Get the free Limited Partnerships

Show details

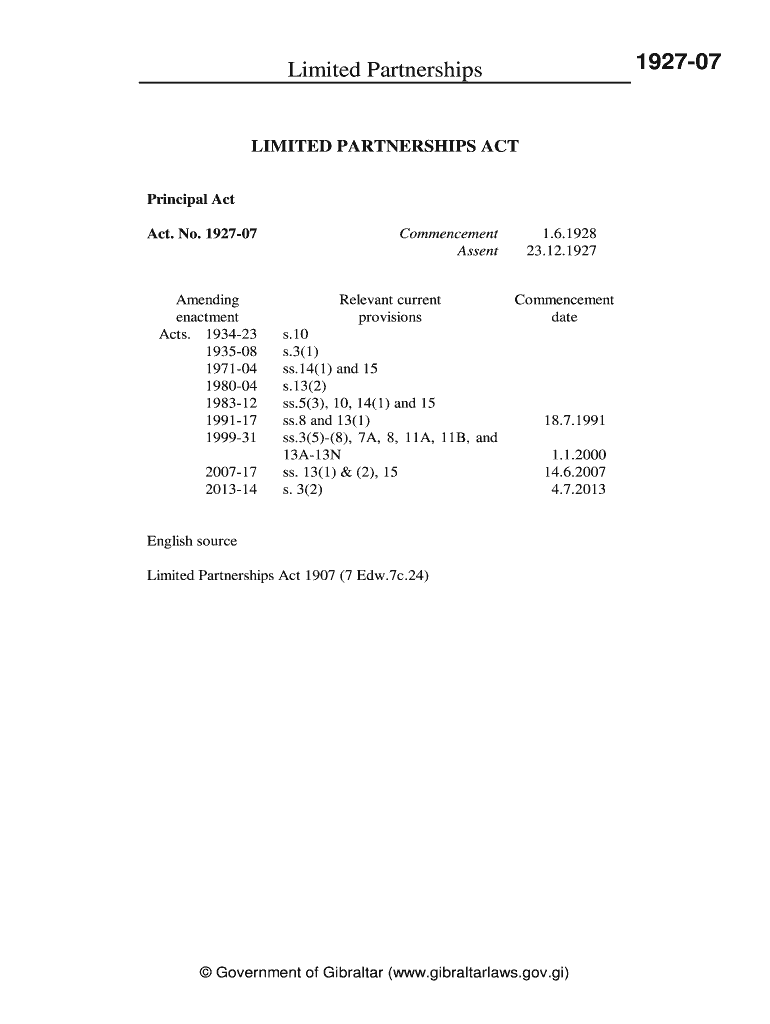

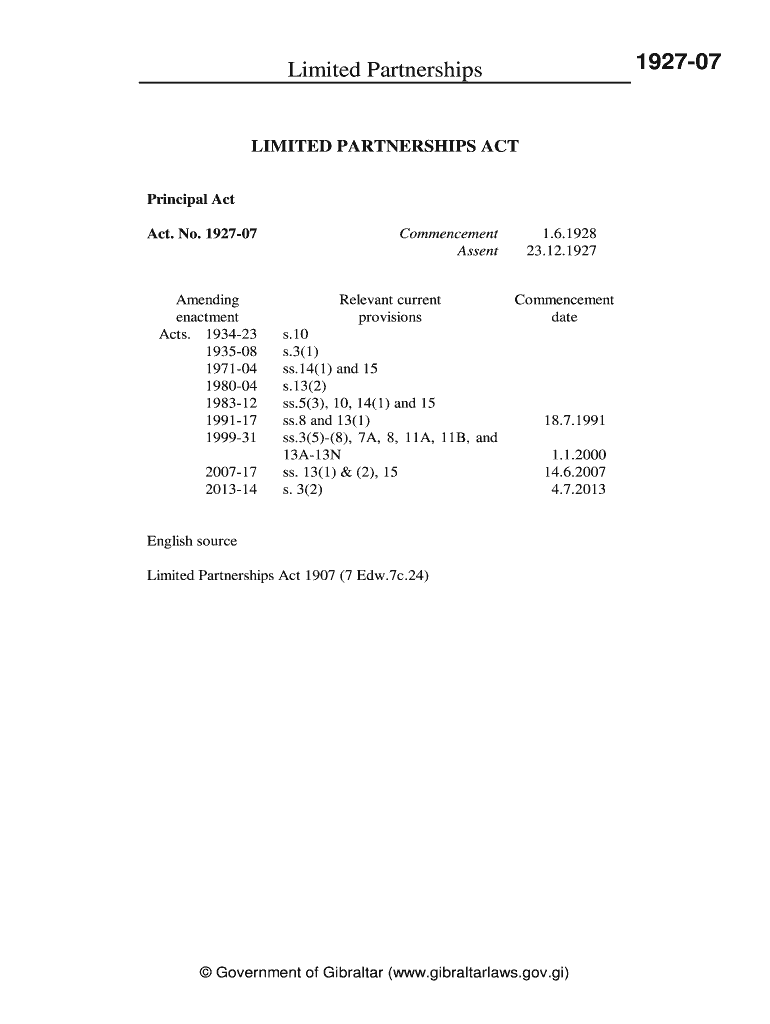

AN ACT TO ESTABLISH LIMITED PARTNERSHIPS, outlining the definition, registration, and legal framework for limited partnerships in Gibraltar.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited partnerships

Edit your limited partnerships form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited partnerships form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit limited partnerships online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit limited partnerships. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited partnerships

How to fill out Limited Partnerships

01

Gather necessary information about the partnership, including names and addresses of all partners.

02

Determine the type of limited partnership being formed.

03

Complete the partnership agreement, specifying the roles and responsibilities of general and limited partners.

04

Choose a unique name for the partnership that complies with state regulations.

05

File the Certificate of Limited Partnership with the appropriate state authority.

06

Obtain any necessary licenses or permits to operate legally.

07

Prepare a tax identification number and any other financial documentation required.

08

Open a separate bank account for the partnership's financial activities.

Who needs Limited Partnerships?

01

Entrepreneurs looking to limit their personal liability while attracting investors.

02

Business partners wanting to create a structured partnership with specific roles.

03

Investors seeking passive investment opportunities in a venture without taking on full liability.

Fill

form

: Try Risk Free

People Also Ask about

What is a limited partnership in English?

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts.

Why would someone want a limited partnership?

Limited partners have limited liability for losses. So, if your company gets sued, you won't be responsible for paying hefty funds like general partners. You get to decide how involved you are in the business, both physically and financially.

What is a limited partnership in English law?

You can set up a limited partnership to run your business. You must have at least one 'general partner' and one 'limited partner'. General and limited partners have different responsibilities and levels of liability for any debts the business cannot pay. All partners pay tax on their share of the profits.

What is the definition of a limited partnership?

Limited Partnership (LP) A limited partnership is a partnership consisting of a general partner, who manages the business and has unlimited personal liability for the debts and obligations of the partnership, and one or more limited partners, who have limited liability but cannot participate in management.

