Get the free APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION - mcad-tx

Show details

This document is an application form used by religious organizations to apply for property tax exemption in Texas. It outlines the necessary steps and details required for the application process,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for religious organization

Edit your application for religious organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for religious organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for religious organization online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for religious organization. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for religious organization

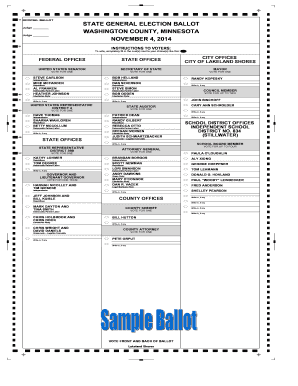

How to fill out APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION

01

Obtain the APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION form from the relevant local tax authority or their website.

02

Fill out the application form completely, providing the name and address of the religious organization.

03

Include the organization’s tax identification number (EIN) and the date of its establishment.

04

Describe the nature of the organization's religious activities and how they contribute to the community.

05

Provide documentation that supports the claim for tax exemption, such as bylaws, articles of incorporation, and financial statements.

06

Indicate the property address for which the exemption is being requested.

07

Sign and date the application, certifying that all information provided is accurate and truthful.

08

Submit the completed application form along with all supporting documents to the designated tax authority by the specified deadline.

Who needs APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

01

Religious organizations that own property and seek tax exemption for that property based on their status as non-profit entities.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for property tax exemption in Texas?

You must own your home. To qualify for a general or disabled homestead exemption you must own your home on January 1. If you are 65 years of age or older you need not own your home on January 1. You will qualify for the over 65 exemption as soon as you turn 65, own the home and live in it as your principal residence.

At what age do you stop paying property tax in California?

Senior Citizen Homeowners' Property Tax Exemption The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

How to reduce your property taxes in California?

Lower My Property Taxes Decline In Value / Prop 8. Calamity / Property Destroyed. Disabled Veterans' Exemption. Homeowners' Exemption. Nonprofit Exemptions. Transfers Between Family Members. Transfer of Base Year Value to Replacement Dwelling. Assessment Appeal.

Is there a religious exemption in California property tax?

The Church Exemption may be claimed on property that is owned, leased, or rented by a religious organization and used exclusively for religious worship services (see section 3(f) and section 5 of article of the California Constitution and Revenue and Taxation Code section 206).

Are churches exempt from property taxes in Texas?

An organization that qualifies as a religious organization as provided by the Texas Property Tax Code is entitled to an exemption from taxation of real property that is owned by the organization and is used primarily as a place of regular religious worship.

What is the religious conscience exemption in California?

If you or any of your dependents are members of a recognized religious sect or division who is opposed to acceptance of public benefits or private insurance benefits, or who relies solely on a religious method of healing, you can apply for a religious conscience exemption.

Are charities exempt from local property tax?

Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by the Board of Equalization and county assessors' offices in California.

How to get a religious exemption in CA?

To apply for the Religious Exemption, the church must file claim form BOE-267-S, Religious Exemption, with the county assessor where the property is located.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

It is a formal request submitted by religious organizations to claim exemption from property taxes based on their non-profit status and charitable activities.

Who is required to file APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

Religious organizations that own property and wish to obtain property tax exemption must file this application.

How to fill out APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

The application must be completed by providing detailed information about the organization's purpose, its financial status, the property in question, and other relevant details as specified by the local tax authority.

What is the purpose of APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

The purpose is to enable religious organizations to receive tax benefits that support their operations and charitable work, thus ensuring that funds are directed towards their mission rather than tax liabilities.

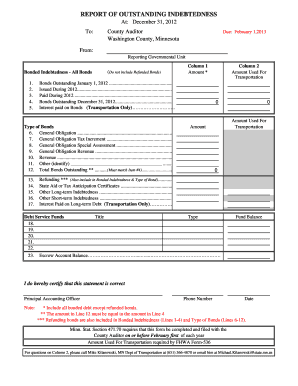

What information must be reported on APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION?

Applicants must report information such as the organization's legal name, address, tax identification number, type of religious activities, property details, and financial statements.

Fill out your application for religious organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Religious Organization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.