Get the free Form SR - copyright

Show details

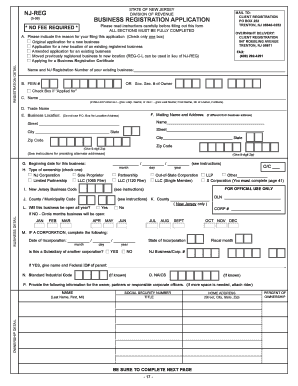

Form SR Detach and read these instructions before completing this form* Make sure all applicable spaces have been lled in before you return this form* BASIC INFORMATION When to Use This Form Use Form SR for registration of published or unpublished sound recordings. Form SR should be used when the copyright claim is limited to the sound recording itself and it may also be used where the same copyright claimant is seeking simultaneous registration of the underlying musical dramatic or literary...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form sr - copyright

Edit your form sr - copyright form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form sr - copyright form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form sr - copyright online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form sr - copyright. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form sr - copyright

How to fill out Form SR

01

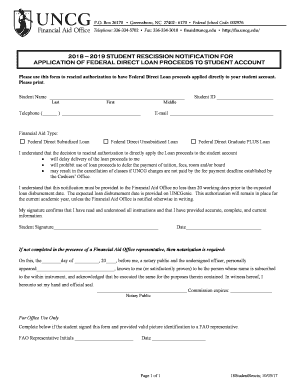

Gather all necessary personal information including your name, address, and Social Security number.

02

Obtain the Form SR from the appropriate agency or website.

03

Begin filling out the form by entering your personal information in the designated sections.

04

Review the eligibility criteria and ensure you meet all requirements.

05

Complete the rest of the form following the instructions provided for each section.

06

Double-check all information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed Form SR as directed, either online or via mail.

Who needs Form SR?

01

Individuals who are eligible for benefits or services that require Form SR.

02

Taxpayers who need to report specific income or claim deductions.

03

People seeking financial assistance or public aid who must provide personal information.

Fill

form

: Try Risk Free

People Also Ask about

Are 1040 forms available at the post office?

1:03 1:59 The answer is it depends some post offices do still carry a limited selection of IRS tax forms. ButMoreThe answer is it depends some post offices do still carry a limited selection of IRS tax forms. But it's not a guarantee. Your best bet is to call your local post office and ask directly.

Where can I pick up 1040 tax forms?

By phone. To get federal tax forms, you can also call the IRS at 1-800-829-3676. In person. You can walk in and pick up your forms at an IRS Taxpayer Assistance Center (TAC). Elsewhere. Your local government offices may have federal and state tax forms.

What is the SR form?

Form 1040-SR is an alternative version of the 1040 form that features a larger print and an easy-to-read standard deduction table. Form 1040-SR can be used by seniors 65 and older filing a paper return.

Who should file the IRS Form 1040-SR?

Form 1040-SR. Form 1040-SR, U.S. Income Tax Return for Seniors, was introduced in 2019. You can use this form if you are age 65 or older at the end of 2024. The form generally mirrors Form 1040. However, the Form 1040-SR has larger text and some helpful tips for older taxpayers.

Is there a difference between 1040 and 1040SR?

Form 1040-SR is an alternative version of the 1040 form that features a larger print and an easy-to-read standard deduction table. Form 1040-SR can be used by seniors 65 and older filing a paper return. Other than these accommodations, it functions the same as the standard 1040 form.

Can Form 1040-SR be filed electronically?

IRS Form 1040, 1040-SR, and 1040-NR. See a full list of tax forms, including 1040 Forms you can prepare and e-File for your 2024 year tax return. If there are certain forms that cannot be electronically filed, you can complete these tax forms and mail them to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form SR?

Form SR is a tax form used by certain taxpayers to report the sale or exchange of specified securities and to reconcile gains and losses from these transactions.

Who is required to file Form SR?

Taxpayers who have sold or exchanged specified securities during the tax year and need to report gains or losses are required to file Form SR.

How to fill out Form SR?

To fill out Form SR, taxpayers should provide information about the securities sold, including the date of acquisition, date of sale, sale proceeds, cost basis, and any resulting gain or loss.

What is the purpose of Form SR?

The purpose of Form SR is to ensure that taxpayers accurately report their capital gains and losses from the sale or exchange of specified securities to the IRS.

What information must be reported on Form SR?

Form SR requires reporting details such as the name of the security, quantity sold, date acquired, date sold, sale price, and cost basis of the securities.

Fill out your form sr - copyright online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Sr - Copyright is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.