Get the free Import and Export (General) Regulations - legislation gov

Show details

These regulations govern the import and export of goods, particularly textiles, including licensing, notifications, and exemptions related to the process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign import and export general

Edit your import and export general form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your import and export general form via URL. You can also download, print, or export forms to your preferred cloud storage service.

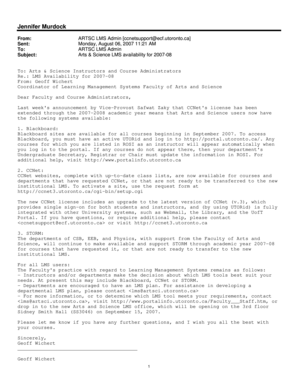

Editing import and export general online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit import and export general. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out import and export general

How to fill out Import and Export (General) Regulations

01

Obtain the Import and Export (General) Regulations form from the appropriate regulatory authority.

02

Carefully read the instructions and guidelines provided with the form.

03

Fill out the identification section with accurate business and contact information.

04

Provide details about the goods being imported or exported, including description, quantity, and value.

05

Indicate the country of origin or destination for the goods.

06

Specify the applicable tariffs or taxes for the import/export transaction.

07

Include any necessary permits or licenses required for the goods.

08

Review the completed form for any errors or omissions.

09

Submit the form to the relevant authority, either online or in person.

Who needs Import and Export (General) Regulations?

01

Businesses engaged in international trade, including importers and exporters.

02

Individuals who are sending or receiving goods across international borders.

03

Customs brokers and logistics companies that facilitate trade.

04

Manufacturers who source materials from abroad or sell products overseas.

Fill

form

: Try Risk Free

People Also Ask about

What do the terms import and export mean?

Exporting is defined as the sale of products and services in foreign countries that are sourced or made in the home country. Importing is the flipside of exporting. Importing refers to buying goods and services from foreign sources and bringing them back into the home country.

What are the terms of trade exports and imports?

To determine a nation's terms of trade, the price of its exports is divided by the price of its imports and then multiplied by 100. A nation's terms of trade are improving when the index number is more than 100. This means that for each unit of exports sold, the country can buy more units of imported goods.

What are the import and export regulations?

In India, imports and exports are regulated by the Foreign Trade (Development and Regulation) Act, 1992, which empowers the federal government to make provisions for the development and regulation of foreign trade.

What are the terms used in import and export?

These terms include Incoterms, Bill of Lading, Customs Clearance, Freight Forwarder, Containerization, Harmonized System (HS) Code, Export License, Letter of Credit, Carrier Liability, Incidental Expenses, Free on Board (FOB), Cost, Insurance, and Freight (CIF), Electronic Data Interchange (EDI), Warehousing, Freight

What are the terms of import and export?

Export: Sending goods to a foreign country for sale or use. Import: Bringing goods or services into a country from another country for sale or use. Tariff: It is a tax levied on imported or exported goods. Customs: The government agency responsible for controlling movement of goods in and out of a country.

What are the terms of trade?

The import of a product is defined by the purchase of a product that was manufactured in a foreign country. Countries import goods that can be more effectively and cheaply produced by another country. On the contrary, the export of a good relates to the sale of a domestically manufactured good in a foreign market.

What is the import and export General Amendment regulation 2013?

The Government gazetted the Import and Export (General)(Amendment) Regulation 2013 (Amendment Regulation) on 22 February 2013 to prohibit the export of powdered formula for infants and young children under 36 months from Hong Kong except with a licence issued by the Director-General of Trade and Industry from 1 March

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Import and Export (General) Regulations?

Import and Export (General) Regulations refer to the set of rules and guidelines established by a government to control and manage the import and export of goods and services into and out of a country. These regulations aim to ensure compliance with national laws, promote trade, and protect domestic industries.

Who is required to file Import and Export (General) Regulations?

Individuals or businesses that engage in importing or exporting goods and services across borders are required to file under the Import and Export (General) Regulations. This typically includes manufacturers, wholesalers, retailers, and logistics companies.

How to fill out Import and Export (General) Regulations?

To fill out the Import and Export (General) Regulations, the filer must gather relevant information such as goods description, value, country of origin, and shipping details. The applicable forms must be completed accurately and submitted to the relevant authorities, often accompanied by required documentation such as invoices and permits.

What is the purpose of Import and Export (General) Regulations?

The purpose of Import and Export (General) Regulations is to facilitate and monitor international trade, prevent illegal transactions, protect national security, ensure compliance with trade agreements, and safeguard public health and the environment.

What information must be reported on Import and Export (General) Regulations?

Essential information that must be reported includes the description of the goods, the classification of the items, value of the shipment, country of origin and destination, importer/exporter details, quantity, and any applicable tariffs or restrictions.

Fill out your import and export general online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Import And Export General is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.