Get the free 2012 MORTGAGE APPROVAL RESOLUTION - townofguilderland

Show details

This document is a resolution adopted by the Town of Guilderland Industrial Development Agency to consent to and authorize the execution of certain mortgage documents related to The Young Men's Christian

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 mortgage approval resolution

Edit your 2012 mortgage approval resolution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 mortgage approval resolution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 mortgage approval resolution online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 mortgage approval resolution. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

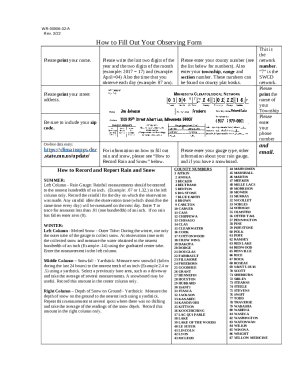

How to fill out 2012 mortgage approval resolution

How to fill out 2012 MORTGAGE APPROVAL RESOLUTION

01

Gather necessary personal information, including your name, address, and Social Security number.

02

Identify the property for which the mortgage approval is being sought.

03

Complete the loan application section, detailing the desired loan amount and loan type.

04

Provide financial information, including income, employment details, and existing debts.

05

Include any required supporting documents, such as tax returns, bank statements, and pay stubs.

06

Review the terms and conditions of the mortgage approval carefully.

07

Sign and date the resolution to signify your agreement with the terms.

Who needs 2012 MORTGAGE APPROVAL RESOLUTION?

01

Individuals applying for a mortgage to purchase a home.

02

Real estate agents assisting clients with mortgage applications.

03

Lenders evaluating potential borrowers for mortgage approval.

Fill

form

: Try Risk Free

People Also Ask about

What is the Marp introduction?

It requires lenders to handle all such cases sympathetically and positively, with the objective at all times of helping people to meet their mortgage obligations. Since January 2011, under the CCMA, lenders must operate a Mortgage Arrears Resolution Process (MARP) when dealing with arrears and pre-arrears customers.

How to ensure mortgage approval?

Can I improve my chances of getting a mortgage? Paying off debts. If you are able to reduce your current debts this might have an impact on the amount you can borrow. Having a strong credit score. Improving mortgage affordability.

What is the mortgage arrears resolution process?

MARP protects borrowers from being immediately evicted from their homes if they fall into mortgage arrears. Another protection is that MARP ensures the borrower receives eight months' notice from the starting date of their arrears before legal proceedings can start.

How to deal with mortgage arrears?

If you're struggling to pay your mortgage every month, you could ask to: pay the debt over a longer period. switch to interest-only payments. take a break from your payments for a few months - this is known as taking a 'repayment holiday'

What does it mean when your mortgage is in arrears?

If you have mortgage arrears it means you are behind with your payments. Missed mortgage payments are recorded on your credit file. If you do not pay what you owe, you are at risk of your house being repossessed.

What is the maximum number of mortgages allowed?

So, how many mortgages can you have? The answer usually varies depending on your credit score, DTI and general financial health. That said, many lenders will likely be reluctant to lend beyond 10 mortgages at any given time to most individuals, as Fannie Mae typically caps their support for mortgages at 10 per person.

How do you clear mortgage arrears?

Lenders will sometimes ask you to pay off the arrears over 12 to 24 months. If you cannot afford to do this, ask for longer to clear the arrears. Start paying what you can afford anyway, and explain your reasons for not being able to pay more. If your home is worth more than your total mortgage, tell your lender.

How many steps are in the marp process?

Under the Central Bank of Ireland's Code of Conduct on Mortgage Arrears (the Code), Finance Ireland implemented a 4-step process called the Mortgage Arrears Resolution Process (MARP) to help customers whose mortgage is in arrears or is at risk of going into arrears.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 MORTGAGE APPROVAL RESOLUTION?

The 2012 Mortgage Approval Resolution is a formal document used by organizations to authorize the approval of mortgage loans. It provides the necessary legal framework for entering into mortgage agreements.

Who is required to file 2012 MORTGAGE APPROVAL RESOLUTION?

Typically, the 2012 Mortgage Approval Resolution must be filed by the governing bodies of organizations, such as boards of directors or trustees, when approving a mortgage loan for real estate purposes.

How to fill out 2012 MORTGAGE APPROVAL RESOLUTION?

To fill out the 2012 Mortgage Approval Resolution, one must include specifics such as the name of the organization, details about the mortgage lender, the amount of the mortgage, the property location, and the signatures of authorized representatives.

What is the purpose of 2012 MORTGAGE APPROVAL RESOLUTION?

The purpose of the 2012 Mortgage Approval Resolution is to provide official consent for the organization to enter into mortgage agreements, ensuring that the process is compliant with relevant governance and legal standards.

What information must be reported on 2012 MORTGAGE APPROVAL RESOLUTION?

The 2012 Mortgage Approval Resolution must report information such as the organization's name, the details of the mortgage, the terms of the loan, the legal descriptions of the property, and the names and signatures of the approving officials.

Fill out your 2012 mortgage approval resolution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Mortgage Approval Resolution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.