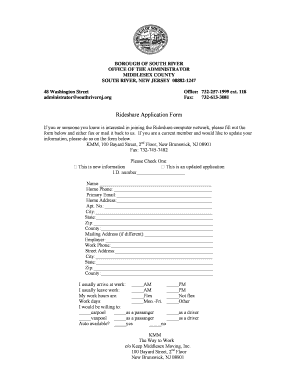

Get the free Value-Added Tax (VAT) Definition - Investopedia - law nyu

Show details

A Hybrid VAT System in the European Union

Michael Temple

Draft 04/24/2007

ABSTRACT

The principle of the common system of Value Added Tax (VAT) in the European

Union involves the application of a general

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign value-added tax vat definition

Edit your value-added tax vat definition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your value-added tax vat definition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing value-added tax vat definition online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit value-added tax vat definition. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out value-added tax vat definition

How to Fill Out Value-Added Tax (VAT) Definition:

Understand the purpose of VAT:

01

Value-Added Tax (VAT) is a consumption tax applied to goods and services at each stage of production or distribution.

02

It is designed to tax the value added by businesses at each stage, ensuring that the ultimate burden falls on the final consumer.

Gather necessary information:

01

Obtain the relevant documents such as invoices, receipts, and financial records.

02

Ensure you have a clear understanding of the goods or services being provided and the applicable VAT rates.

Determine your VAT liability:

01

Calculate the total value of your taxable supplies, including any additional charges subject to VAT.

02

Subtract the value of any VAT-exempt supplies to arrive at the taxable amount.

Register for VAT:

01

Check if you meet the required threshold for VAT registration in your country.

02

If eligible, register with the tax authorities and obtain a VAT identification number.

Issue VAT invoices:

01

Ensure that your invoices contain all required information, such as your business details, customer details, description of goods or services, VAT amount, and total amount payable.

02

Follow any specific invoicing requirements mandated by your country's VAT regulations.

Charge the correct VAT rate:

01

Determine the applicable VAT rate based on the nature of the goods or services being provided.

02

Apply the correct rate to the taxable amount and calculate the VAT owed.

Keep accurate records:

01

Maintain organized records of all sales, purchases, and VAT payments made during the reporting period.

02

This includes keeping track of input and output VAT, as well as any VAT refunds or credits.

Who Needs Value-Added Tax (VAT) Definition?

01

Business owners and entrepreneurs: Understanding VAT is crucial for business owners to comply with tax laws and accurately calculate and report their VAT liabilities.

02

Accounting and finance professionals: Professionals involved in financial management, bookkeeping, and tax preparation need a comprehensive understanding of VAT to assist their clients or organizations.

03

Government officials and tax authorities: Policymakers and tax authorities rely on VAT definitions to enforce tax regulations and ensure compliance by businesses and individuals.

Remember to consult a qualified tax advisor or refer to the specific VAT regulations and guidelines applicable in your country for accurate and tailored information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit value-added tax vat definition online?

With pdfFiller, the editing process is straightforward. Open your value-added tax vat definition in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in value-added tax vat definition without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing value-added tax vat definition and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the value-added tax vat definition in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your value-added tax vat definition in minutes.

What is value-added tax vat definition?

Value-added tax (VAT) is a consumption tax that is imposed on the value added at each stage of the production and distribution process. It is commonly used in many countries around the world.

Who is required to file value-added tax vat definition?

Businesses that meet the threshold for VAT registration are required to file value-added tax returns. The threshold may vary from country to country.

How to fill out value-added tax vat definition?

To fill out a value-added tax return, businesses need to report the taxable sales and purchases made during a specific period. They also need to calculate the VAT owed and claim any VAT refunds.

What is the purpose of value-added tax vat definition?

The purpose of value-added tax is to generate revenue for the government and shift the burden of taxation from end consumers to businesses.

What information must be reported on value-added tax vat definition?

The information that must be reported on a value-added tax return includes the total taxable sales, total taxable purchases, VAT owed, VAT refunds claimed, and any other required information specified by the tax authority.

Fill out your value-added tax vat definition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Value-Added Tax Vat Definition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.