Get the free Total Losses on Sales - alpine courts ca

Show details

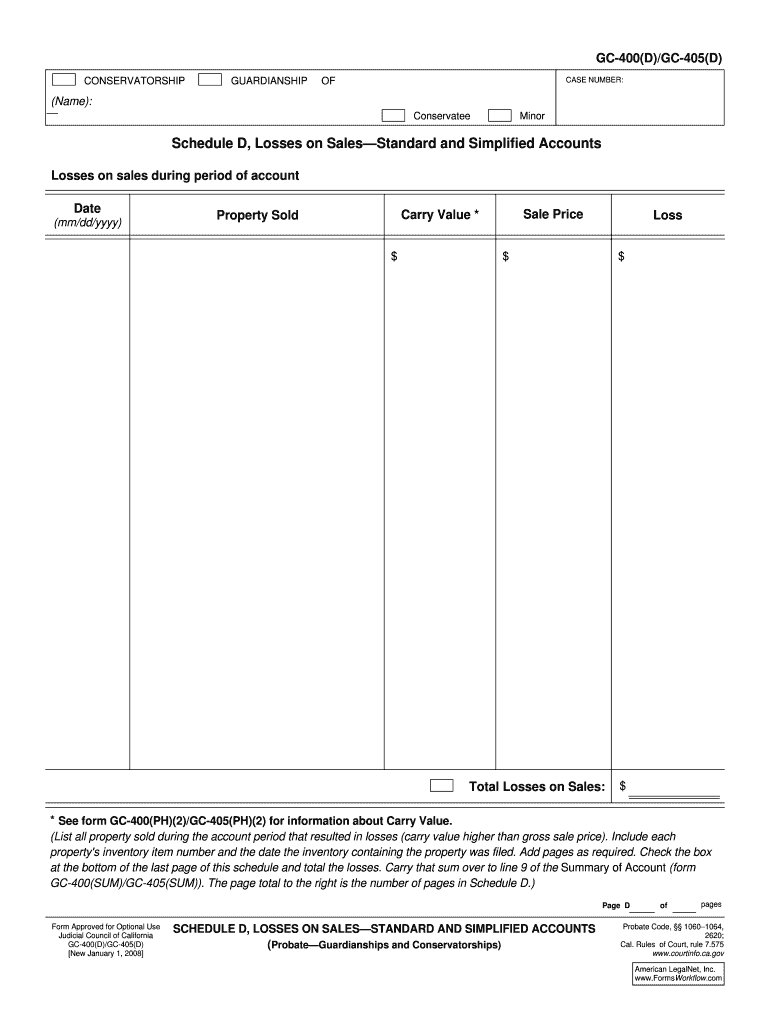

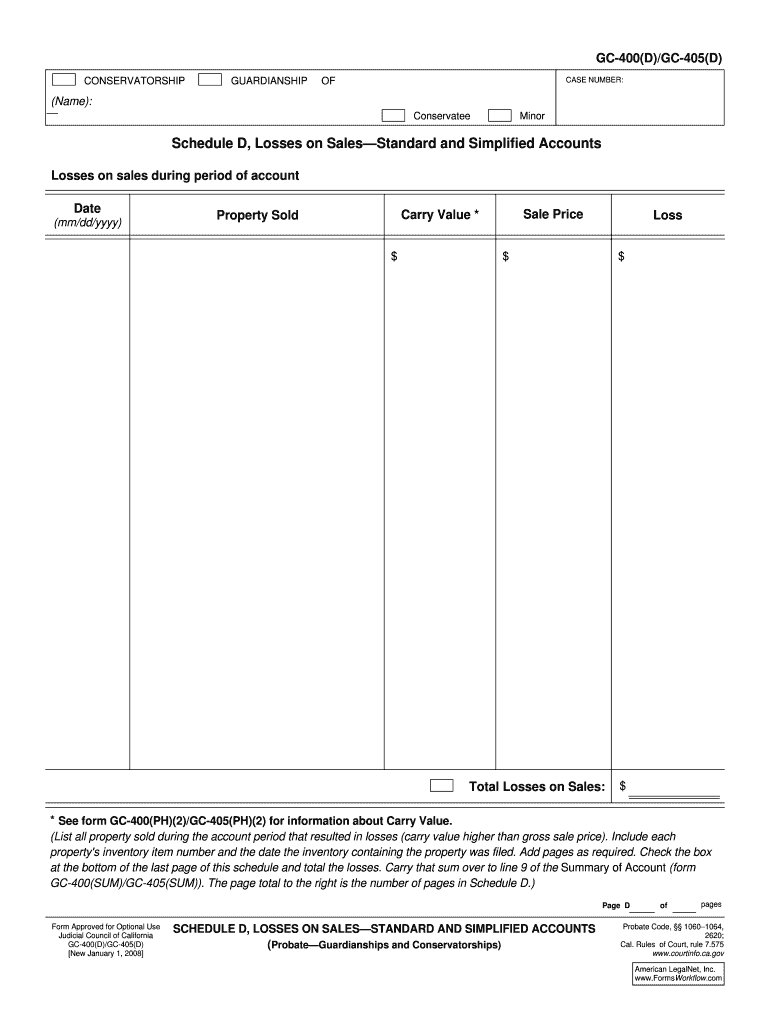

To keep other people from seeing what you entered on your form, please press the Clear This Form button at the end of the form when finished. GC400×D)/GC405×D) CONSERVATORSHIP GUARDIANSHIP OF CASE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign total losses on sales

Edit your total losses on sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total losses on sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit total losses on sales online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit total losses on sales. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out total losses on sales

How to fill out total losses on sales:

01

Calculate the total losses: Begin by determining the total amount lost on sales. This can include products that were damaged, spoiled, or unsold.

02

Track the reasons for losses: Keep a record of the specific reasons for the losses on sales. This can help identify patterns or areas that need improvement in the future.

03

Categorize the losses: It can be useful to categorize the losses based on different factors such as product type, location, or time frame. This helps in analyzing and identifying trends or areas that require attention.

04

Document the losses: Proper documentation is essential for accurate reporting. Keep records of all the losses, including dates, quantities, and values. This information will be needed for financial reporting and analysis.

05

Fill out the total losses section: In the financial statements or reports, there is usually a designated section for reporting total losses on sales. Fill out this section accurately and provide the necessary details, such as the total amount of losses and any relevant breakdowns or explanations.

06

Review and verify: Before finalizing the reporting, review all the information and calculations to ensure accuracy. It's crucial to double-check the figures and confirm that everything aligns with the records.

07

Seek professional advice if needed: If you are unsure about how to fill out total losses on sales or have complex situations, consider consulting with an accountant or financial advisor for guidance.

Who needs total losses on sales?

01

Businesses: Companies of all sizes and industries need to track and report total losses on sales. This information helps in assessing the financial health of the business, identifying areas for improvement, and making informed decisions.

