Get the free SAMPLE DEBT COLLECTION PROCESS

Show details

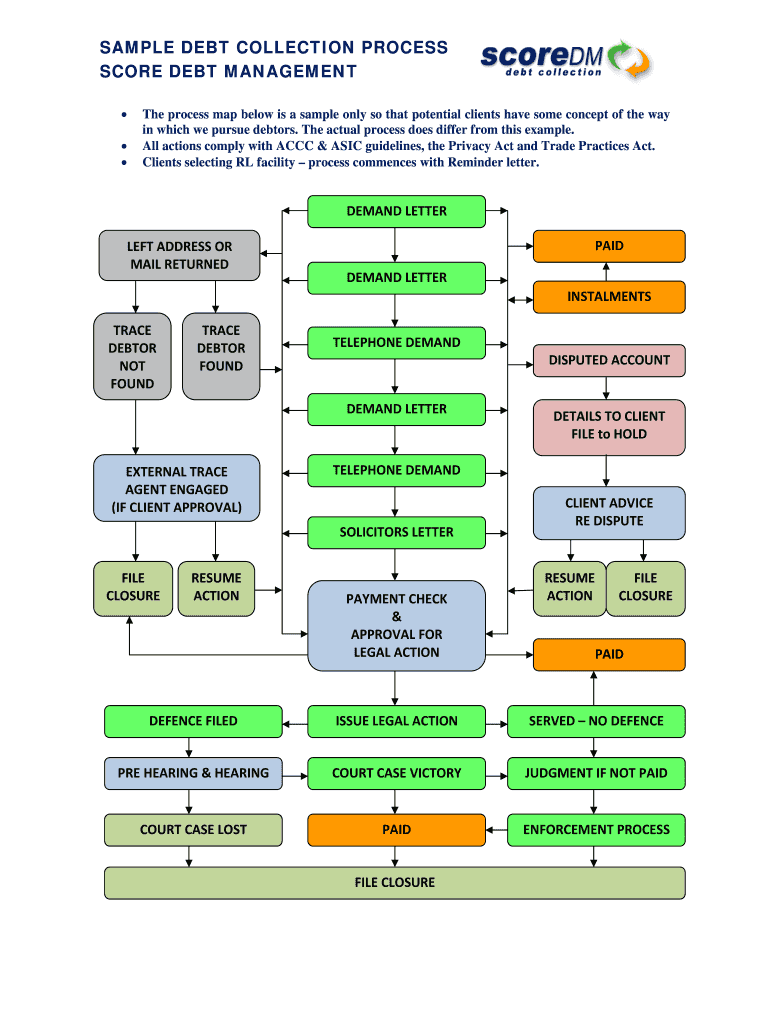

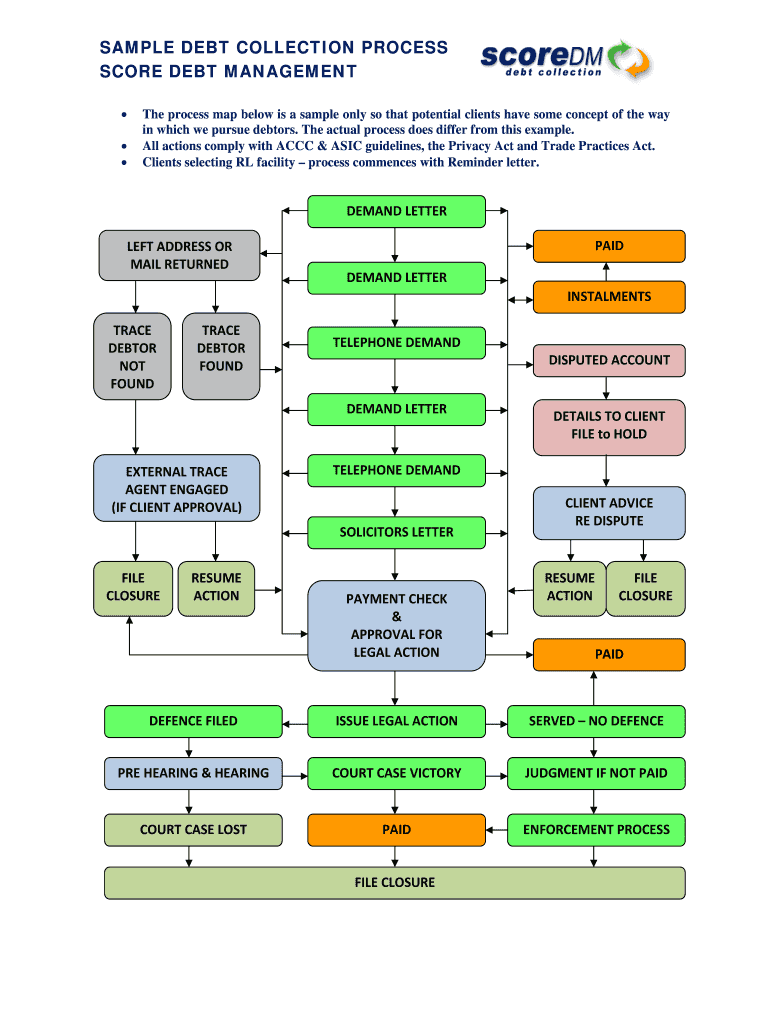

SAMPLE DEBT COLLECTION PROCESS SCORE DEBT MANAGEMENT The process map below is a sample only so that potential clients have some concept of the way in which we pursue debtors. The actual process does

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample debt collection process

Edit your sample debt collection process form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample debt collection process form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample debt collection process online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sample debt collection process. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample debt collection process

How to fill out a sample debt collection process:

01

Understand the purpose of the debt collection process: Familiarize yourself with the purpose of collecting debts, which is to recover outstanding payments from individuals or businesses who owe you money.

02

Gather necessary information: Before starting the process, you need to gather all relevant information related to the debt, including the debtor's contact details, amount owed, and any supporting documents such as invoices, contracts, or payment agreements.

03

Review the sample debt collection process: Take time to carefully review the sample debt collection process provided to ensure you understand each step and its significance. Familiarize yourself with the terminology used and any specific instructions mentioned.

04

Customize the process to fit your needs: Every business or individual may have unique requirements or preferences when it comes to debt collection. Tailor the sample process to suit your specific situation, adding or removing steps as necessary.

05

Follow the outlined steps: Begin by following the first step mentioned in the sample debt collection process. Take each subsequent step as outlined, ensuring all required actions are completed accurately and within the designated timeframe.

06

Keep track of progress: Maintain detailed records of each step you complete in the debt collection process. Update the records regularly, including any communications, payments received, or disputes encountered along the way. This will help you stay organized and monitor the progress of the collection efforts.

Who needs a sample debt collection process:

01

Small business owners: Small business owners often encounter situations where they need to collect outstanding debts from their customers or clients. Having a sample debt collection process can guide them in effectively navigating the collection process.

02

