Get the free DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE

Show details

This document outlines the requirements, conditions, and procedures for applying to the Downtown Residential Loan Program in Niagara Falls, aimed at stimulating the creation of residential units downtown.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign downtown residential loan application

Edit your downtown residential loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your downtown residential loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

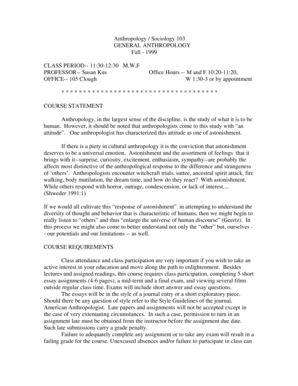

Editing downtown residential loan application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit downtown residential loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

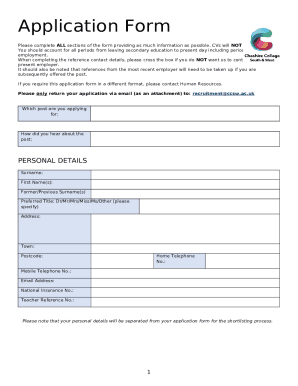

How to fill out downtown residential loan application

How to fill out DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE

01

Gather necessary documents, including proof of income, credit history, and employment verification.

02

Obtain the DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE from the lender's website or office.

03

Fill out the personal information section, including your name, address, and contact details.

04

Complete the financial information section, providing details about your income, assets, and liabilities.

05

Specify the type of loan you are applying for and the amount needed.

06

Review the terms and conditions of the loan application carefully.

07

Sign the application and any required consent forms.

08

Submit the completed application package along with all supporting documents to the lender.

Who needs DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

01

Individuals or families looking to purchase a home in downtown areas.

02

People seeking to refinance their existing residential loans in downtown locations.

03

Homebuyers who need financing for residential properties in urban settings.

Fill

form

: Try Risk Free

People Also Ask about

How to write a simple loan document?

What's included in a Loan Agreement Lender and borrower contact information. Include details of both the lender and the borrower, including their full names and addresses. Loan amount and date. Interest rate. Repayment method and schedule. Late fees and penalties. Co-signer information. Collateral. Additional clauses.

What is the purpose of the Urla?

The purpose of the URLA is to provide lenders with a comprehensive understanding of the borrower's creditworthiness, which helps them assess the risk of lending money. The form is also used by underwriters to approve or deny mortgage loan applications.

What is a red flag on a loan application?

Inconsistent Information: When information provided by an applicant contradicts itself or is inconsistent across documents, it's a clear sign of potential fraud. Lenders should closely examine discrepancies in addresses, employment history, income details, and more.

How to write a loan application in English?

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

What is the most common loan application form?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use.

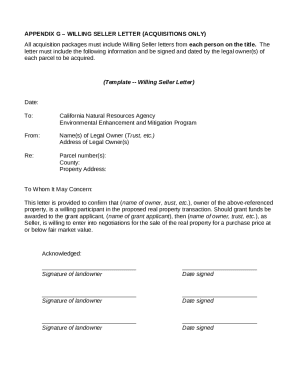

How do I write a letter of explanation for a loan?

What to include in a letter of explanation Your name, mailing address and phone number. The date. The loan application number. The lender's name, mailing address and phone number. Your explanation, along with references to any supporting documents you are including.

How do I write a loan application letter to my company?

Salutation: Use a formal greeting (eg, ``Dear (Recipient's Name),''). Introduction: State your purpose for writing. Body: Provide details about your loan request (amount, purpose, repayment terms, etc.). Conclusion: Thank the recipient and express your hope for a positive response.

How do I write a simple loan application?

How to Write a Loan Application Letter Structure and Formatting. Use a formal business letter format. Salutation. Begin with a polite salutation, such as: Start with a Purpose. Clearly state the purpose of your letter in the first paragraph. Provide Necessary Details. Closing and Politeness. Attach Supporting Documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

The DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE is a set of documents required for individuals seeking to apply for residential loans in downtown areas, which typically include various forms, disclosures, and supporting materials.

Who is required to file DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

Individuals or entities seeking to secure a residential loan for properties located in the downtown area are required to file the DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE.

How to fill out DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

To fill out the DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE, applicants should complete the required forms with accurate personal and financial information, gather necessary documentation (such as proof of income and property details), and submit the package to the lending institution for review.

What is the purpose of DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

The purpose of the DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE is to provide lenders with the necessary information to assess the creditworthiness of an applicant and determine eligibility for a residential loan in downtown areas.

What information must be reported on DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE?

The information that must be reported on the DOWNTOWN RESIDENTIAL LOAN APPLICATION PACKAGE typically includes personal identification details, financial information (income, debts, assets), property information, and other relevant disclosures as required by the lending institution.

Fill out your downtown residential loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Downtown Residential Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.