Get the free Unclaimed Money Regulations 2009 - legislation vic gov

Show details

This document outlines the regulations pertaining to unclaimed money, including the objectives, authorizing provisions, definitions, and the form and details to be included in the business register

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unclaimed money regulations 2009

Edit your unclaimed money regulations 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unclaimed money regulations 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

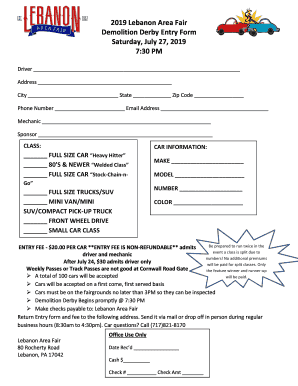

Editing unclaimed money regulations 2009 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unclaimed money regulations 2009. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

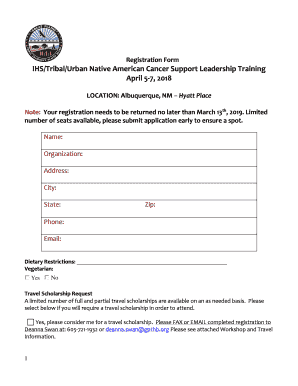

How to fill out unclaimed money regulations 2009

How to fill out Unclaimed Money Regulations 2009

01

Gather all necessary personal information including full name, address, and identification details.

02

Review the Unclaimed Money Regulations 2009 to understand the requirements and procedures.

03

Obtain the appropriate forms needed for filling out the claim.

04

Carefully fill out the forms with accurate information, ensuring all details are correct.

05

Attach any necessary documents that support your claim, such as proof of identity or ownership.

06

Submit the completed forms and documents to the designated authority or organization as specified in the regulations.

07

Keep a copy of all submitted documents for your records.

08

Follow up after submission to ensure your claim is being processed.

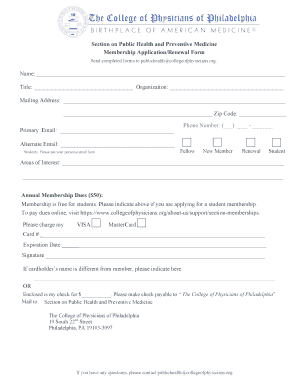

Who needs Unclaimed Money Regulations 2009?

01

Individuals who have unclaimed money owed to them, such as bank accounts, insurance payouts, or lost wages.

02

Businesses that may have unclaimed funds from previous transactions or transactions with employees.

03

Heirs of deceased individuals who may be entitled to unclaimed estates or properties.

04

Organizations that hold unclaimed funds and need to comply with regulations to manage these assets.

Fill

form

: Try Risk Free

People Also Ask about

What is Regulation 20 of the Electronic Money Regulations 2011?

20. — (1) Electronic money institutions must safeguard funds that have been received in exchange for electronic money that has been issued (referred to in this regulation and regulations 21 and 22 as “relevant funds”). (2) Relevant funds must be safeguarded in accordance with either regulation 21 or regulation 22.

How do I get my unclaimed money back in Malaysia?

Claimant need to prove to Registrar that he is the rightful owner of the unclaimed moneys or have the legal right over the unclaimed moneys. Registrar had already set the guidelines for application of unclaimed moneys by listing the documents required to be submitted together with the application.

How much is unclaimed money in Malaysia?

KUALA LUMPUR: An estimated RM12. 7bil in unclaimed money (WTD) belongs to the public as of Jan 31, says Prime Minister Datuk Seri Anwar Ibrahim.

What is the largest amount of unclaimed money?

According to the last NAUPA survey in 2020, the state with the most unclaimed property is New York. At the time, New York had upwards of $17 billion in unclaimed property, 67% more than second-place California. It is widely believed that New York has the most unclaimed funds because of its global financial position.

What is the Unclaimed money Act Malaysia?

UNCLAIMED MONEYS ACT 1965. An Act relating to the payment of unclaimed moneys into the Federal Consolidated Fund. [1 June 1975] Short title and application.

What is the Unclaimed Money Act in Malaysia?

SUBMISSION OF UNCLAIMED MONEYS In accordance with Section 10 of the Unclaimed Moneys Act 1965, companies/firms are obligated to: Manage and maintain a register for unclaimed moneys until the 31st of December in the format stipulated by the UM Registrar.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Unclaimed Money Regulations 2009?

The Unclaimed Money Regulations 2009 is a set of legal guidelines that govern the handling of unclaimed funds held by various organizations, such as banks and insurance companies, ensuring that these funds are reported and managed properly.

Who is required to file Unclaimed Money Regulations 2009?

Entities that hold unclaimed money, such as banks, credit unions, insurance companies, and other financial institutions, are required to file compliance reports under the Unclaimed Money Regulations 2009.

How to fill out Unclaimed Money Regulations 2009?

To fill out the Unclaimed Money Regulations 2009 forms, organizations must provide details such as account information, the amount of unclaimed money, and account holder identities, following the specific instructions provided in the regulations.

What is the purpose of Unclaimed Money Regulations 2009?

The purpose of the Unclaimed Money Regulations 2009 is to protect consumers by ensuring that unclaimed funds are properly reported, held, and made accessible to rightful owners, thereby promoting transparency and accountability.

What information must be reported on Unclaimed Money Regulations 2009?

Information that must be reported includes the owner's name and last known address, account details, the amount of unclaimed money, and the nature of the payment that remains unclaimed.

Fill out your unclaimed money regulations 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unclaimed Money Regulations 2009 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.