Collection agencies: Collection agencies are specialized firms that help businesses recover overdue payments. A sample debt collection process can serve as a reference point for these agencies, ensuring they adhere to proper guidelines and industry best practices.

03

Individuals with personal debts: Individuals who lend money to others or have outstanding debts may also benefit from a sample debt collection process. It provides a structured approach to help them recover their owed funds while maintaining professionalism and adhering to legal requirements.

In summary, filling out a sample debt collection process involves understanding its purpose, gathering necessary information, reviewing the process, customizing it to fit your needs, following the outlined steps, and keeping track of progress. This process can be useful for small business owners, collection agencies, and individuals dealing with personal debts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sample debt collection process in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your sample debt collection process and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit sample debt collection process from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your sample debt collection process into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I fill out sample debt collection process on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sample debt collection process by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is sample debt collection process?

The sample debt collection process is a system or procedure used by businesses to collect overdue payments from customers.

Who is required to file sample debt collection process?

Any business or organization that extends credit to customers and needs to collect overdue payments may be required to have a sample debt collection process in place.

How to fill out sample debt collection process?

To fill out a sample debt collection process, businesses can include steps such as contacting the customer for payment, sending reminder notices, and escalating to legal action if necessary.

What is the purpose of sample debt collection process?

The purpose of a sample debt collection process is to help businesses streamline their collection efforts, improve cash flow, and recover unpaid debts.

What information must be reported on sample debt collection process?

Information that may be reported on a sample debt collection process includes customer contact details, payment history, outstanding balances, and collection actions taken.

Fill out your sample debt collection process online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Debt Collection Process is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.