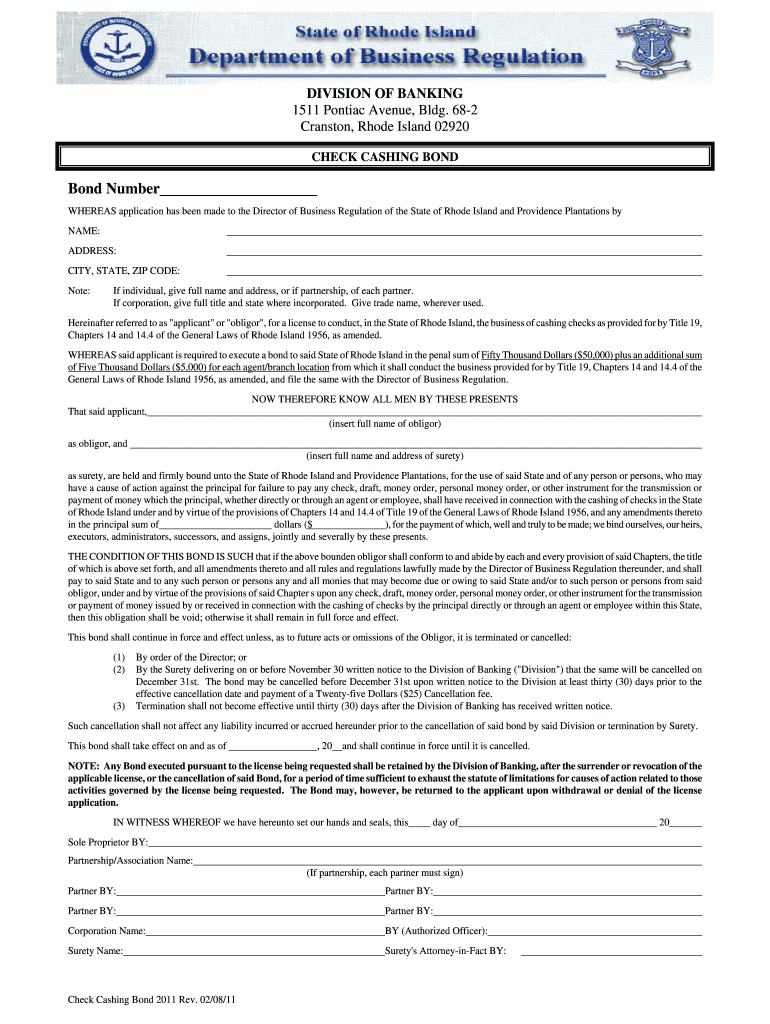

This document serves as a bond application for individuals or entities seeking a license to conduct check cashing business in the State of Rhode Island, ensuring compliance with state regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check cashing bond

Edit your check cashing bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check cashing bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check cashing bond online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit check cashing bond. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check cashing bond

How to fill out CHECK CASHING BOND

01

Obtain the CHECK CASHING BOND form from your local regulatory authority or online.

02

Provide your full name and the name of your business if applicable.

03

Fill in your business address, phone number, and email address.

04

Enter the required bond amount as specified by the regulatory authority.

05

Include the name and address of the bond company that will issue the bond.

06

Sign the form and date it.

07

Submit the completed form along with any required fees or documentation to the regulatory authority.

Who needs CHECK CASHING BOND?

01

Business owners who operate check cashing services.

02

Individuals seeking to start a check cashing business.

03

Entrepreneurs required to comply with state or local regulations for financial services.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I cashed a bond?

At a bank: If a bank cashes your savings bond, they are responsible for getting you a 1099-INT. They may give or mail you the 1099-INT as soon as you cash the bond or they may wait until the following January.

Do banks cash paper bonds?

How do I cash a paper savings bond? Many local banks cash them. You also can cash by mail.

How to cash in a bond check?

Here are three basic ways to convert your savings bonds to cash. Redeem Online With a TreasuryDirect Account. You can redeem your electronic Series EE and Series I savings bonds on the TreasuryDirect website. Cash In Paper Bonds by Mail With TreasuryDirect. Take Paper Bonds to Your Bank or Credit Union.

How do I cash a premium bond cheque?

Cash in Premium Bonds online or by phone Then, either call 08085 007 007 or go to the NS&I site and log in to your online account. Once the process is completed, the value of the Premium Bonds you've cashed in will be transferred into the bank account that you nominated when you registered.

How can you cash in a bond?

You can cash paper bonds at a bank or through the U.S. Department of the Treasury's TreasuryDirect website. Not all banks offer the service, and many only provide it if you are an account holder, according to a NerdWallet analysis of the 20 largest U.S. banks.

How do I cash bearer bonds?

How to Redeem Old Bearer Bonds: A Step-by-Step Guide Gather your old bearer bonds and coupons. Fill out IRS Form W-9 for tax purposes. Write clear payment instructions, including your current address, for the U.S. Treasury to send your payment.

How do you get money out of a bond?

You can cash in a savings bond one year after buying the bond. You will forfeit some interest if you redeem within the first five years. To get the full face value of the bond, you must wait until the maturity date. You can sell the bond before maturity, but you will lose some of its face value.

What is a cash bond in English?

A cash bond is a set amount of money paid directly to the court to secure someone's release from jail. This method offers a straightforward, often quick solution for bail. However, it comes with the risk of forfeiture. If the defendant fails to attend their court hearings, the court may retain the full amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHECK CASHING BOND?

A Check Cashing Bond is a type of surety bond required by many states for businesses engaged in the check cashing industry. It serves as a financial guarantee that the business will comply with state laws and regulations regarding check cashing.

Who is required to file CHECK CASHING BOND?

Businesses that operate in the check cashing industry and are seeking a license or permit to legally cash checks are generally required to file a Check Cashing Bond.

How to fill out CHECK CASHING BOND?

To fill out a Check Cashing Bond, the applicant must provide information such as the name and address of the business, the license number, the bond amount, and details of the surety company providing the bond. It's also important to read and comply with any specific requirements outlined by the state.

What is the purpose of CHECK CASHING BOND?

The purpose of a Check Cashing Bond is to protect consumers and the state by ensuring that the check cashing business operates legally and ethically. If the business violates regulations, the bond provides a means for affected parties to seek compensation.

What information must be reported on CHECK CASHING BOND?

Information reported on a Check Cashing Bond typically includes the name and address of the principal (the check cashing business), the surety company details, the bond amount, and the effective date of the bond. It may also require a description of the services provided by the business.

Fill out your check cashing bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Cashing Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.