Get the free CT-4 - nysscpa

Show details

This document is a tax return form for General Business Corporations to report their franchise tax in New York State, including computations for entire net income base, capital base, and minimum taxable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-4 - nysscpa

Edit your ct-4 - nysscpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-4 - nysscpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct-4 - nysscpa online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct-4 - nysscpa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-4 - nysscpa

How to fill out CT-4

01

Start by downloading the CT-4 form from the official tax website.

02

Fill in the taxpayer identification information at the top of the form.

03

Enter the relevant financial details in the designated sections, such as income and deductions.

04

Ensure that all calculations are accurate and match any supporting documents you have.

05

Review the form for any errors or omissions.

06

Sign and date the form before submission.

07

Submit the completed form by the deadline specified by the tax authority.

Who needs CT-4?

01

Individuals or businesses who are required to report specific tax information.

02

Tax professionals who prepare tax filings for clients.

03

Anyone claiming certain exemptions or credits related to state taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of CET-4?

CET4 or CET-4 may be: College English Test CET-4, national English level test in the People's Republic of China.

What is the meaning of CET?

Central European Time (CET) is a standard time of Central, and parts of Western Europe, which is one hour ahead of Coordinated Universal Time (UTC). The time offset from UTC can be written as UTC+. It is used in most parts of Europe and in several African countries.

What is the English level equivalent of CET-4?

This proficiency level was determined based on their recent College English Test Band 4 (CET 4) scores (the completion of CET4 mostly corresponds to the CEFR B1 level [47] , while a CET 4 score of 425-450 aligns with the CEFR B2 level [48]). The average age of the participants is 19.

What is the full score of CET-4?

In contrast, participants considered their reading performance with greater certainty (m=3.46). Students' actual CET4 test scores are shown in Table 3 below. Note that CET4 has a full score of 710, and writing and translating are combined into a composite score in the score report.

What is level 4 English proficiency in English?

Able to use the language to: ∎ satisfy work requirements in the wide range of demanding tasks, ∎ read with almost complete comprehension of a variety of materials on different subjects, ∎ discuss work related issues with reasonable ease, ∎ communicate with the general public, ∎ effectively combine structure and

What is the difference between CET-4 and cet6?

Students who have completed the College English Courses Band 1 to 4, usually second-year students, take the CET-4. Those students who have completed the College English Courses Band 5 to 6 and have passed the CET-4, usually third-year students, take the CET-6.

What is CET-4 in China?

The CET test-takers are undergraduates in China, who are majoring in any discipline except English. Students who have completed the College English Courses Band 1 to 4, usually second-year students, take the CET-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

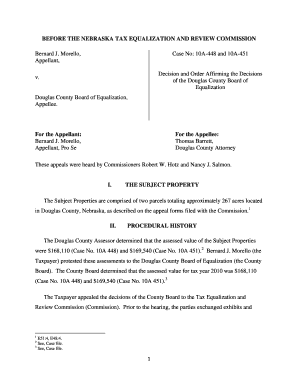

What is CT-4?

CT-4 is a tax form used by certain corporations in the United States to report their income, deductions, andtax liability to the Internal Revenue Service (IRS).

Who is required to file CT-4?

Corporations that are doing business in the state and meet specific income thresholds are required to file CT-4.

How to fill out CT-4?

To fill out CT-4, corporations must provide their identifying information, report their total income, claim any applicable deductions, and calculate their tax liability according to the provided instructions.

What is the purpose of CT-4?

The purpose of CT-4 is to ensure compliance with state tax laws by reporting income and calculating the amount of tax owed by corporations.

What information must be reported on CT-4?

CT-4 requires corporations to report their name, address, Federal Employer Identification Number (FEIN), total income, deductions, and any applicable credits.

Fill out your ct-4 - nysscpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-4 - Nysscpa is not the form you're looking for?Search for another form here.

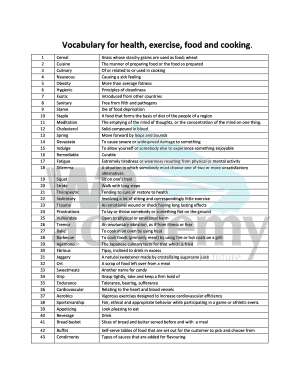

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.