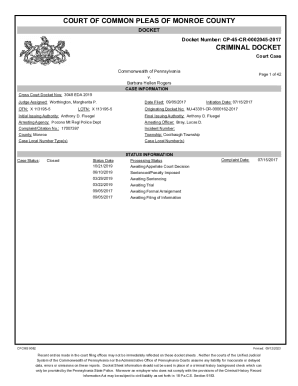

Get the free DCRAC’s Plan for the low income taxpayer

Show details

This document outlines the plan of DCRAC related to the provision of tax clinic services for low income taxpayers in Delaware, detailing the importance of education, representation, and outreach in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dcracs plan for form

Edit your dcracs plan for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dcracs plan for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dcracs plan for form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dcracs plan for form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dcracs plan for form

How to fill out DCRAC’s Plan for the low income taxpayer

01

Obtain the DCRAC Plan form for low-income taxpayers from the appropriate agency or website.

02

Review the eligibility criteria to ensure you qualify as a low-income taxpayer.

03

Gather all necessary documentation, including income statements, tax returns, and any other required financial information.

04

Fill out the personal information section accurately, including your name, address, and Social Security number.

05

Complete the income section by detailing all sources of income and their amounts.

06

Provide information on your household size and any dependents.

07

Detail any allowable expenses or deductions you may have.

08

Review your completed form for accuracy and completeness before submitting.

09

Submit the form by the specified deadline via the method indicated in the instructions.

Who needs DCRAC’s Plan for the low income taxpayer?

01

Low-income individuals or families who require assistance with tax-related issues.

02

Taxpayers who might struggle with filing their taxes or meeting tax obligations due to financial constraints.

03

Non-profit organizations or community groups supporting low-income individuals in navigating tax-related matters.

Fill

form

: Try Risk Free

People Also Ask about

What are the low income certification guidelines for the IRS?

Do I qualify for the low income certification? You qualify if your adjusted gross income (AGI), as determined by your most recently filed income tax return (Form 1040 or 1040-SR), is less than or equal to the amount shown in the chart on Form 656, Section 1, based on your family size and where you live.

What is the Maryland Low income Taxpayer Clinic?

Welcome. The University of Maryland Low Income Taxpayer Clinic (LITC) is an academic clinic operating since 2011 within the Clinical Law Offices of the University of Maryland Carey School of Law. We provide free, independent legal representation to low-income taxpayers in disputes with the IRS.

What is the qualified allocation plan for the low income housing tax credit program?

The federal Low Income Housing Tax Credit program requires each state agency that allocates tax credits, generally called a housing finance agency, to have a Qualified Allocation Plan (QAP). The QAP sets out the state's eligibility priorities and criteria for awarding federal tax credits to housing properties.

What is the University of Florida Low Income Tax Clinic?

The LITC provides representation throughout the lifecycle of a tax case, from resolving issues of non-filing, through audits, through litigation, and ultimately through collection. The LITC provides taxpayer education throughout North Central Florida.

Who is eligible for low income taxpayer clinic referral?

In order to qualify for assistance from an LITC, generally a taxpayer's income must be below a certain threshold, and the amount in dispute with the IRS is usually less than $50,000. Although LITCs receive partial funding from the IRS, LITCs, their employees, and their volunteers are completely independent of the IRS.

What is the Maryland Low income taxpayer Clinic?

Welcome. The University of Maryland Low Income Taxpayer Clinic (LITC) is an academic clinic operating since 2011 within the Clinical Law Offices of the University of Maryland Carey School of Law. We provide free, independent legal representation to low-income taxpayers in disputes with the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DCRAC’s Plan for the low income taxpayer?

DCRAC's Plan for the low income taxpayer aims to provide assistance and resources to help low income individuals navigate tax obligations and maximize their benefits.

Who is required to file DCRAC’s Plan for the low income taxpayer?

Individuals or organizations that provide services to low income taxpayers are required to file DCRAC's Plan to ensure compliance and access to various assistance programs.

How to fill out DCRAC’s Plan for the low income taxpayer?

To fill out DCRAC's Plan, one must gather necessary personal and financial information, follow the provided guidelines, and submit the completed plan to the appropriate DCRAC office.

What is the purpose of DCRAC’s Plan for the low income taxpayer?

The purpose is to establish a structured approach to assist low income taxpayers in meeting their tax responsibilities, ensuring they are aware of their rights, benefits, and any available resources.

What information must be reported on DCRAC’s Plan for the low income taxpayer?

The information required includes taxpayer identification details, income levels, any existing tax liabilities, and documentation to support claims for credits or deductions.

Fill out your dcracs plan for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dcracs Plan For Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.