Get the free Untaxed Income Information Parent b2015b-2016

Show details

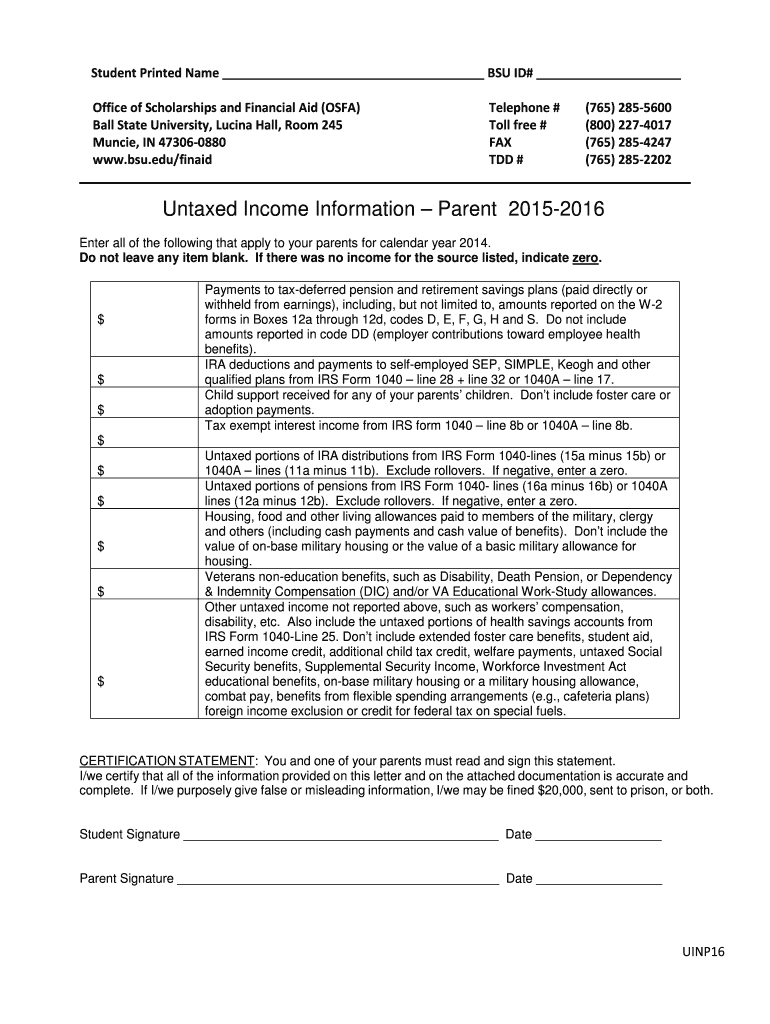

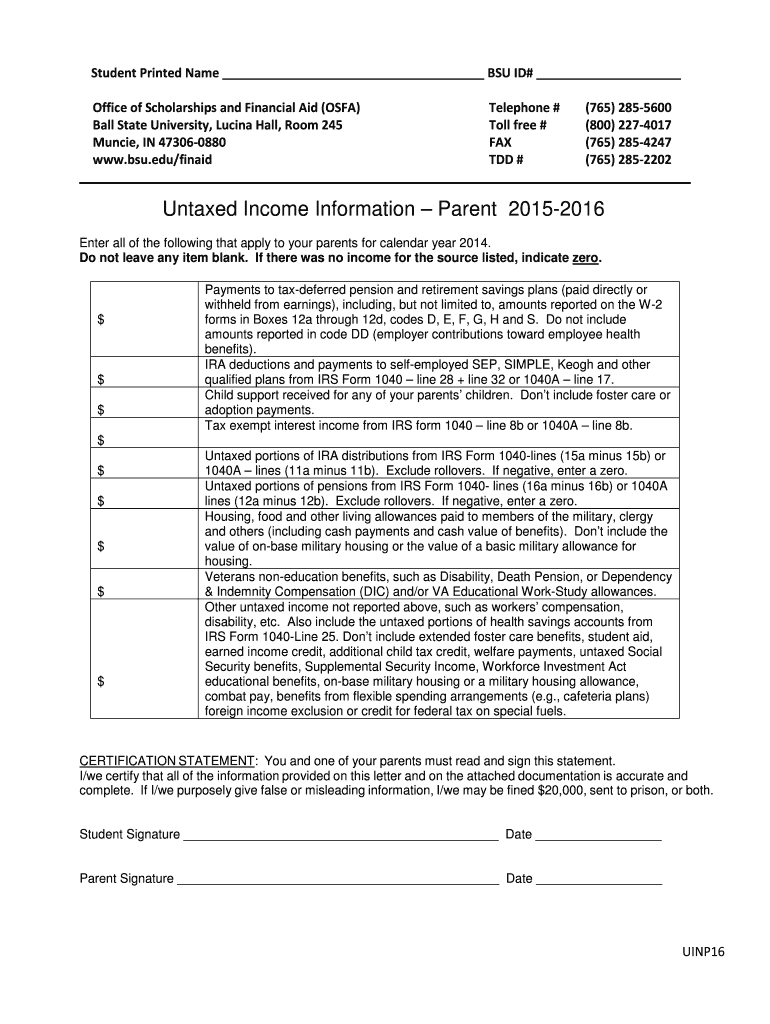

Student Printed Name BSU ID# Office of Scholarships and Financial Aid (OSF) Ball State University, Lucia Hall, Room 245 Muncie, IN 473060880 www.bsu.edu×fin aid Telephone # Toll free # FAX TDD #

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign untaxed income information parent

Edit your untaxed income information parent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your untaxed income information parent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing untaxed income information parent online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit untaxed income information parent. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out untaxed income information parent

How to fill out untaxed income information parent:

01

Gather all relevant documentation: Before starting the filling out process, gather all necessary documentation such as tax returns, W-2 forms, and any other income-related documents for the parent.

02

Start with the FAFSA: Access the Free Application for Federal Student Aid (FAFSA) form online and navigate to the section where untaxed income information is requested.

03

Identify the specific questions: Look for the questions that pertain to untaxed income information for the parent. These questions will typically ask about sources of untaxed income, such as child support, veterans benefits, or workers' compensation.

04

Enter accurate information: Fill in each question with accurate and up-to-date information. Double-check the answers to ensure accuracy and avoid any potential issues.

05

Attach required documents, if applicable: Some untaxed income sources may require additional documentation. Make sure to attach any required documents as instructed, such as a copy of the Social Security benefits statement or proof of receipt of veterans benefits.

06

Review and submit: Once all questions have been answered and necessary documentation attached, review the entire form to ensure accuracy and completeness. Make any necessary corrections, and then submit the FAFSA form.

07

Keep a copy for record: After submission, it is important to keep a copy of the filled-out FAFSA form for personal records and future reference.

Who needs untaxed income information parent:

01

