Get the free POSITIVE BUDGET BALANCE EXPLANATION FORM - mtsac

Show details

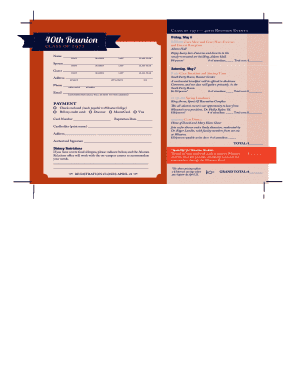

This document serves to explain why positive budget balances in specific accounts of the Unrestricted General Fund cannot be reduced, includes sample organizational data and account details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign positive budget balance explanation

Edit your positive budget balance explanation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your positive budget balance explanation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing positive budget balance explanation online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit positive budget balance explanation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out positive budget balance explanation

How to fill out POSITIVE BUDGET BALANCE EXPLANATION FORM

01

Start by gathering all relevant financial documents and records to support your budget balance.

02

Begin filling out the form by entering your personal or organization details at the top section.

03

Clearly state the budget period for which you are providing the explanation.

04

Provide a detailed breakdown of income sources that contributed to the positive balance.

05

List all expenses during the budget period, ensuring to categorize them appropriately.

06

Calculate the total income and total expenses, and ensure the positive balance is clearly highlighted.

07

Include a concise explanation of any variances or unexpected changes that contributed to the positive balance.

08

Attach any necessary supporting documents or evidence that may help explain the figures provided.

09

Review and ensure all sections of the form are completed accurately before submission.

Who needs POSITIVE BUDGET BALANCE EXPLANATION FORM?

01

Individuals or organizations who have experienced a surplus in their budget and need to provide an explanation, often for reporting or auditing purposes.

02

Entities that require a formal record of their positive budget balance for financial reviews or strategic planning.

Fill

form

: Try Risk Free

People Also Ask about

What is a positive budget balance?

A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

What is a negative budget balance?

A negative balance is an over expenditure of funds within a specific cost center. Payroll and allocations override budget and are the primary transactions that create a negative balance.

What does it mean to have a positive balance when budgeting?

Balance Your Budget If you have a positive balance, then your income is greater than your expenses. In other words, you're earning more money than you're spending. If you have a positive balance, you shouldn't start looking at new ways to spend your money.

What does a positive budget mean?

Positive Budget Variance: This means actual results exceeded expectations, such as earning more revenue than projected or spending less than budgeted. Negative Budget Variance: This occurs when actual results fall short of the budgeted figures, indicating overspending or lower-than-expected income.

What is budget balance?

A balanced budget occurs when revenues are equal to or greater than total expenses. A budget can be considered balanced after a full year of revenues and expenses have been incurred and recorded. Proponents of a balanced budget argue that budget deficits burden future generations with debt.

What is the balanced budget formula?

Y / = G + Y; Y / Y = G; Y = G: In this case the multiplier is found to be equal to 1 : by increasing public spending by G we are able to increase output by G. We have so shown that the balanced budget multiplier is equal to 1 (one-to-one relationship between public spending and output).

What is a budget balance?

A balanced budget occurs when revenues are equal to or greater than total expenses. A budget can be considered balanced after a full year of revenues and expenses have been incurred and recorded. Proponents of a balanced budget argue that budget deficits burden future generations with debt.

How to use balanced budget in a sentence?

He said this week that he would prioritize military spending over a balanced budget. It's the governor's responsibility to propose a balanced budget, then lawmakers can take it up. I will get us on track to a balanced budget.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is POSITIVE BUDGET BALANCE EXPLANATION FORM?

The POSITIVE BUDGET BALANCE EXPLANATION FORM is a document used to provide detailed explanations for entities that maintain a budget surplus, outlining how the surplus is managed and allocated.

Who is required to file POSITIVE BUDGET BALANCE EXPLANATION FORM?

Entities or organizations that have a positive budget balance at the end of a fiscal period are typically required to file this form, including government agencies and non-profit organizations.

How to fill out POSITIVE BUDGET BALANCE EXPLANATION FORM?

To fill out the form, entities must provide their identifying information, detail the amount of the positive budget balance, and include explanations for the surplus, along with any relevant financial statements or documents.

What is the purpose of POSITIVE BUDGET BALANCE EXPLANATION FORM?

The purpose of this form is to ensure transparency and accountability regarding budget surpluses, allowing oversight bodies to understand how surplus funds are being utilized.

What information must be reported on POSITIVE BUDGET BALANCE EXPLANATION FORM?

Required information includes the entity's financial details, the amount of the positive balance, a breakdown of the surplus allocation, and any planned expenditures or savings measures associated with the surplus.

Fill out your positive budget balance explanation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Positive Budget Balance Explanation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.