Get the free BA 18

Show details

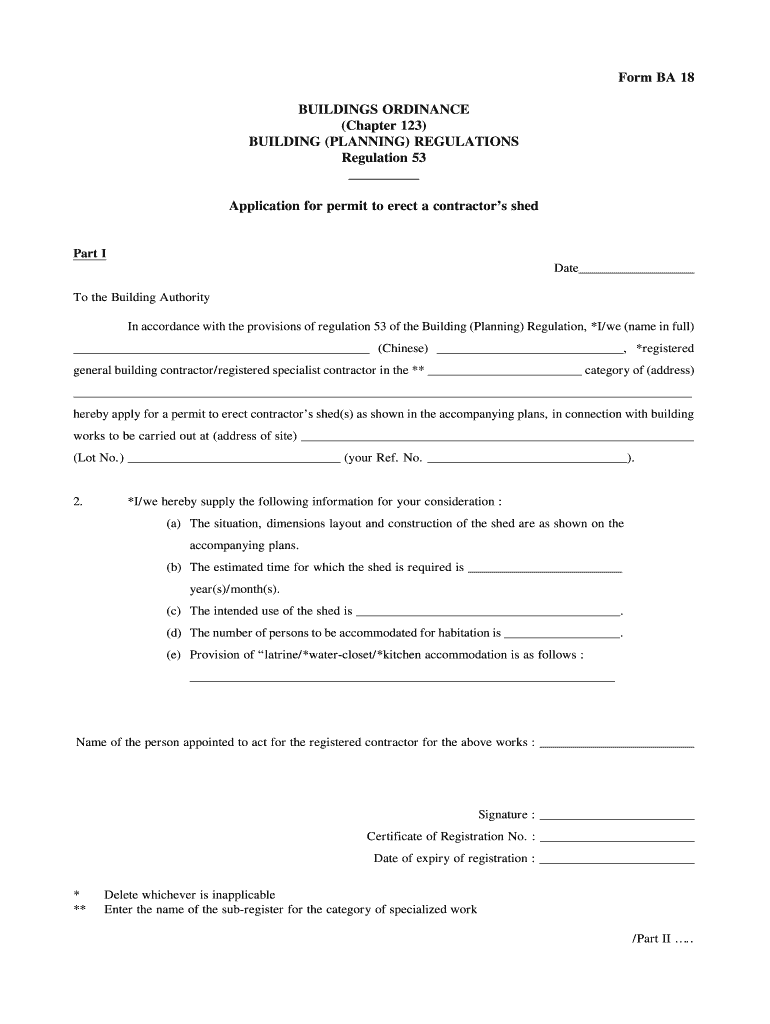

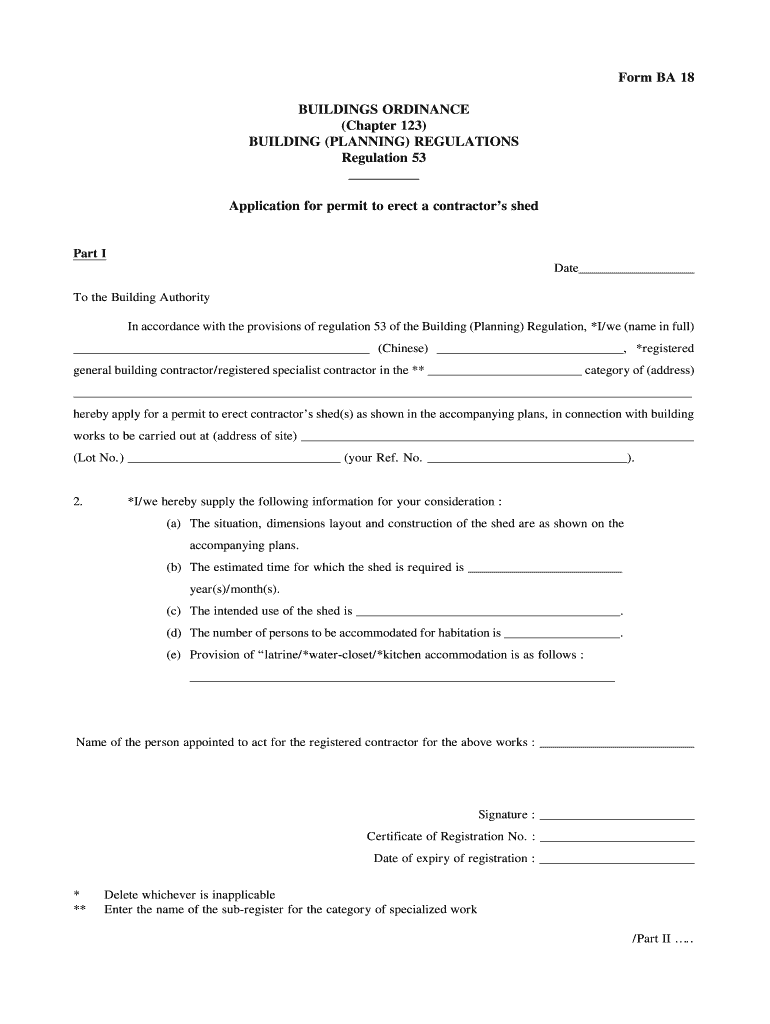

This form is used to apply for a permit to erect a contractor's shed in accordance with the Building (Planning) Regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ba 18

Edit your ba 18 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ba 18 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ba 18 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ba 18. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ba 18

How to fill out BA 18

01

Obtain the BA 18 form from the relevant tax authority or download it from their website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal information, including your name, address, and identification number.

04

Provide details about your income sources for the relevant tax year.

05

Report any deductions you are claiming, ensuring you have supporting documentation.

06

Double-check all entries for accuracy to avoid delays in processing.

07

Sign and date the form in the designated area.

08

Submit the completed form by mail or online, depending on the options provided by the tax authority.

Who needs BA 18?

01

Individuals who are self-employed or freelance workers.

02

People earning income from sources outside of traditional employment.

03

Taxpayers needing to report specific types of income or deductions.

Fill

form

: Try Risk Free

People Also Ask about

What is a BA in English?

Bachelor of Arts in English.

What is the use of BA English?

Versatile Career Opportunities: Graduates with a Ba in English can explore a wide range of career options, such as teaching, content creation, copywriting, editing, publishing, freelance writing, and many more.

What's the meaning of BA in English?

