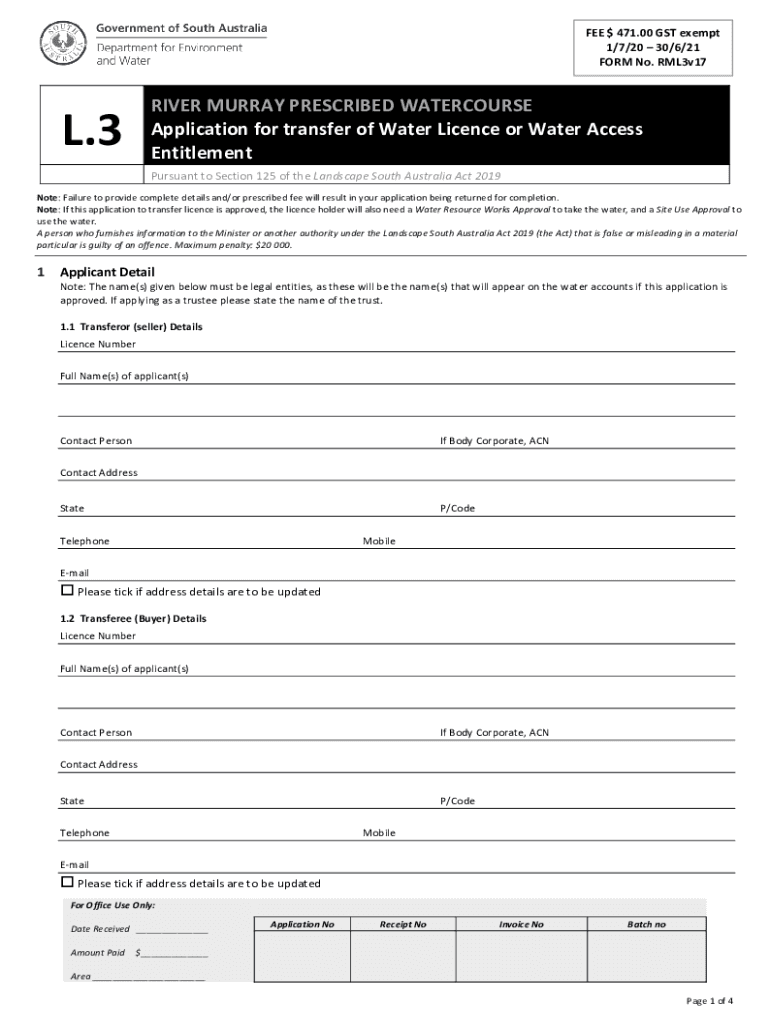

Get the free FEE $ 471.00 GST exempt

Show details

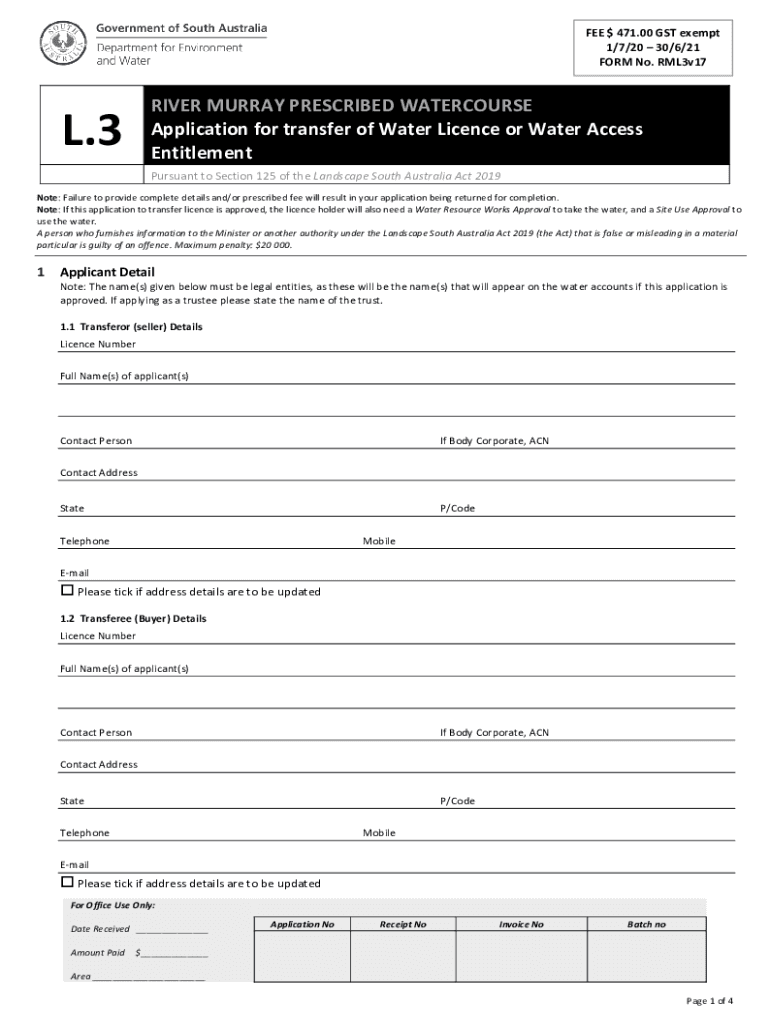

This document is an application form for the transfer of a water licence or water access entitlement in accordance with the Landscape South Australia Act 2019. It includes sections for applicant details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fee 47100 gst exempt

Edit your fee 47100 gst exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fee 47100 gst exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fee 47100 gst exempt online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fee 47100 gst exempt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fee 47100 gst exempt

How to fill out FEE $ 471.00 GST exempt

01

Obtain the FEE form that requires payment of $471.00.

02

Review the instructions on the form for GST exemption eligibility.

03

Fill out your personal information, ensuring accuracy.

04

Indicate the reason for GST exemption in the appropriate section.

05

Attach any required documentation to support your GST-exempt status.

06

Double-check all entries for completeness.

07

Submit the completed form along with the payment of $471.00.

Who needs FEE $ 471.00 GST exempt?

01

Individuals or organizations that qualify for GST exemption based on specific criteria.

02

Non-profit organizations or charities that provide exempt services.

03

Educational institutions that are exempt from GST on certain fees.

04

Businesses registered under GST that are eligible for exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What is the Washington sales tax?

6.5% State Sales Tax The State of Washington imposes a 6.5% sales tax on all retail sales as defined by statute (RCW 82.08. 020). Cities, towns, counties, transit districts, and public facilities, districts may impose additional local sales taxes as described below.

What is the GST rate in Brazil?

Current GST Rates in Brazil. Understanding GST rates in Brazil is crucial for correctly calculating the returns. Here's a breakdown: ICMS: 17%–20% in most states for intrastate sales; interstate rates vary between 4%, 7%, or 12%.

What rate is GST?

GST is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia.

What is the GST list in India?

As of now, GST in India has the following major slabs: 0% (Exempt): Essential daily needs such as fresh fruits, vegetables, milk, bread, etc. 5% GST Slab: Common goods such as packaged food. 12% GST Slab: Processed food, fruit juices, frozen meat, butter, ghee, nuts, etc.

