Get the free STANDING ORDER PAYMENT FOR COUNCIL TAX - aberdeenshire gov

Show details

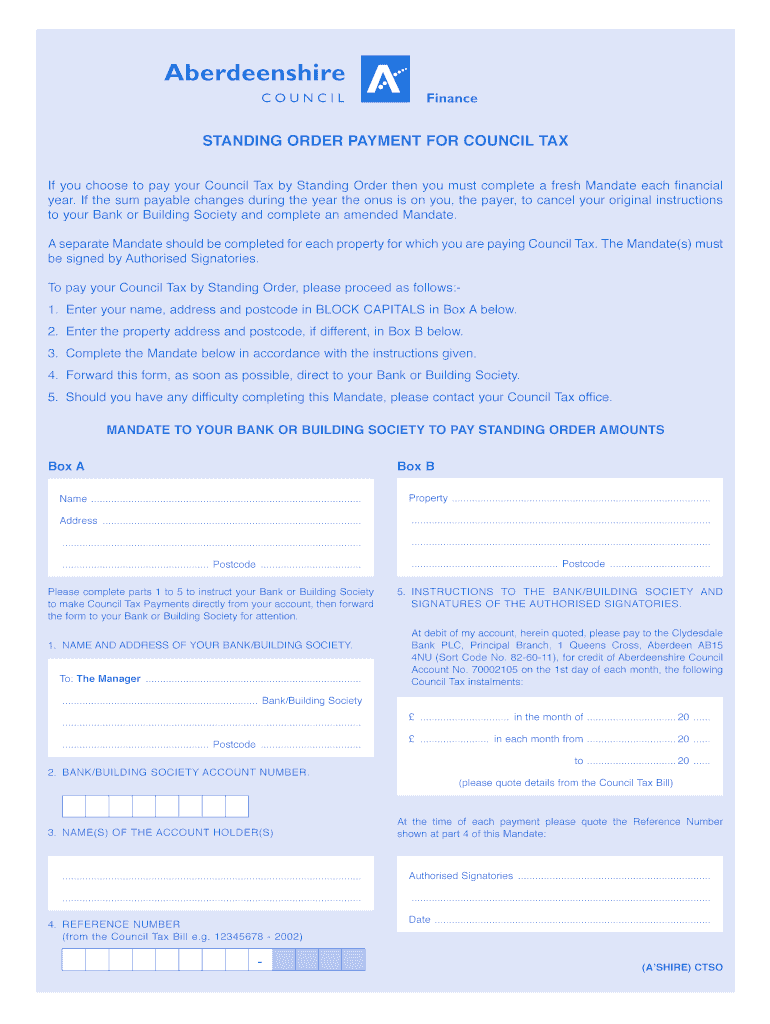

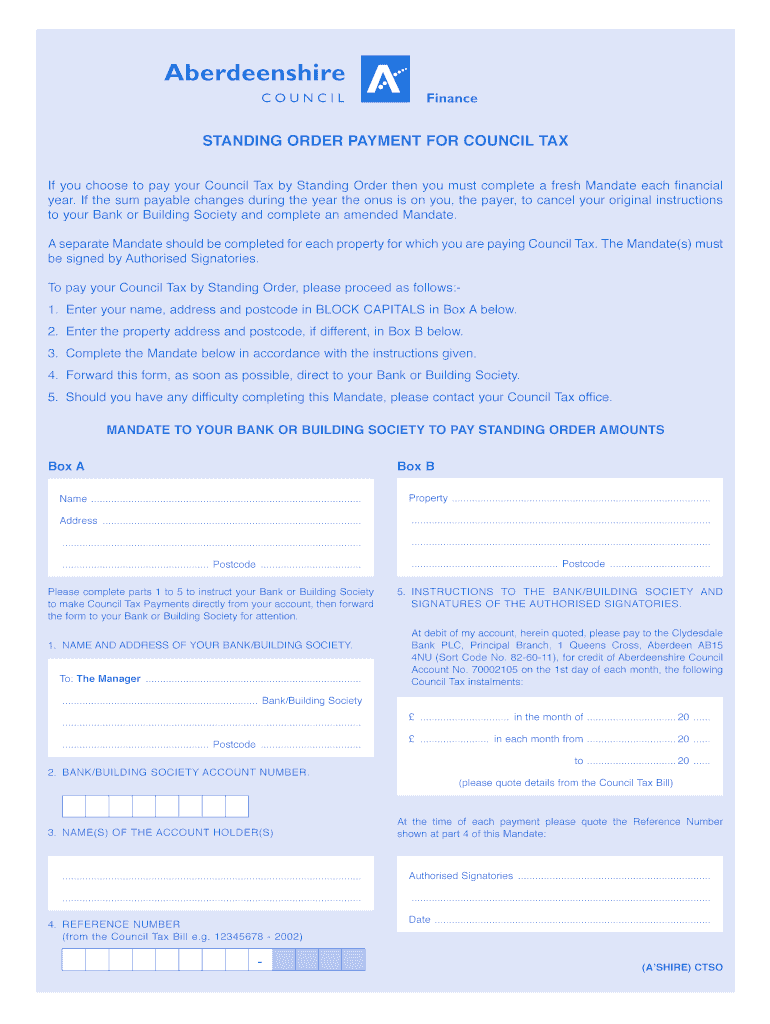

This document provides instructions for setting up a Standing Order payment for Council Tax, including the necessary information to complete and submit the payment mandate to a bank or building society.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standing order payment for

