Get the free Corporate Life Insurance Application Form Broker 01082014 - libertyinternational com

Show details

13×F, Berkshire House, 25 Wetlands Road, Quarry Bay, Hong Kong Tel : (852× 2892 3888 Fax: (852× 2572 8071 www.libertyinsurance.com.hk Corporate Life Insurance Application Form : Registered office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate life insurance application

Edit your corporate life insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate life insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

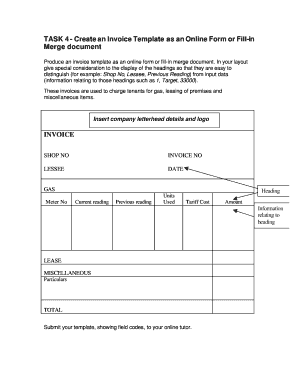

Editing corporate life insurance application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate life insurance application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate life insurance application

How to fill out a corporate life insurance application?

01

Gather necessary information: Before filling out the corporate life insurance application, gather all relevant information such as the employee's personal details, employment status, beneficiary information, and any additional information required by the insurance provider.

02

Review the application form: Carefully read through the entire application form to understand the sections and questions being asked. This will help ensure that you provide accurate and complete information.

03

Provide personal details: Start by filling out the personal details section, which typically includes the employee's full name, date of birth, contact information, and social security number. Double-check the accuracy of this information.

04

Employment details: Provide information about the employee's current employment, including their job title, duration of employment, and annual income. Some applications may also require details about the employee's job responsibilities.

05

Beneficiary designation: Indicate the beneficiary or beneficiaries who will receive the life insurance benefits in the event of the employee's death. Provide their full names, relationship to the employee, and their contact information.

06

Medical history: Fill in the medical history section honestly and accurately. You may need to provide details about pre-existing medical conditions, past surgeries, medications, or any other relevant health information. Insurance providers use this information to assess the level of risk and determine the premium.

07

Coverage amount and type: Specify the desired coverage amount and type of life insurance policy the employee wants. This could be term life, whole life, or another type offered by the insurance provider. Consider discussing the options with a financial advisor or insurance professional to choose the most suitable coverage.

08

Review and sign: Carefully review all the information provided in the application form for accuracy and completeness. Ensure that any required signatures are given in the designated areas.

09

Submit the application: Once you have reviewed and signed the application, submit it to the insurance provider through the specified channels. This may involve sending a physical copy by mail or submitting an electronic application online.

Who needs a corporate life insurance application?

01

Employers: Companies or organizations may require their employees to fill out a corporate life insurance application to offer group life insurance coverage as part of their employee benefits package. This helps protect employees' families in the event of their death.

02

Employees: Individuals employed in a company or organization that offers corporate life insurance coverage should fill out the application. It provides an opportunity to secure life insurance protection and ensure financial support for their loved ones if the unexpected happens.

03

Business partners and key stakeholders: In some cases, business partners, shareholders, or key stakeholders may be required to fill out a corporate life insurance application to protect the financial interests of the company in case of their untimely death.

Remember, it's always recommended to consult with an insurance professional or financial advisor to understand the specific details and requirements of the corporate life insurance application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate life insurance application for eSignature?

Once you are ready to share your corporate life insurance application, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the corporate life insurance application in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your corporate life insurance application.

How do I fill out corporate life insurance application on an Android device?

Use the pdfFiller Android app to finish your corporate life insurance application and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is corporate life insurance application?

Corporate life insurance application is a form that a company completes to apply for life insurance coverage for its employees or key executives.

Who is required to file corporate life insurance application?

The HR department or the designated insurance coordinator of the company is required to file the corporate life insurance application.

How to fill out corporate life insurance application?

To fill out a corporate life insurance application, the company must provide information about the employees to be covered, the desired coverage amount, and any other relevant details requested by the insurance provider.

What is the purpose of corporate life insurance application?

The purpose of a corporate life insurance application is to secure life insurance coverage for employees or key executives to provide financial protection in case of death.

What information must be reported on corporate life insurance application?

The information that must be reported on a corporate life insurance application includes employee names, dates of birth, coverage amounts, beneficiary information, and any other relevant details requested by the insurance provider.

Fill out your corporate life insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Life Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.