Get the free HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM - sholland gov

Show details

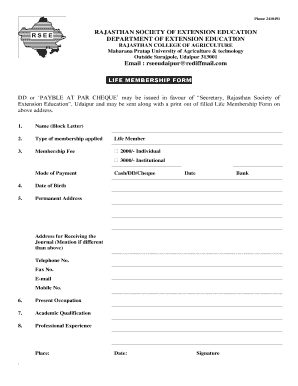

This form is used to collect information from individuals to determine their eligibility for housing benefit and council tax benefit. It requires personal details, income information, and details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign housing benefit and council

Edit your housing benefit and council form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your housing benefit and council form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit housing benefit and council online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit housing benefit and council. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out housing benefit and council

How to fill out HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM

01

Obtain the Housing Benefit and Council Tax Benefit Review Form from the local council website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details, including name, address, and contact information.

04

Provide information about your current housing situation, including rent amount and landlord details.

05

Report any changes in your financial circumstances, such as income, savings, or household composition.

06

Include any supporting documents required, such as payslips or bank statements.

07

Double-check all information for accuracy before submission.

08

Submit the completed form by the specified deadline, either online or via mail.

Who needs HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

01

Individuals or families who receive Housing Benefit or Council Tax Benefit and need to report changes in their circumstances.

02

Those who are reapplying for benefits after a change in their situation.

03

New applicants who are looking to apply for Housing Benefit and Council Tax Benefit.

Fill

form

: Try Risk Free

People Also Ask about

What happens in a benefit review?

Once we've received your form we'll review your entitlement and take account of any changes. We'll send you a benefit notification letter to let you know if the amount of benefit you receive has changed. If there has been any change to your Council Tax Support, we'll send you an up to date Council Tax bill.

How do I get a universal credit letter?

You'll receive a letter in the post from the Department for Work and Pensions. This is called a Universal Credit Migration Notice and it tells you when you need to move to Universal Credit. It is important that you do not do anything until you receive your letter.

What is proof of rent letter UK?

Proof of rent payment letters often include information on a tenant that proves that they are currently renting and have a good record of paying rent on time. In the letter, include the following information on a business letterhead: Your tenant's name. Rental property address.

What is the maximum amount of Housing Benefit you can receive?

Every privately rented property has a Local Housing Allowance (LHA) rate. The maximum amount of Housing Benefit you can get is 100% of the LHA rate. If your rent is more than the LHA rate, you cannot get Housing Benefit on the difference. You can search Directgov for LHA rates by postcode.

What is a proof of income letter UK?

Employed proof of income This must show the name of your employer, your year to date income and the tax and National Insurance that's been deducted, a handwritten payslip with a P60, or. a job offer letter or contract of employment showing your annual salary.

How do I get a proof of benefit letter in the UK?

You can get a proof of benefit letter using the online form if you are currently getting: Employment and Support Allowance. Income Support. Jobseeker's Allowance.

How to change circumstances on Housing Benefit?

You have to tell us if your circumstances change as this can affect how much benefit you get. You may be asked to give evidence. You will be able to upload documents to submit with the online form. Or you can provide the documents by post to the addresses shown below.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

The Housing Benefit and Council Tax Benefit Review Form is a document used by local authorities to assess an individual's ongoing eligibility for housing benefit and council tax benefit. It collects updated information about the claimant's financial situation, living circumstances, and any changes that may affect their benefits.

Who is required to file HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

Individuals currently receiving housing benefit or council tax benefit may be required to file this form, especially when there are changes in their circumstances, such as income, employment status, or household composition.

How to fill out HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

To fill out the form, individuals should provide accurate and up-to-date information regarding their personal details, income, expenses, and any other relevant circumstances. It's important to follow the instructions provided on the form and submit any necessary supporting documents.

What is the purpose of HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

The purpose of the review form is to ensure that the benefits awarded are still appropriate and to prevent any overpayments or underpayments. It helps local authorities verify that claimants remain eligible for the benefits they receive.

What information must be reported on HOUSING BENEFIT AND COUNCIL TAX BENEFIT REVIEW FORM?

Claimants must report various information including their current income, savings, household members, any changes in work status, and other relevant financial details. It's crucial to provide complete and accurate information to avoid issues with benefit eligibility.

Fill out your housing benefit and council online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Housing Benefit And Council is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.