Get the free PAYDAY LOANS

Show details

This document outlines the regulations governing payday loans in Saskatchewan, detailing the licensing process, requirements for payday lenders, and consumer protection measures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payday loans

Edit your payday loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payday loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payday loans online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payday loans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

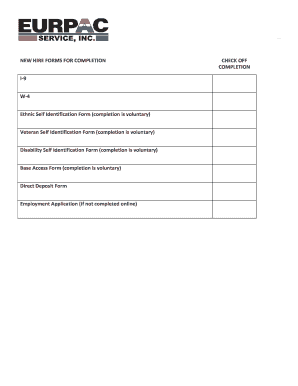

How to fill out payday loans

How to fill out PAYDAY LOANS

01

Identify your financial need.

02

Determine the loan amount you need to borrow.

03

Research payday loan providers and their terms.

04

Prepare the necessary documentation, including identification and proof of income.

05

Fill out the application form accurately.

06

Review the loan agreement and interest rates.

07

Submit the application either online or in person.

08

Receive approval and funds quickly, typically within one business day.

Who needs PAYDAY LOANS?

01

Individuals facing unexpected expenses.

02

People in need of quick cash before their next payday.

03

Those with limited access to traditional banking services.

04

Borrowers with poor credit history seeking immediate relief.

Fill

form

: Try Risk Free

People Also Ask about

What are the advantages of a payday loan?

Payday loans advantages Quick access to funds. Payday loans offer quick access to cash. More available for bad credit (in some cases) Part of the reason payday lenders are higher-cost is because they're a higher risk for the payday loan lender themselves. Repaid quickly. No collateral required.

Why is it called a payday loan?

The term "payday" in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary, but receives part of that payday sum in immediate cash from the lender.

What is the difference between a payday loan and a regular loan?

Key takeaways. Payday loans are usually short-term, high cost loans designed for immediate financial needs. Payday loans are typically small and do not help strengthen your credit history. Personal loans may offer higher borrowing limits with a variety of repayment terms.

What is a payday loan?

Payday loans are small loans based on very short terms. They're for $300 or less, and typically have to be repaid within two to four weeks. Also called cash advance loans, they are legal in many states, including California.

What is a payday loan in simple terms?

A "payday loan" is a loan of short duration, usually two weeks, with exorbitant interest rates. The payday loan industry generates billions of dollars a year. States are cracking down on payday lenders, and the industry is regulated in the states where it is still legal.

What is true about payday loans?

Payday loans are designed to cover short-term expenses, and they can be taken out without a credit check or providing any collateral. The catch is that these loans charge very high fees and interest rates.

How does payday work?

No credit check is necessary. Loan amounts vary from $50 to $1,000, depending on the law in your state. If approved, you receive cash on the spot, or it's deposited in your bank account within one or two days. Full payment is due on the borrower's next payday, which typically is two weeks.

What is another term for a payday loan?

A payday loan (also called a cash-advance loan, a check-advance loan, a post-dated check loan, or a deferred deposit loan) is a short-term, high-interest loan from a check cashing business or a finance company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PAYDAY LOANS?

Payday loans are short-term, high-interest loans typically due on the borrower's next payday, used to cover urgent expenses.

Who is required to file PAYDAY LOANS?

Individuals who take out payday loans are typically the ones required to file paperwork associated with these loans, including lenders who must adhere to state regulations.

How to fill out PAYDAY LOANS?

To fill out payday loan applications, borrowers must provide personal information, employment details, income verification, and bank account information.

What is the purpose of PAYDAY LOANS?

The purpose of payday loans is to provide quick access to cash for urgent financial needs or emergencies, often for borrowers who may not qualify for traditional loans.

What information must be reported on PAYDAY LOANS?

Information that must be reported includes the loan amount, interest rate, repayment terms, borrower's identification, and income details.

Fill out your payday loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payday Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.