Get the free FORM 50-115 (Rev. 12-01/7) - mcad-tx

Show details

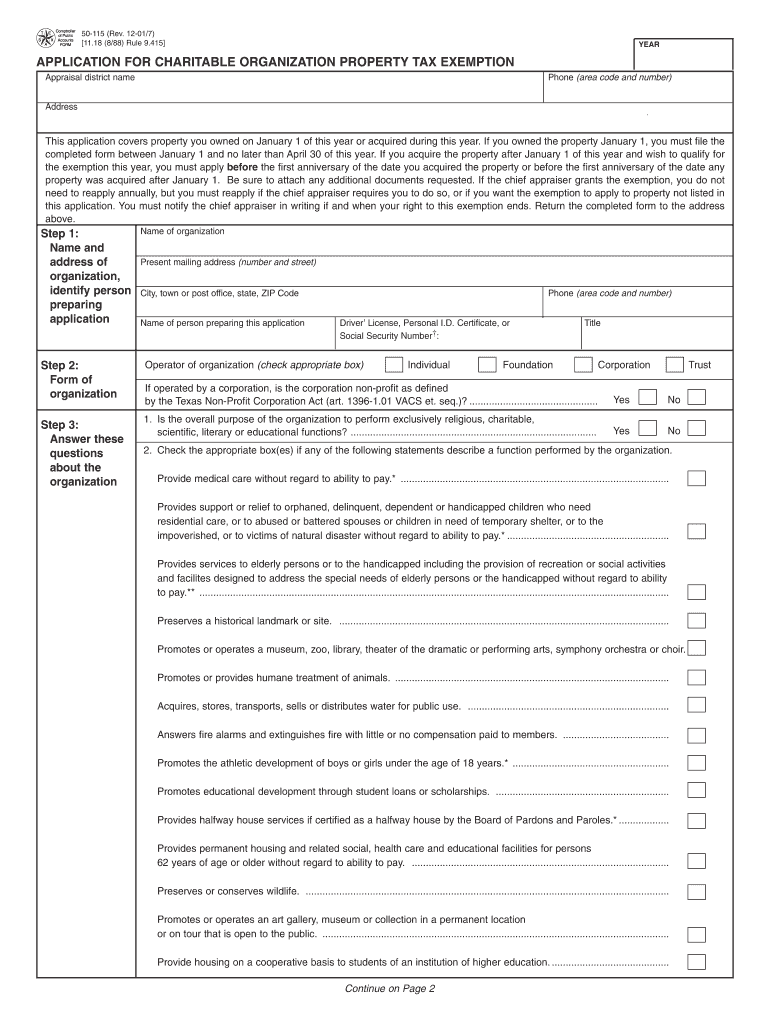

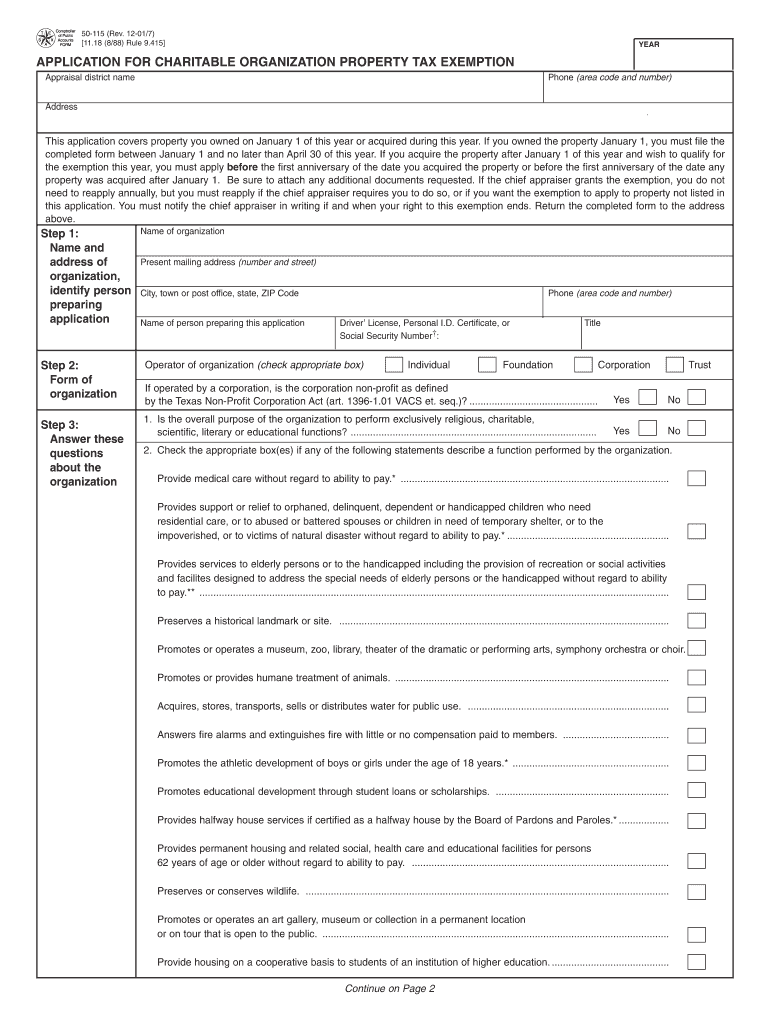

This form is used by charitable organizations in Texas to apply for property tax exemptions on property owned as of January 1 or acquired during the year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 50-115 rev 12-017

Edit your form 50-115 rev 12-017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 50-115 rev 12-017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 50-115 rev 12-017 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 50-115 rev 12-017. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 50-115 rev 12-017

How to fill out FORM 50-115 (Rev. 12-01/7)

01

Start by downloading FORM 50-115 (Rev. 12-01/7) from the official website.

02

Review the instructions provided on the form to understand the required information.

03

Fill in your personal details in the designated sections, including name, address, and contact information.

04

Provide any relevant identification numbers as requested, such as Social Security number or tax identification numbers.

05

Complete the specific sections related to the purpose of the form, ensuring all information is accurate.

06

Review the completed form for any errors or omissions before signing.

07

Sign and date the form as required.

08

Submit the form according to the instructions, either electronically or by mailing it to the specified address.

Who needs FORM 50-115 (Rev. 12-01/7)?

01

Individuals or businesses seeking to apply for benefits or services related to the specific purpose of FORM 50-115.

02

Anyone who is required to submit this form for compliance with regulations or guidelines set by the administering agency.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for senior property tax exemption in Texas?

You must apply with your county appraisal district to apply for an over-65 exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

How much do property taxes go down when you turn 65 in Texas?

Every Texas homeowner can apply for a general homestead exemption, which reduces the taxable value of their primary residence. Seniors age 65 and older qualify for additional exemptions that can further reduce their property tax bill. The general homestead exemption reduces the taxable value of a home by $25,000.

