Get the free Audit Data Standard - aicpa

Show details

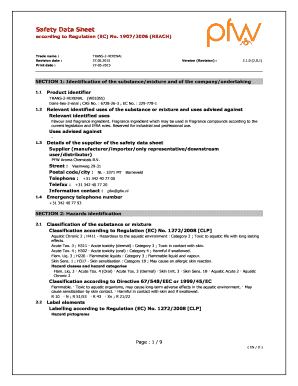

This exposure draft contains audit data standards developed by the AICPA for review and comment, particularly focusing on financial audit processes and improving data acquisition efficiency.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit data standard

Edit your audit data standard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit data standard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit data standard online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit audit data standard. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit data standard

How to fill out Audit Data Standard

01

Review the Audit Data Standard documentation to understand the requirements.

02

Gather the necessary data needed for the audit, including financial records and transaction logs.

03

Organize the data according to the specified categories in the standard.

04

Use appropriate tools or software to format the data in compliance with the standard.

05

Double-check the data for accuracy and completeness before submission.

06

Submit the completed Audit Data Standard form to the relevant authorities or stakeholders.

Who needs Audit Data Standard?

01

Companies and organizations required to undergo financial audits.

02

Regulatory bodies that mandate adherence to auditing standards.

03

Auditors who need a structured format to assess compliance and performance.

04

Stakeholders looking for transparency in financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is GAAS in accounting?

Generally accepted auditing standards or GAAS are the minimum standards certified public accountants (CPAs) must follow when they perform audits. Auditing standards have evolved over the last four decades to ensure consistency and uniformity in the performance of audits.

Is GAAS AICPA or PCAOB?

GAAS serve as the overarching framework for the three main financial auditing standards in the United States: SAS, PCAOB standards and the GAGAS. Auditors use the American Institute of Certified Public Accountants' (AICPA) Statements on Auditing Standards (SAS) to evaluate privately-held companies.

What is the auditing standard 145?

SAS 145 requires the auditor to identify general information technology (IT) controls that address the risks arising from the use of IT and evaluate their design and implementation. Auditors cannot continue to audit around IT controls.

Is GAAS the same as GAAP?

GAAP provides guidelines for preparing financial statements, ensuring consistency and transparency. GAAS focuses on the accuracy and reliability of audits, maintaining financial integrity.

Is GAAP still used in the US?

GAAP is used mainly in the U.S., while most other countries follow the international financial reporting standards (IFRS). GAAP is also used by states and other government entities in the U.S. to prepare their financial statements.

What are the standards for an audit?

AUDIT STANDARDS Standards are more specific than objectives. They are quantifiable statements detailing the specific aspects of patient care and/or management that you intend to measure current practice against.

Is it GAAP or GAAS?

GAAP provides guidelines for preparing financial statements, ensuring consistency and transparency. GAAS focuses on the accuracy and reliability of audits, maintaining financial integrity.

Are GAAP and GAAS the same thing?

The fundamental difference between these frameworks is the following: GAAP is a set of accounting principles governing how companies prepare financial statements, while GAAS consists of auditing standards dictating how auditors verify those statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Audit Data Standard?

Audit Data Standard (ADS) is a standardized framework for reporting financial audit data, designed to enhance transparency and consistency in the audit process.

Who is required to file Audit Data Standard?

Organizations that undergo financial audits typically, such as public companies, not-for-profits, and certain governmental entities, are required to file the Audit Data Standard.

How to fill out Audit Data Standard?

To fill out the Audit Data Standard, organizations must collect financial data according to the prescribed format and guidelines, ensuring accuracy and completeness, and then submit the data through the designated channels.

What is the purpose of Audit Data Standard?

The purpose of the Audit Data Standard is to streamline the audit process, promote uniform data reporting, and facilitate easier analysis and comparison of financial information across different entities.

What information must be reported on Audit Data Standard?

The information that must be reported on the Audit Data Standard includes financial statements, notes, auditor's opinion, and other critical financial data that reflect the organization's financial health.

Fill out your audit data standard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Data Standard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.