Get the free Financial CheckUp

Show details

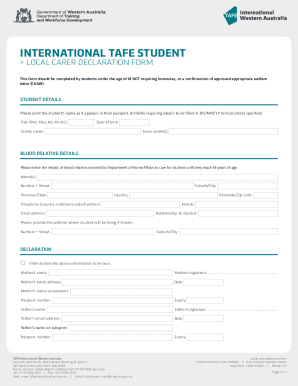

Personal Financial CheckUp GENERAL INFORMATION All information will be kept strictly confidential Please complete form, save to your computer and email to advisors wealthmanagers.com Name: Preferred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial checkup

Edit your financial checkup form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial checkup form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial checkup online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial checkup. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial checkup

How to Fill Out a Financial Checkup:

01

Gather all necessary documents: Before starting the financial checkup, make sure you have all the relevant documents such as bank statements, investment account statements, bills, and any other financial records.

02

Identify your financial goals: Before diving into the checkup, it's important to have a clear understanding of your financial goals. Whether it's saving for retirement, buying a house, or paying off debt, knowing your objectives will help guide the checkup and make it more effective.

03

Evaluate your income and expenses: Begin by analyzing your income sources and calculating your total monthly income. Then, review your expenses and categorize them into fixed (mortgage, insurance) and variable (entertainment, dining out) expenses. This will give you an overview of where your money is going and identify any areas of potential improvement.

04

Assess your debt situation: This step involves understanding your current debt obligations. List out all your debts, including credit cards, loans, and mortgages, along with their corresponding interest rates and monthly payments. Assess whether you're able to manage your debt load or if adjustments need to be made.

05

Review your savings and investments: Examine your current savings and investment accounts. Determine whether you're saving enough for emergencies and future goals. Check the performance of your investments and assess if any adjustments are required to align with your long-term objectives.

06

Examine insurance coverage: Evaluate your insurance policies, such as life, health, homeowners/renters, and auto insurance. Ensure that the coverage is adequate and meets your needs. Update policies if necessary or consider obtaining additional coverage if required.

07

Analyze your financial progress: Compare your current financial status to your previous checkup or goals. Identify any positive changes or areas that need improvement. This analysis will help you track your progress and make adjustments to your financial plan accordingly.

Who Needs a Financial Checkup?

01

Individuals with complex financial situations: People with multiple sources of income, investment properties, or significant debts can benefit from a financial checkup to ensure their finances are well-managed and optimized.

02

Those experiencing major life changes: Life events such as marriage, divorce, birth of a child, or career change can significantly impact one's financial situation. A checkup during such times can help adjust financial plans accordingly.

03

Young professionals starting out: Starting your financial journey on the right foot is crucial. A financial checkup can provide guidance on budgeting, saving, and setting long-term financial goals.

04

Pre-retirees and retirees: Transitioning into retirement requires careful financial planning. Conducting a checkup can help ensure retirement savings are on track and provide peace of mind for those entering this phase of life.

05

Anyone wanting to improve their financial health: Regardless of your current financial situation, conducting regular financial checkups is a proactive approach to improving your financial well-being. By assessing your finances, you can identify areas for improvement and take steps towards achieving your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial checkup for eSignature?

When you're ready to share your financial checkup, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the financial checkup in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your financial checkup directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit financial checkup on an Android device?

You can edit, sign, and distribute financial checkup on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is financial checkup?

Financial checkup is a process of reviewing one's financial health and assessing areas of improvement.

Who is required to file financial checkup?

Individuals or entities mandated by law or regulations to submit financial checkup are required to file it.

How to fill out financial checkup?

Financial checkup can be filled out by providing accurate financial information and submitting it to the appropriate authorities.

What is the purpose of financial checkup?

The purpose of financial checkup is to ensure transparency and compliance with financial regulations.

What information must be reported on financial checkup?

Information such as income, expenses, assets, and liabilities must be reported on financial checkup.

Fill out your financial checkup online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Checkup is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.