Get the free Death claims

Show details

This document serves as a comprehensive guide for beneficiaries on how to claim under a life assurance plan following the death of a loved one. It outlines the claiming process, necessary documentation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign death claims

Edit your death claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your death claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit death claims online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit death claims. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out death claims

How to fill out Death claims

01

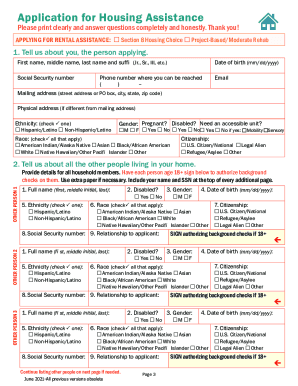

Obtain the death claim form from the insurance company or the employer.

02

Gather necessary documents such as the death certificate, policy documents, and identification of the claimant.

03

Fill out the claim form accurately with the required information, including the deceased's details and policy number.

04

Attach all supporting documents mentioned in the form.

05

Review the completed claim form for any errors or missing information.

06

Submit the claim form along with the supporting documents to the appropriate insurance company address.

07

Follow up with the insurance company to confirm receipt and inquire about any additional information needed.

Who needs Death claims?

01

Beneficiaries of a deceased person's life insurance policy.

02

Family members seeking to settle the deceased's financial affairs.

03

Individuals who are responsible for managing the deceased's estate.

04

Employers or organizations that need to process claims for employee benefits.

Fill

form

: Try Risk Free

People Also Ask about

What are death claims?

Definition of Death Claim In insurance, a death claim refers to the process by which the beneficiaries or nominees of an insurance policy receive the sum assured or death benefit from the insurance company upon the death of the policyholder.

What is a death claim payment?

What is the death benefit of a life insurance policy? It is the sum of money that the insurance company pays to beneficiaries when the insured passes away – and the defining aspect of a life insurance policy.

What is the purpose of the death claim?

Death Claim is a formal request made by the nominee* in a life insurance policy to the life insurance company. This request is made for the payment** of the Life Cover amount in case of the unfortunate event of death of the Life Assured*.

How to submit a death claim?

Formalities for a death claim 1 Filled-up claim form (provided by the insurance company) 2 Certificate of death. 3 Policy document. 4 Deeds of assignments/ re-assignments if any. 5 Legal evidence of title, if the policy is not assigned or nominated. 6 Form of discharge executed and witnessed.

How to claim a death claim?

Generally, you will need: Original Insurance Policy or Policy Number. Duly accomplished Claim Form from the insurance company. Death Certificate (PSA-authenticated). Proof of Identity and/or relationship to the deceased (if claimant is not the policyholder, e.g., a child or spouse).

What to do with death claim money?

How Could a Death Benefit Be Used? Pay Off a Mortgage. A home can be a large asset and a large financial responsibility. Pay Off Other Existing Debt. Set Up a College Fund. Set Pp an Income Stream. Invest In Your Future. Stocks, Bonds & Real Estate. Retirement Accounts. Annuities.

How long does a death claim take?

We will consider the claim based on the information that you gave us. Once we have all the information that we need, we will inform you of the outcome of the claim within 10 to 15 working days. We cannot process your claim unless we have received all outstanding documents.

What is a death claim?

If you are a beneficiary of a life insurance policy – and the insured has passed away – you need to file a claim with the company in order to collect the death benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Death claims?

Death claims refer to the process of filing a claim for benefits or payouts from an insurance policy, estate, or other financial accounts after the death of an individual. This typically involves submitting documentation to the insurer or financial institution.

Who is required to file Death claims?

Typically, the executor of the deceased's estate, a beneficiary named in the will or insurance policy, or a close family member is responsible for filing death claims.

How to fill out Death claims?

To fill out death claims, gather necessary documents such as the death certificate, insurance policy, and any required identification. Complete the claim form provided by the insurance company or financial institution, ensuring all information is accurate and complete.

What is the purpose of Death claims?

The purpose of death claims is to allow beneficiaries to receive financial benefits or payouts after an individual's death, providing support during a difficult time and facilitating the settlement of the deceased's financial affairs.

What information must be reported on Death claims?

Information required on death claims typically includes the deceased's personal details, policy number, date of death, cause of death, and relevant documentation such as the death certificate and identification of the claimant.

Fill out your death claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Death Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.