Get the free Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual

Show details

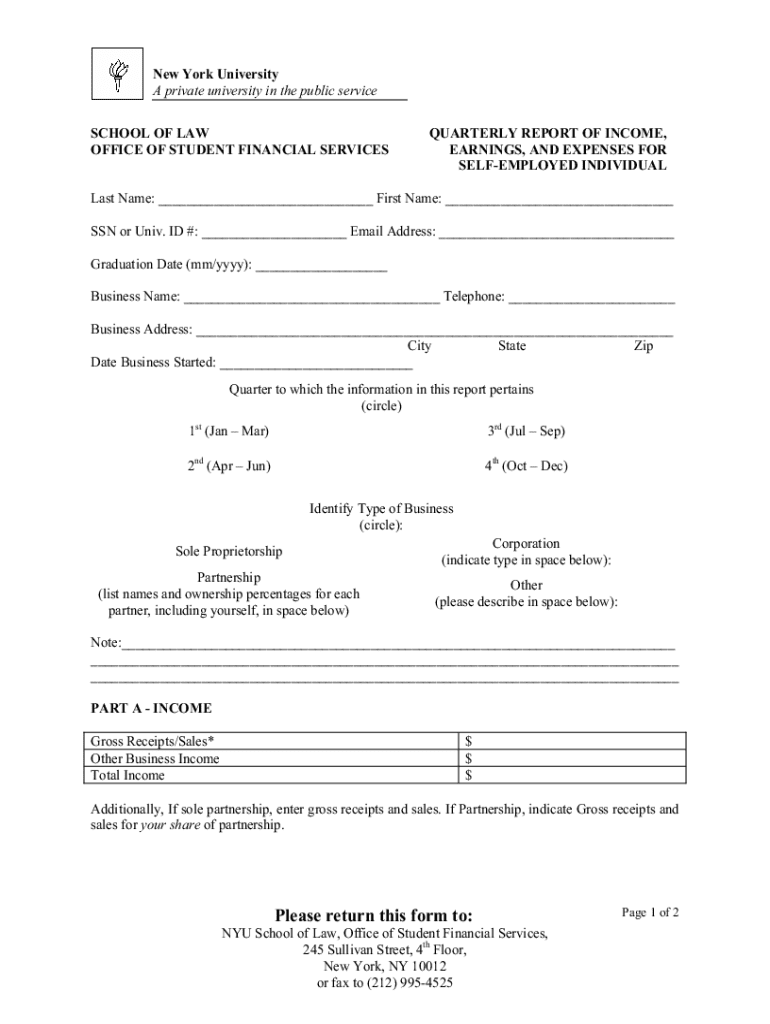

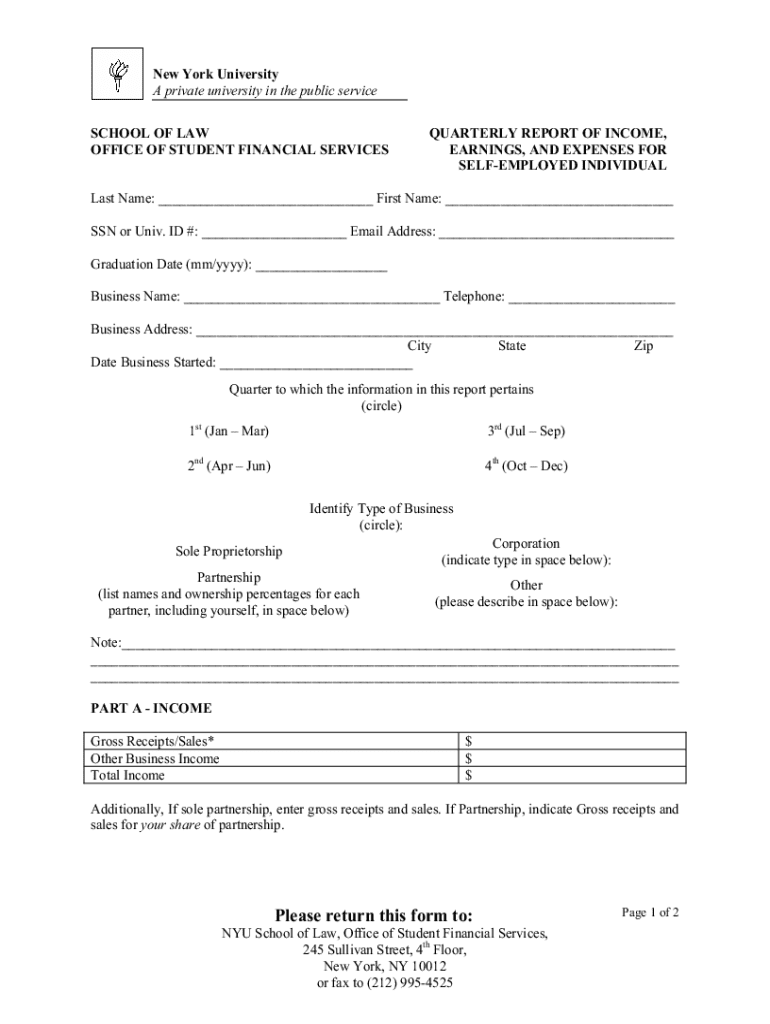

This document is a report that self-employed individuals at New York University School of Law must complete, detailing their income, earnings, and expenses for a specified quarter.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly report of income

Edit your quarterly report of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly report of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quarterly report of income online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quarterly report of income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly report of income

How to fill out Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual

01

Gather all income documents, including invoices, sales records, and bank statements.

02

Organize your income records by quarter.

03

Calculate total income for the quarter by summing all sources of income.

04

Collect all expense receipts and invoices related to your business.

05

Categorize your expenses into different types, such as operating expenses, materials, and utilities.

06

Calculate total expenses for the quarter by adding all categorized expenses.

07

Determine your net earnings by subtracting total expenses from total income.

08

Fill out the Quarterly Report form with the calculated figures for income, expenses, and net earnings.

09

Review the report for accuracy and completeness.

10

Submit the report to the appropriate tax authorities by the deadline.

Who needs Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

01

Self-employed individuals who must report their income and expenses for tax purposes.

02

Freelancers who need to keep track of their earnings and expenditures quarterly.

03

Small business owners who operate as sole proprietors and want to maintain accurate financial records.

04

Individuals who may want to apply for loans or grants and need to provide proof of income.

Fill

form

: Try Risk Free

People Also Ask about

What is the self employed income and expense statement?

A self-employed profit and loss statement is a report that summarizes your business's revenues, expenses, gains, and losses over a given period. Also commonly referred to as an income statement, it's one of two essential financial statements for self-employed people, along with the balance sheet.

What is self-employment income?

Money you earn as a contractor, consultant, freelancer, or other independent worker.

What form does a self-employed person file for expenses and income?

To file your annual income tax return, you will need to use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report any income or loss from a business you operated or profession you practiced as a sole proprietor, or gig work performed.

What is proof of income for self employed people in Canada?

A proof of income statement from the CRA offers a summary of your income and deductions for a specific tax year. This document is often requested by lenders and financial institutions. A notice of assessment, a summary of your tax return issued by the CRA, may also be acceptable.

