Get the free Form 3 Off-Balance Sheet Items - bol gov

Show details

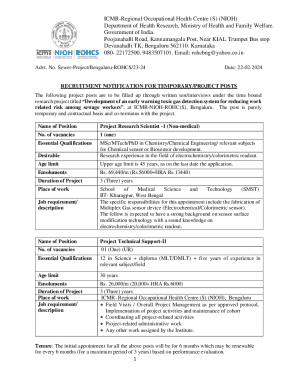

Form 3: Outbalance Sheet Items SCU Name: 1 1.1 2 2.1 2.2 3 3.1 Report as of (date): Amount in a million Kip Write-off Loans Overdue Interest Other Overdue Interest Other Commitments and Obligations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 3 off-balance sheet

Edit your form 3 off-balance sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3 off-balance sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3 off-balance sheet online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 3 off-balance sheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 3 off-balance sheet

How to fill out form 3 off-balance sheet:

01

Start by gathering all the necessary financial information for your company. This includes details about your assets, liabilities, and equity.

02

Begin filling out the form by entering your company's name, address, and other basic identification details at the top of the form.

03

Proceed to section 1 of the form, which typically requires you to report your total assets. Provide accurate figures for each asset category, such as cash, accounts receivable, inventory, and investments.

04

Move on to section 2, where you'll need to disclose your total liabilities. This includes any outstanding debts, loans, accounts payable, or accrued expenses.

05

In section 3, calculate your company's equity by subtracting the total liabilities from the total assets. Make sure to indicate the breakdown of equity, whether it's common stock, retained earnings, or other types of equity.

06

Next, you may need to provide additional information requested in section 4, such as any off-balance sheet arrangements or contingencies that could affect your company's financial position. Be sure to provide accurate and transparent details.

07

After completing all the necessary sections, review the form thoroughly for any errors or missing information. It's crucial to double-check the calculations and ensure the form is filled out accurately.

Who needs form 3 off-balance sheet:

01

Businesses that prepare financial statements in accordance with Generally Accepted Accounting Principles (GAAP) often require form 3 off-balance sheet. This form helps to provide a comprehensive view of a company's financial position by disclosing off-balance sheet arrangements and other contingent liabilities.

02

Regulators, such as the Securities and Exchange Commission (SEC), may request form 3 off-balance sheet from publicly traded companies to ensure transparency and accurate financial reporting.

03

Lenders or creditors may also require this form when evaluating a company's creditworthiness or financial health before extending loans or credit facilities.

In summary, form 3 off-balance sheet is necessary for businesses following GAAP guidelines, regulators, and lenders who need a thorough understanding of a company's financial position. By following the step-by-step instructions provided, you can confidently fill out this form and convey accurate information about your company's assets, liabilities, and equity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 3 off-balance sheet in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 3 off-balance sheet in seconds.

How can I edit form 3 off-balance sheet on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form 3 off-balance sheet, you can start right away.

How do I fill out the form 3 off-balance sheet form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 3 off-balance sheet and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is form 3 off-balance sheet?

Form 3 off-balance sheet is a financial document that shows assets or liabilities that are not recorded directly on a company's balance sheet.

Who is required to file form 3 off-balance sheet?

Companies or entities with off-balance sheet items are required to file form 3 off-balance sheet.

How to fill out form 3 off-balance sheet?

Form 3 off-balance sheet should be filled out by providing detailed information about any off-balance sheet items, including the nature, value, and purpose of the items.

What is the purpose of form 3 off-balance sheet?

The purpose of form 3 off-balance sheet is to provide transparency and disclosure of off-balance sheet items that could impact a company's financial position.

What information must be reported on form 3 off-balance sheet?

Form 3 off-balance sheet must include information on off-balance sheet assets, liabilities, commitments, and contingencies.

Fill out your form 3 off-balance sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 3 Off-Balance Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.