Parents or legal guardians of students applying for financial aid: Any parent or legal guardian whose child is applying for financial aid through the FAFSA will need to provide untaxed income information.

02

Students who depend on their parent's income: If the student applying for financial aid is considered dependent, their parent's untaxed income information will be required.

03

Students seeking federal and state aid: Both federal and state financial aid programs usually require the untaxed income information of the parent to determine the student's eligibility for various forms of aid.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get untaxed income information parent?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the untaxed income information parent in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete untaxed income information parent online?

With pdfFiller, you may easily complete and sign untaxed income information parent online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete untaxed income information parent on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your untaxed income information parent. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is untaxed income information parent?

Untaxed income information parent refers to any income that is not subject to taxation and is required to be reported on financial aid forms.

Who is required to file untaxed income information parent?

Parents or legal guardians of dependent students who are applying for financial aid may be required to file untaxed income information.

How to fill out untaxed income information parent?

Untaxed income information for parents can usually be provided by completing the appropriate sections on financial aid forms such as the FAFSA or CSS Profile.

What is the purpose of untaxed income information parent?

The purpose of untaxed income information for parents is to provide a complete picture of the family's financial situation and help determine the student's eligibility for financial aid.

What information must be reported on untaxed income information parent?

Information such as child support received, tax-exempt interest income, and any other untaxed income sources may need to be reported on untaxed income information for parents.

Fill out your untaxed income information parent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Untaxed Income Information Parent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.