Edit your standing order payment for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standing order payment for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standing order payment for online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standing order payment for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standing order payment for

How to fill out STANDING ORDER PAYMENT FOR COUNCIL TAX

01

Obtain the standing order mandate form from your local council's website or office.

02

Fill in your personal details, including your name, address, and bank account information.

03

Specify the amount to be paid for the council tax on a monthly basis.

04

Provide the council's bank details, including the sort code and account number.

05

Indicate the start date for the standing order payment.

06

Review all the information entered to ensure it's accurate.

07

Sign and date the form.

08

Submit the completed form to your bank for processing.

Who needs STANDING ORDER PAYMENT FOR COUNCIL TAX?

01

Anyone who is liable to pay council tax and prefers to automate their payments.

02

Homeowners and tenants living in properties that are subject to council tax.

03

Individuals seeking to manage their budgeting by spreading payments evenly.

Fill

form

: Try Risk Free

People Also Ask about

What's the best way to pay my taxes?

Paying electronically is a convenient way to pay your federal taxes. Electronic payment options are available on our payments page and the IRS2Go app. You can pay your federal taxes electronically online or by phone. When paying electronically, you can schedule your payment in advance.

What is a standing order for payment?

A standing order is a regular payment of the same amount that's paid on a specified date. It allows the bank to take money regularly from your account to pay another account. You can use a standing order for many payment types, including: Transferring money between your accounts.

What is the best way to pay Council Tax?

The easiest way to pay your Council Tax is to set up a Direct Debit and pay in monthly instalments. You will need: Your Council Tax account number: you can find this on the front of your bill or on any Council Tax letters from us. your bank or building society details.

Do foreigners pay Council Tax in the UK?

Being in the UK on a visa does not exempt you from paying council tax. If you rent private accommodation, you are liable to pay the council tax in the period leading up to the start of your course and once you complete your course even if your visa ends after this.

How do I pay my Council Tax in England?

Ways to pay You can usually pay your Council Tax online. You can also use 'Paypoint', 'Payzone' or 'Quickcards' for cash payments at post offices, banks, newsagents and convenience stores. Check your bill to find out which other payment methods you can use.

What's the best way to pay Council Tax?

Direct Debit is quickest and easiest. You can also pay online, by phone, or in person. To pay Council Tax, you must be registered for a Council Tax account. Once you've registered, we send you a Council Tax bill every year.

How often do you have to pay Council Tax in the UK?

Find out more about your Council Tax bill. You usually pay for Council Tax in 10 monthly instalments from 1 April to 1 January. But you can spread your payments over 12 months instead, or suggest a different payment plan. Find out how to change your payment plan.

Is it a legal requirement to pay Council Tax in the UK?

You cannot opt out of paying council tax Some people - including those calling themselves 'Freeman on the Land' - think that people are only bound by the contracts and laws they have agreed to. You cannot choose whether you are liable for council tax. And you cannot choose which laws to obey and which to ignore.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STANDING ORDER PAYMENT FOR COUNCIL TAX?

A standing order payment for council tax is a recurring payment method that allows taxpayers to pay their council tax bills automatically on a regular basis, usually monthly, directly from their bank account.

Who is required to file STANDING ORDER PAYMENT FOR COUNCIL TAX?

All residents or property owners who are liable for council tax payments are required to set up a standing order payment arrangement to ensure their council tax is paid on time.

How to fill out STANDING ORDER PAYMENT FOR COUNCIL TAX?

To fill out a standing order for council tax, you need to provide your bank details, specify the amount to be paid, choose the frequency of payments, and include the council's bank details. You may also need to fill out a form provided by your bank or online banking portal.

What is the purpose of STANDING ORDER PAYMENT FOR COUNCIL TAX?

The purpose of a standing order payment for council tax is to facilitate timely and automatic payments, helping residents manage their finances and avoid late payment penalties.

What information must be reported on STANDING ORDER PAYMENT FOR COUNCIL TAX?

The information that must be reported includes your bank account details, the amount to be transferred, the frequency of payments, the council's receiving bank information, and your reference number to ensure the payment is applied correctly.

Fill out your standing order payment for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standing Order Payment For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.