02

Investors: Investors, stakeholders, and shareholders may be interested in understanding the extent of losses on sales for a company. It can impact their investment decisions and provide insights into the company's performance.

03

Financial institutions: Banks and lenders may require information on total losses on sales when evaluating a company's creditworthiness or when assessing loan applications.

04

Government authorities: Regulatory bodies and government agencies may request total losses on sales as part of financial reporting requirements or for tax purposes.

05

Internal management: The management team within a company needs to be aware of total losses on sales to monitor performance, identify areas for cost reduction, and implement strategies to minimize losses in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my total losses on sales in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your total losses on sales and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit total losses on sales on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share total losses on sales on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out total losses on sales on an Android device?

On an Android device, use the pdfFiller mobile app to finish your total losses on sales. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is total losses on sales?

Total losses on sales refer to the amount of inventory or products that have been lost, damaged, or stolen during the sales process.

Who is required to file total losses on sales?

Businesses or individuals who have experienced losses on sales are required to file total losses on sales.

How to fill out total losses on sales?

Total losses on sales can be filled out by documenting the details of the lost inventory or products, including the quantity, value, and reason for the loss.

What is the purpose of total losses on sales?

The purpose of total losses on sales is to accurately track and report any inventory or product losses that may affect the financial status of a business.

What information must be reported on total losses on sales?

The information that must be reported on total losses on sales includes the quantity and value of the lost inventory or products, as well as the reason for the loss.

Fill out your total losses on sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Losses On Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.