Get the free Agency Retirement Income Fund Application and Instructions

Show details

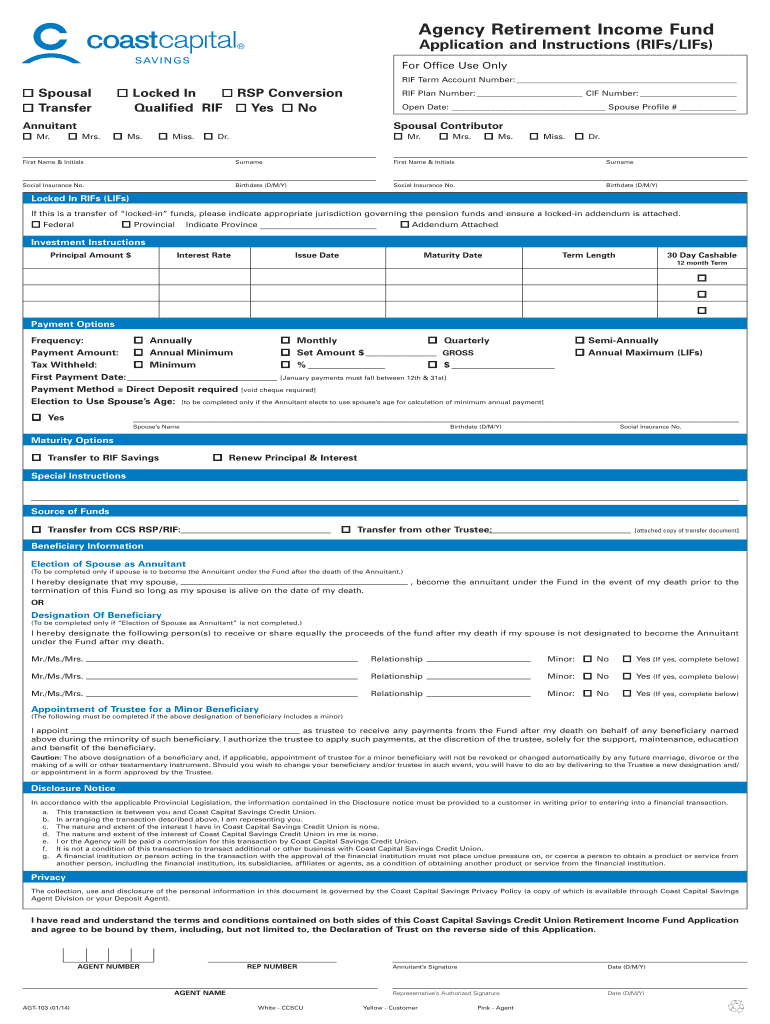

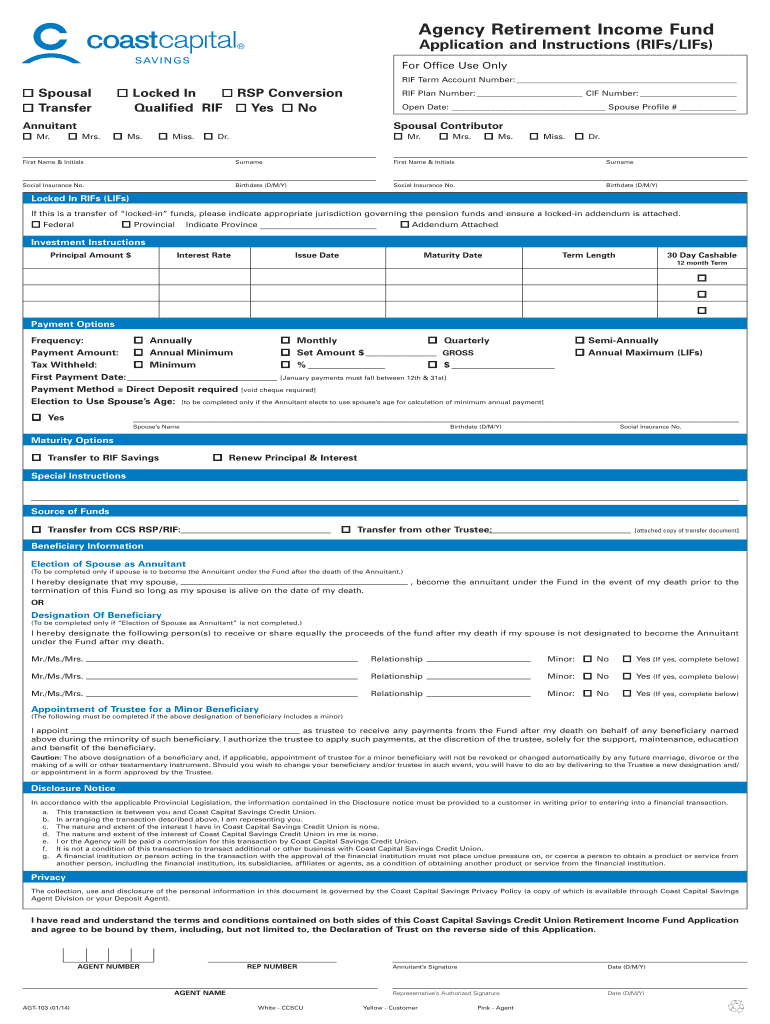

Agency Retirement Income Fund Application and Instructions (RIF's×Life) For Office Use Only RIF Term Account Number: Spousal Transfer Locked In RSP Conversion Qualified RIF Yes No Annuitant Mr. Mrs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agency retirement income fund

Edit your agency retirement income fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agency retirement income fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing agency retirement income fund online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit agency retirement income fund. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agency retirement income fund

How to fill out agency retirement income fund:

01

Gather all necessary paperwork and documentation, including identification, Social Security number, and financial information.

02

Research different options for agency retirement income funds and choose the one that best suits your needs and future goals.

03

Contact the agency responsible for managing the retirement income fund and inquire about the application process.

04

Fill out the application form accurately and thoroughly, providing all required information and supporting documents.

05

Submit the completed application along with any additional documentation required by the agency.

06

Keep track of the application status and follow up with the agency if necessary.

07

Once approved, review the terms and conditions of the retirement income fund carefully to understand the rules and regulations.

08

Determine how much to contribute to the fund regularly based on your financial situation and retirement goals.

09

Set up automatic contributions if available to ensure consistent funding.

10

Monitor the performance of the retirement income fund and adjust contributions or investment options as needed.

Who needs agency retirement income fund:

01

Individuals who have reached retirement age and want a reliable and regular source of income during their retirement years.

02

Employees who were members of a specific agency or organization and are eligible for a retirement income fund as part of their benefits package.

03

Individuals who prefer a managed retirement fund that is overseen by professionals to ensure proper investment strategies and steady income generation.

04

Those who want to supplement their other retirement savings or pension plans with an additional income source.