What is the self-employed income statement?

A self-employed profit and loss statement is a report that summarizes your business's revenues, expenses, gains, and losses over a given period. Also commonly referred to as an income statement, it's one of two essential financial statements for self-employed people, along with the balance sheet.

How often do self-employed individuals have to report earnings?

You must report your business income and expenses information to DWP or DfC each month, between the period of seven days before your assessment period ends and 14 days after the end of your assessment period.

How do I do a profit and loss statement for self-employed?

Here's a general step-by-step guide to creating a profit and loss statement: Choose a reporting period. Gather financial statements and information. Add up revenue. List your COGS. Record your expenses. Figure your EBITDA. Calculate interest, taxes, depreciation, and amortization. Determine net income.

What is proof of income for self-employed people?

What documents can be used as proof of income for self-employed individuals? Documents such as tax returns, bank statements, profit and loss statements, and paid invoices can be used to verify a self-employed person's income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

The Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individuals is a financial document that summarizes the income, earnings, and expenses incurred by self-employed individuals over a three-month period. It helps in tracking financial performance and is often used for tax reporting.

Who is required to file Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

Self-employed individuals, including freelancers, contractors, and small business owners, are required to file the Quarterly Report of Income, Earnings, and Expenses to report their income and expenses to the tax authorities for accurate tax calculation.

How to fill out Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

To fill out the report, a self-employed individual should gather all financial records for the quarter, including income statements, receipts for expenses, and any other relevant documents. They should accurately detail their total income, itemize their expenses, and calculate net earnings before submitting.

What is the purpose of Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

The purpose of the Quarterly Report is to provide a comprehensive overview of a self-employed individual's financial situation for the quarter, helping them to track their earnings and expenses, ensure compliance with tax obligations, and make informed business decisions.

What information must be reported on Quarterly Report of Income, Earnings, and Expenses for Self-Employed Individual?

The report must include total income earned during the quarter, a detailed list of expenses incurred, any applicable deductions, and the resulting net earnings. It may also require information on prior quarters and estimates for future income and expenses.

Fill out your quarterly report of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Report Of Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.