What is an example of a limited partnership?

Some examples of business ventures that commonly use the limited partnership structure include: Shopping malls, apartment complexes and other real estate businesses: With the limited partnership structure, businesses in the real estate industry can provide passive income from rent to the limited partners.

What is limited partnership in simple words?

A limited partnership is a form of partnership in which some of the partners contribute only financially and are liable only to the extent of the amount of money that they have invested. In a limited partnership structure, limited partners are shielded to the extent of their investment.

What is the difference between LLP and LP?

Limited Partnerships (LPs) have at least one general partner with unlimited liability and limited partners with liability capped at their investment amount. Limited Liability Partnerships (LLPs) only have limited liability partners, all of whom can participate in making business decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Limited Partnerships?

A Limited Partnership is a business structure that consists of at least one general partner who manages the business and assumes all liabilities, and one or more limited partners who contribute capital and share profits but have limited liability and do not participate in day-to-day operations.

Who is required to file Limited Partnerships?

Generally, the general partner of the Limited Partnership is responsible for filing the necessary paperwork with the state authorities to officially form and register the partnership.

How to fill out Limited Partnerships?

To fill out a Limited Partnership agreement, you need to provide the names and addresses of the general and limited partners, description of the business, contribution amounts from each partner, distribution of profits and losses, and conditions for dissolution.

What is the purpose of Limited Partnerships?

The purpose of Limited Partnerships is to allow investors (limited partners) to contribute capital to a business while limiting their liability to the amount they invested, enabling greater investment opportunities without risking personal assets.

What information must be reported on Limited Partnerships?

Information that must be reported typically includes the names and addresses of all partners, contributions made by each partner, the partnership's business purpose, terms of profit and loss distribution, and any other relevant operational details.

Fill out your limited partnerships online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Partnerships is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.