Get the free Application of Tax Rebates for Charitable Organizations

Show details

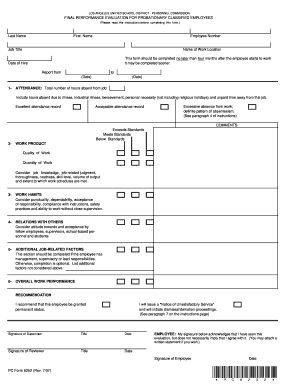

This document serves as an application form for charitable organizations seeking tax rebates on commercial or industrial properties within the Township of Perth East. It includes essential details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application of tax rebates

Edit your application of tax rebates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application of tax rebates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application of tax rebates online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application of tax rebates. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application of tax rebates

How to fill out Application of Tax Rebates for Charitable Organizations

01

Obtain the Application of Tax Rebates form from the appropriate tax authority website or office.

02

Read the instructions thoroughly to understand eligibility and requirements.

03

Fill in your organization's legal name and IRS tax identification number.

04

Provide details about the organization's charitable activities and mission.

05

Include financial statements and documentation of past charitable actions.

06

Specify the amount of rebate being requested and attach supporting documents.

07

Review all the information for accuracy and completeness.

08

Sign and date the application as required.

09

Submit the application via the specified method (online, mail, or in-person).

10

Keep a copy of the submitted application for your records.

Who needs Application of Tax Rebates for Charitable Organizations?

01

Charitable organizations that engage in tax-exempt activities and wish to receive tax rebates.

02

Non-profit organizations that seek financial support through tax incentives.

03

Any eligible entity looking to benefit from tax rebates for charitable contributions made.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum amount you can deduct for charitable donations?

No matter how generously you gave to charities in 2024, you'll only be able to deduct up to 60% of your AGI if you gave in cash to standard public charities. For donations of appreciated assets, the maximum charitable deduction in 2024 is 30% of your AGI.

What is the maximum you can write off for charitable donations?

No matter how generously you gave to charities in 2024, you'll only be able to deduct up to 60% of your AGI if you gave in cash to standard public charities. For donations of appreciated assets, the maximum charitable deduction in 2024 is 30% of your AGI.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application of Tax Rebates for Charitable Organizations?

The Application of Tax Rebates for Charitable Organizations is a formal request submitted by qualifying non-profit organizations to claim tax rebates or exemptions on certain tax liabilities.

Who is required to file Application of Tax Rebates for Charitable Organizations?

Charitable organizations that are recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code are typically required to file this application to receive tax rebates.

How to fill out Application of Tax Rebates for Charitable Organizations?

To fill out the application, organizations need to provide their tax identification number, details about their charitable activities, financial information, and any supporting documentation required by the tax authority.

What is the purpose of Application of Tax Rebates for Charitable Organizations?

The purpose of the application is to enable charitable organizations to recover taxes paid on certain purchases or expenses, thereby enabling them to allocate more resources towards their charitable missions.

What information must be reported on Application of Tax Rebates for Charitable Organizations?

The application must report organizational details such as name, address, tax ID, specific tax periods for which the rebates are claimed, financial statements, and descriptions of qualifying expenditures.

Fill out your application of tax rebates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Of Tax Rebates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.