Get the free Form 691

Show details

This document serves as an application for reviewing a premises licence or club premises certificate under the Licensing Act 2003, outlining details of the premises, applicant, grounds for review,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 691

Edit your form 691 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 691 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 691 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 691. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 691

How to fill out Form 691

01

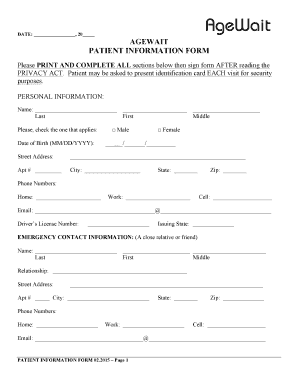

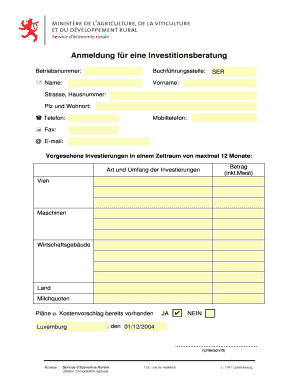

Gather necessary personal information such as your name, address, date of birth, and contact details.

02

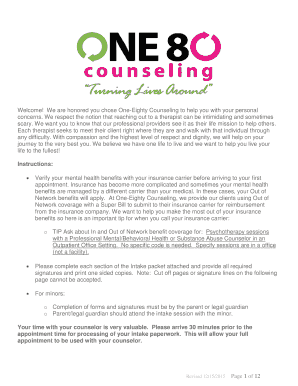

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill out the form sections one by one, starting with personal information.

04

Provide details regarding the purpose of the form as required in the specified sections.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form as per the submission guidelines, either online or via postal mail.

Who needs Form 691?

01

Individuals applying for a specific program or benefit that requires the completion of Form 691.

02

Those who need to provide verification of their eligibility for certain government services.

Fill

form

: Try Risk Free

People Also Ask about

Who does the corporate alternative minimum tax apply to?

The CAMT applies to corporations with $1 billion or more in average annual earnings, calculated over a consecutive three-year period ending in tax years beginning after December 31, 2021. For a calendar year taxpayer, that period comprises 2020, 2021, and 2022.

What is Form 145 in English?

Form 145 is a form that workers must submit to their company to communicate their personal and family situation, which is used to calculate the Personal Income Tax (IRPF) withholding rate.

How do I avoid the alternative minimum tax?

7 ways to avoid the AMT Defer income to next year. Contribute to your 401(k) or 403(b) Self employed? Create future tax-free income with a Roth IRA or a health savings account. Give to charity. Move deductions to a different schedule. Be mindful of ISOs.

Who must complete the form 6251?

If you're a particularly high-income taxpayer, you may need to use Form 6251 to calculate your alternative minimum tax, or AMT. You can also use this form to figure out whether you're subject to the AMT. Here's a complete breakdown of Form 6251, including when you should file it and how you can calculate your AMT.

How do I recover my alternative minimum tax in Canada?

If you end up having to pay the AMT, there is an opportunity to recover some of that money in future tax years. Essentially, you can carry forward the difference between the AMT and your regular tax liability for seven years, or until you use it up.

Who needs to fill out T691?

If the total is more than $40,000, you may have to pay minimum tax. Therefore, complete Form T691, Alternative Minimum Tax. You also may have to complete Form 428 or Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions, to calculate additional provincial or territorial tax for minimum tax purposes.

Who is most likely to pay AMT?

Certain financial situations and deductions also increase the likelihood of being subject to AMT. Individuals who claim large state and local tax (SALT) deductions, exercise incentive stock options or report significant passive income from investments or rental properties are more likely to trigger the AMT.

What is minimum tax carryover?

If the AMT results in additional tax payable, that extra amount becomes a "minimum tax carryover" which can be carried forward for up to seven years. This carryover can be used to offset future regular income tax if it exceeds the AMT in any of those years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 691?

Form 691 is a specific tax form used by certain individuals and organizations to report income and financial information to the IRS.

Who is required to file Form 691?

Individuals and entities that meet certain criteria related to income thresholds or specific tax situations are required to file Form 691.

How to fill out Form 691?

To fill out Form 691, gather all relevant financial documents, provide accurate income and expense information, and follow the instructions provided on the form to ensure proper completion.

What is the purpose of Form 691?

The purpose of Form 691 is to enable the IRS to collect necessary tax information and to ensure compliance with federal tax laws.

What information must be reported on Form 691?

Form 691 requires reporting of income sources, deduction amounts, credits claimed, and any other relevant financial information pertaining to the taxpayer's situation.

Fill out your form 691 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 691 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.