05

Individuals who are looking for a retirement savings option that offers tax advantages and potential growth.

06

People who want to have more control over their retirement funds compared to traditional pension plans or Social Security benefits.

07

Individuals who value the security and stability offered by agency retirement income funds, as they are often backed by government entities or reputable organizations.

08

Retirees who want flexibility in how they receive their retirement income, such as monthly payments or lump-sum withdrawals.

09

Those who want to ensure a comfortable retirement lifestyle by securing a steady income stream to cover living expenses and other financial obligations.

10

Individuals who have a long-term retirement plan and understand the benefits of diversifying their investment and income sources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the agency retirement income fund electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your agency retirement income fund in minutes.

How do I edit agency retirement income fund on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign agency retirement income fund on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete agency retirement income fund on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your agency retirement income fund, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is agency retirement income fund?

Agency retirement income fund is a type of retirement savings account offered by an agency that provides a stream of income in retirement.

Who is required to file agency retirement income fund?

Employees who participate in the agency retirement income fund are required to file it.

How to fill out agency retirement income fund?

To fill out agency retirement income fund, employees need to provide information about their contributions, investment choices, and beneficiary designations.

What is the purpose of agency retirement income fund?

The purpose of agency retirement income fund is to help employees save for retirement and provide them with a source of income in their retirement years.

What information must be reported on agency retirement income fund?

Information such as contributions, investment earnings, withdrawals, and beneficiary designations must be reported on agency retirement income fund.

Fill out your agency retirement income fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agency Retirement Income Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.