Are property taxes deductible in Texas for seniors?

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

How do seniors apply for an exemption from Texas property taxes?

You are eligible for the over-65 exemption the year that you turn 65. You can apply at any time during that year, but if you file by April 30, the exemption can be processed in time for your property tax bill that year. Otherwise, the exemption will be applied retroactively.

What is the protest form for the Comptroller property taxes in Texas?

You may use Comptroller Form 50-132, Property Appraisal - Notice of Protest, to file your written request for an ARB hearing. Prior to your hearing, you may request a copy of the evidence the appraisal district plans to introduce at the hearing to establish any matter at issue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 50-115 (Rev. 12-01/7)?

FORM 50-115 (Rev. 12-01/7) is a specific form used for reporting certain financial or personal information, typically required by a governmental agency.

Who is required to file FORM 50-115 (Rev. 12-01/7)?

Individuals or entities that meet specific criteria set by the governing agency or relevant regulation are required to file FORM 50-115 (Rev. 12-01/7).

How to fill out FORM 50-115 (Rev. 12-01/7)?

To fill out FORM 50-115 (Rev. 12-01/7), follow the provided instructions detailed on the form, which include entering accurate personal or financial information as required.

What is the purpose of FORM 50-115 (Rev. 12-01/7)?

The purpose of FORM 50-115 (Rev. 12-01/7) is to collect necessary information for compliance with regulations or for administrative purposes by a governmental body.

What information must be reported on FORM 50-115 (Rev. 12-01/7)?

FORM 50-115 (Rev. 12-01/7) typically requires reporting personal identification information, financial data, and any other details specified by the concerned agency.

Fill out your form 50-115 rev 12-017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 50-115 Rev 12-017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.