Get the free Risk Tolerance Questionnaire - Fulton Financial Planning

Show details

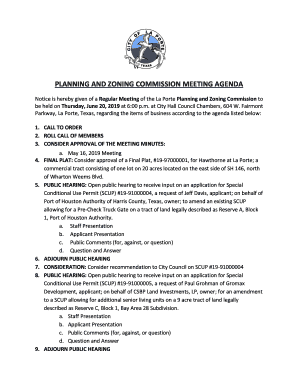

Client: Date: Risk Tolerance Questionnaire Show how much you Agree or Disagree with each of the following investment statements by marking the appropriate box at the end of each sentence. Disagree

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk tolerance questionnaire

Edit your risk tolerance questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk tolerance questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk tolerance questionnaire online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk tolerance questionnaire. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk tolerance questionnaire

How to fill out a risk tolerance questionnaire:

01

Start by reading the questionnaire instructions carefully to understand the purpose and instructions for each section.

02

Assess your financial goals and objectives – Determine your short-term and long-term financial goals, such as retirement plans, saving for a house, or funding your child's education. This will help you understand your risk capacity.

03

Evaluate your risk capacity – Consider your financial situation, including income, expenses, and assets. Assess your ability to withstand potential financial losses and fluctuations in the market.

04

Consider your time horizon – Determine the length of time you can keep your investments before needing the money. Longer time horizons can tolerate more risk as they have more time to recover from any downturns.

05

Assess your risk tolerance – Reflect on your emotional and psychological ability to handle investment volatility. Consider how you would react to market fluctuations and potential losses.

06

Review your investment knowledge – Analyze your understanding of various investment products, like stocks, bonds, or mutual funds. Assess your knowledge of different investment strategies and risk management techniques.

07

Complete the questionnaire – Answer each question honestly, based on your financial goals, risk capacity, time horizon, risk tolerance, and investment knowledge.

08

Seek professional advice if needed – If you are unsure about any question or need assistance in determining your risk tolerance, consider consulting a financial advisor who can guide you through the process.

Who needs a risk tolerance questionnaire?

01

Individuals planning for retirement – A risk tolerance questionnaire can help individuals understand the level of risk they are comfortable with when investing their retirement savings.

02

Investors considering different asset classes – By assessing their risk tolerance, investors can determine the appropriate mix of assets such as stocks, bonds, or real estate to align with their risk preferences.

03

New investors – Those who are new to investing can benefit from a risk tolerance questionnaire to gain insights about their risk appetite and make informed investment decisions.

04

Individuals undergoing a major life change – When facing a significant life event such as marriage, divorce, the birth of a child, or changing careers, a risk tolerance questionnaire can help individuals reassess their risk profile and adjust their investment strategy accordingly.

05

Individuals approaching retirement – As retirement approaches, it becomes important to evaluate risk tolerance to ensure the investment portfolio aligns with future income needs and helps preserve capital.

Remember, filling out a risk tolerance questionnaire is personal and unique to each individual. It is crucial to approach the questionnaire thoughtfully and honestly to make informed investment decisions aligned with your financial goals and risk preferences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit risk tolerance questionnaire on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing risk tolerance questionnaire right away.

How do I fill out risk tolerance questionnaire using my mobile device?

Use the pdfFiller mobile app to fill out and sign risk tolerance questionnaire. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit risk tolerance questionnaire on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as risk tolerance questionnaire. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is risk tolerance questionnaire?

Risk tolerance questionnaire is a tool used to assess an individual's willingness and ability to take on financial risk.

Who is required to file risk tolerance questionnaire?

Investors and financial advisors are typically required to file a risk tolerance questionnaire.

How to fill out risk tolerance questionnaire?

To fill out a risk tolerance questionnaire, individuals need to answer questions about their financial goals, time horizon, and comfort level with different levels of risk.

What is the purpose of risk tolerance questionnaire?

The purpose of a risk tolerance questionnaire is to help investors and financial professionals understand an individual's risk preferences and tailor investment strategies accordingly.

What information must be reported on risk tolerance questionnaire?

Information such as financial goals, investment experience, time horizon, and risk tolerance levels must be reported on a risk tolerance questionnaire.

Fill out your risk tolerance questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Tolerance Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.