Get the free SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SE...

Show details

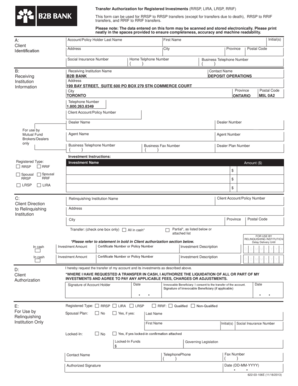

This document provides detailed information on the Separate Trading of Registered Interest and Principal of South African Government Securities (STRIPS), outlining the methodology, features, market

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign separate trading of registered

Edit your separate trading of registered form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your separate trading of registered form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing separate trading of registered online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit separate trading of registered. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out separate trading of registered

How to fill out SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)

01

Obtain the necessary forms from your bank or the South African Reserve Bank.

02

Fill out the required details, including your personal information, tax details, and investment account information.

03

Specify the amount and denominations of the registered interest and principal you wish to trade separately.

04

Review and sign the documentation to confirm your intention to trade STRIPS.

05

Submit the completed forms to your bank or the designated authority for processing.

06

Keep a copy of all submitted documents for your records.

Who needs SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

01

Individual investors looking to diversify their investment portfolio in fixed-income securities.

02

Institutional investors such as pension funds and mutual funds seeking options for trading government securities.

03

Financial advisors and brokers who manage investment portfolios for their clients.

04

Compliance officers requiring knowledge of government securities for regulatory reporting.

Fill

form

: Try Risk Free

People Also Ask about

What statement best describes Treasury STRIPS separate trading of registered interest and principal of securities?

Identify the statement that best describes Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities). The answer is zero-coupon bonds created by separating the semiannual coupon payments and the principal repayment portions of a U.S. Treasury note and bond.

Do STRIPS pay interest?

Treasury STRIPS are a type of zero- coupon bond. In general, a zero- coupon bond is any bond which doesn't pay periodic interest. The investor's earnings grow over the life of the bond as the deeply discounted purchase price gradually rises toward the bond's par value as maturity approaches.

In which of the following instruments is there a separate trading of interest payment and principal payment?

The idea of STRIPS is that the principal and each interest payment become separate securities that are treated individually. Each separated piece is a zero-coupon security that matures separately and, has only one payment.

What is the difference between interest STRIPS and principal STRIPS?

Interest-Only Strips. There are some fundamental differences between principal-only strips and interest-only strips. Principal-only strips consist of a known dollar amount but an unknown payment timing. They are sold to investors at a discount on face value, which is determined by interest rates and prepayment speed.

What is separate trading of registered interest and principal of securities?

STRIPS is the acronym for Separate Trading of Registered Interest and Principal of Securities. STRIPS let investors hold and trade the individual interest and principal components of eligible Treasury notes, bonds, and TIPS as separate securities.

Which statement best describes Treasury STRIPS separate trading of registered interest and principal of securities?

Identify the statement that best describes Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities). The answer is zero-coupon bonds created by separating the semiannual coupon payments and the principal repayment portions of a U.S. Treasury note and bond.

What is the difference between STRIPS interest and STRIPS principal?

Interest-Only Strips. There are some fundamental differences between principal-only strips and interest-only strips. Principal-only strips consist of a known dollar amount but an unknown payment timing. They are sold to investors at a discount on face value, which is determined by interest rates and prepayment speed.

What is separate trading of registered interest and principal of securities STRIPS?

Separate Trading of Registered Interest and Principal Securities (STRIPS) was created to provide investors with another alternative in the fixed-income arena that could meet certain investment objectives that were difficult to achieve using traditional bonds and notes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS) refers to the process whereby the interest payments and the principal amount of government securities are traded separately. This allows investors to buy and sell these cash flows independently, creating flexibility in investment strategies.

Who is required to file SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

Entities that engage in the trading of these separated components of government securities, including financial institutions, brokers, and dealers, are typically required to file STRIPS.

How to fill out SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

To fill out the STRIPS form, you need to provide details such as the security identifier, the amount of interest or principal being traded, the dates of the transactions, and the parties involved in the trade. It is important to follow the specific guidelines provided by the South African government or relevant authority.

What is the purpose of SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

The purpose of STRIPS is to enhance liquidity and flexibility in the bond market by allowing investors to tailor their investment strategies. It provides opportunities for investors who may wish to invest only in fixed interest or principal cash flows.

What information must be reported on SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL OF SOUTH AFRICAN GOVERNMENT SECURITIES (STRIPS)?

The information that must be reported includes details such as the security identifier, transaction amounts for both interest and principal, transaction dates, and the involved parties. Additional compliance information may also be required depending on the regulatory framework.

Fill out your separate trading of registered online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Separate Trading Of Registered is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.