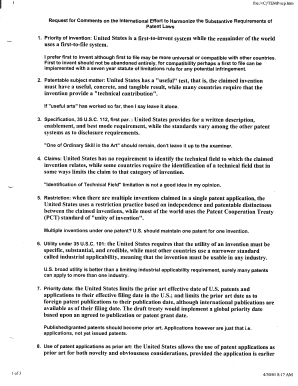

Get the free Personal Budget planner T - Jonathan Pond

Show details

Personal Budget planner T his worksheet can be used either to record your past income and expenses and×or to budget future income and expenses. Use the first column to record your past income and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal budget planner t

Edit your personal budget planner t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal budget planner t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal budget planner t online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal budget planner t. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal budget planner t

How to Fill Out Personal Budget Planner T:

01

Start by gathering all your financial information, including income, expenses, debts, and savings.

02

List your sources of income, such as salary, freelance work, or rental income. Include the amount and frequency of each income source.

03

Identify and categorize your expenses, such as housing, transportation, groceries, utilities, entertainment, and debt payments. Be as specific as possible and allocate a realistic amount for each category.

04

Determine your fixed expenses, which are recurring costs that remain constant each month, such as rent or mortgage payments.

05

Calculate your variable expenses, which can change from month to month, such as groceries or entertainment.

06

Analyze your debt payments, including credit card bills, student loans, or car loans. List the minimum payment amount and the due date for each debt.

07

Evaluate your savings goals, such as an emergency fund, retirement savings, or a vacation fund. Set aside a portion of your income for these goals.

08

Deduct your expenses, debt payments, and savings goals from your total income to determine your remaining discretionary income.

09

Regularly track your actual expenses and compare them to your budget. Make adjustments and reallocations as necessary.

10

Review and revisit your budget periodically, especially when there are changes in your income or expenses.

Who Needs Personal Budget Planner T:

01

Individuals who want to gain control over their finances and have a clear understanding of where their money is going.

02

People who want to save money and build financial stability for their future goals.

03

Individuals who are looking to pay off debts strategically and efficiently.

04

Those who wish to make informed spending decisions and avoid unnecessary expenses.

05

People who want to track their progress and make adjustments to their spending habits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal budget planner t to be eSigned by others?

personal budget planner t is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in personal budget planner t without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your personal budget planner t, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the personal budget planner t in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your personal budget planner t and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is personal budget planner t?

Personal budget planner t is a tool used to track income and expenses in order to better manage finances.

Who is required to file personal budget planner t?

Any individual or household looking to take control of their financial situation can use a personal budget planner t.

How to fill out personal budget planner t?

To fill out a personal budget planner t, you need to gather information about your income, expenses, and financial goals. Then, allocate your income towards different categories, such as bills, savings, and discretionary spending.

What is the purpose of personal budget planner t?

The purpose of a personal budget planner t is to help individuals track their income and expenses, set financial goals, and make informed decisions about their finances.

What information must be reported on personal budget planner t?

Information that must be reported on a personal budget planner t includes income sources, expenses, savings goals, and any debts or loans.

Fill out your personal budget planner t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Budget Planner T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.