What is the current GST rate?

The latest reforms mark a major simplification of the GST structure. The shift to a two-slab system of 5% and 18%, removing the earlier 12% and 28% rates, will make taxation more transparent and easier to follow.

Is GST the same as VAT?

The Value Added Tax (VAT) or Goods and Services Tax (GST) are broadly based consumption tax assessed on the value added to goods and services. It applies to all goods and services that are bought and sold for use or consumption in foreign tax jurisdiction.

What is the rate of GST?

The latest reforms mark a major simplification of the GST structure. The shift to a two-slab system of 5% and 18%, removing the earlier 12% and 28% rates, will make taxation more transparent and easier to follow.

What is the GST exemption BMO?

BMO Exemption: The exemption code refers to an exemption, pursuant to paragraph 13-10(1)(b) of the GST Act in conjunction with section 38-50 of the GST Act, from payment of the GST levied on importation of certain drugs and medicinal preparations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FEE $ 471.00 GST exempt?

FEE $ 471.00 GST exempt refers to a specific fee amount that is not subject to Goods and Services Tax (GST) in a transaction or service.

Who is required to file FEE $ 471.00 GST exempt?

Generally, individuals or businesses that have transactions that fall under the conditions specified by tax authorities as GST exempt must file FEE $ 471.00 GST exempt.

How to fill out FEE $ 471.00 GST exempt?

To fill out FEE $ 471.00 GST exempt, provide accurate details regarding the transaction, including the amount, applicable exemptions, and any relevant identification information required by the tax authorities.

What is the purpose of FEE $ 471.00 GST exempt?

The purpose of FEE $ 471.00 GST exempt is to establish a standard fee that is recognized as exempt from GST, ensuring compliance with tax regulations while facilitating proper accounting practices.

What information must be reported on FEE $ 471.00 GST exempt?

The information that must be reported on FEE $ 471.00 GST exempt typically includes the nature of the transaction, total fee amount, GST exemption justification, and any relevant identification such as tax file numbers or business registration details.

Fill out your fee 47100 gst exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fee 47100 Gst Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.