Get the free MSS bBusiness Credit Applicationb - ComBlock

Show details

MSS Business Credit Application 18221A Flower Hill Way Gaithersburg MD 20879 Phone: (240× 6311111 Fax: (240× 6311676 CREDIT LIMIT DESIRED $ DATE: Company Information COMPANY NAME CONTACT NAME BILLING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mss bbusiness credit applicationb

Edit your mss bbusiness credit applicationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mss bbusiness credit applicationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mss bbusiness credit applicationb online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mss bbusiness credit applicationb. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mss bbusiness credit applicationb

How to fill out a business credit application:

01

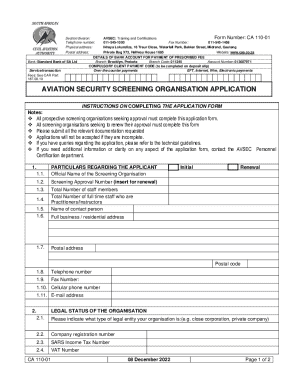

Gather all necessary information: Before filling out a business credit application, it is important to gather all the necessary information. This may include your business's legal name, address, contact information, tax identification number, financial statements, and relevant business licenses.

02

Read the instructions carefully: Each business credit application may have specific instructions and requirements. Take the time to read and understand these instructions thoroughly before proceeding. This will ensure that you provide all the necessary information and complete the application correctly.

03

Provide accurate business details: Fill in accurate and up-to-date information about your business. This includes your legal business name, address, and contact details. Make sure to double-check the accuracy of this information to avoid any delays or misunderstandings.

04

Complete the financial section: The financial section of the application will require you to provide information about your business's financial status. This may include details about your annual revenue, debt obligations, existing lines of credit, and other financial information. It is important to be honest and accurate while providing this information to give potential creditors a clear picture of your business's financial health.

05

Attach relevant documents: Many business credit applications require supporting documents to be attached. These may include financial statements, tax returns, bank statements, and any other documents that can support your business's financial credibility. Gather these documents in advance and make sure they are properly organized and labeled for easy reference.

06

Provide references: Some business credit applications may require you to provide references from existing vendors, suppliers, or business partners. Make sure to include accurate contact information for these references, as they may be contacted to verify your business's reputation and creditworthiness.

Who needs a business credit application?

01

Startups and new businesses: Startups and new businesses often need a business credit application to establish their creditworthiness. By applying for business credit, they can demonstrate their ability to manage financial obligations and build a positive credit history.

02

Small and medium-sized businesses: Small and medium-sized businesses may need a business credit application to access additional funds or credit lines. This can help them manage their cash flow, invest in growth opportunities, and meet their financial obligations.

03

Established businesses seeking expansion: Established businesses that are looking to expand their operations may require a business credit application to secure financing for their expansion plans. This can include obtaining funds for purchasing new equipment, opening new branches, or entering new markets.

Overall, anyone running a business that requires additional funds, financing, or credit should consider filling out a business credit application. It is a crucial step in establishing and building a business's creditworthiness and gaining access to various financial resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mss bbusiness credit applicationb?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mss bbusiness credit applicationb and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit mss bbusiness credit applicationb online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your mss bbusiness credit applicationb to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the mss bbusiness credit applicationb in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mss bbusiness credit applicationb and you'll be done in minutes.

What is mss business credit application?

MSS business credit application is a form used by businesses to apply for credit with a company or financial institution.

Who is required to file mss business credit application?

Businesses that wish to establish a line of credit with a company or financial institution are required to file an MSS business credit application.

How to fill out mss business credit application?

To fill out an MSS business credit application, businesses must provide detailed information about their company, financial history, and credit needs.

What is the purpose of mss business credit application?

The purpose of an MSS business credit application is to request credit from a company or financial institution in order to make purchases or invest in the business.

What information must be reported on mss business credit application?

Information such as company financials, credit history, banking information, and references may be required on an MSS business credit application.

Fill out your mss bbusiness credit applicationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mss Bbusiness Credit Applicationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.