Meaning of BA in English abbreviation for Bachelor of Arts: a first university degree (= qualification) in the arts or social sciences, or someone who has this degree: have a BA in Farida has a BA in History from the University of Sussex. SMART Vocabulary: related words and phrases. Qualifications: university & college.

Is English literature a BA?

On our English Literature BA course, you'll study vital and influential works of literature, reading and discussing contemporary works as well as classics in a wide range of genres and cultures from around the world.

What is an English BA?

This BA in English combines contemporary literary theory, close textual examination and historical study to offer open and imaginative approaches to classic English texts. Many modules are offered in collaboration with cultural institutions and local archives, including the Globe Theatre.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BA 18?

BA 18 is a tax form used for reporting certain business activities in some jurisdictions, typically related to franchise taxes or other business fees.

Who is required to file BA 18?

Businesses operating within the jurisdiction that requires the BA 18 form are typically required to file it, including sole proprietors, partnerships, and corporations.

How to fill out BA 18?

To fill out BA 18, businesses should gather their financial information, follow the form's instructions for each section, and provide accurate data regarding their business activities.

What is the purpose of BA 18?

The purpose of BA 18 is to provide regulatory authorities with information about a business's operations and financial status to ensure compliance with local tax laws.

What information must be reported on BA 18?

BA 18 typically requires reporting information such as business identification details, revenue, expenses, and any other relevant financial data that reflects the business's activities.

Fill out your ba 18 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ba 18 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.