Get the free Declaration for the Import into Malaysia - maff go

Show details

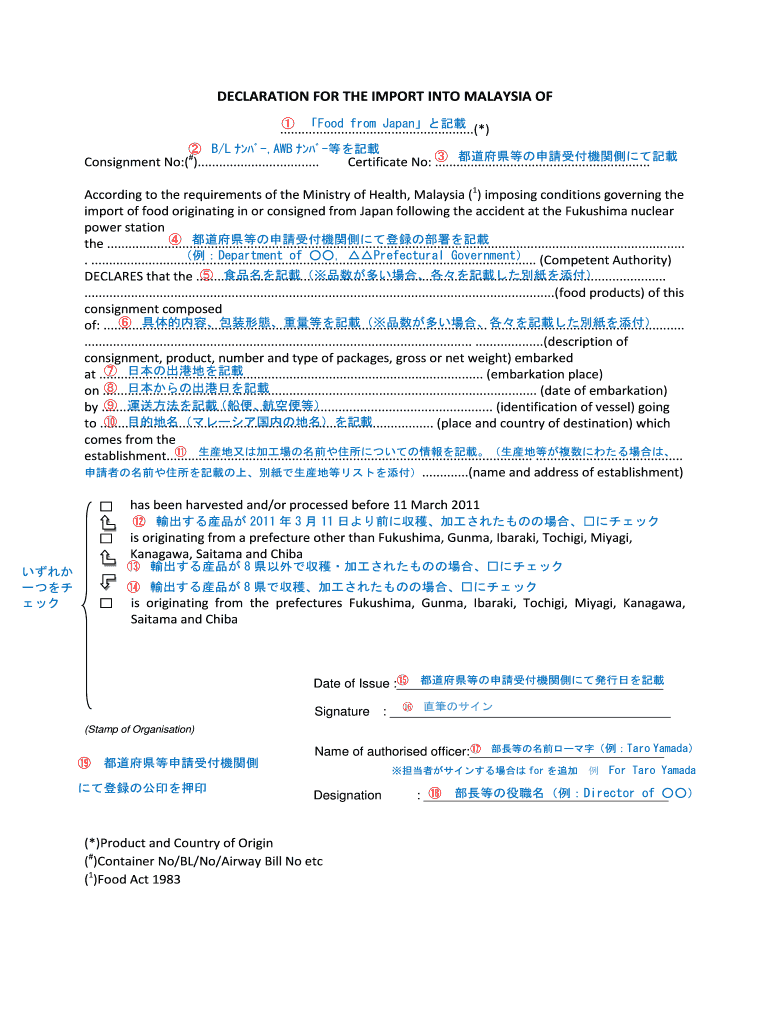

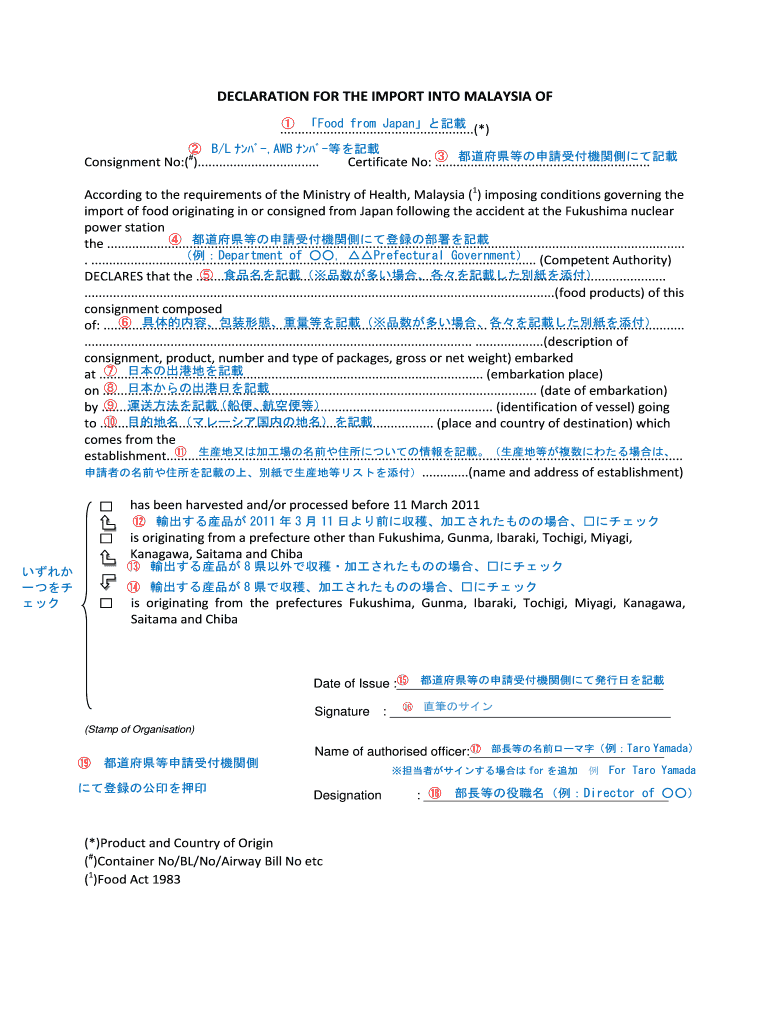

This document is a declaration form required for importing food products from Japan into Malaysia, particularly following specific health regulations after the Fukushima nuclear incident. It serves

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration for form import

Edit your declaration for form import form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration for form import form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration for form import online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit declaration for form import. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration for form import

How to fill out Declaration for the Import into Malaysia

01

Obtain the Declaration for the Import form from the Customs Department website or relevant authorities.

02

Fill in the importer’s details, including name, address, and contact information.

03

Provide details of the goods being imported, including description, quantity, and value.

04

Indicate the country of origin of the goods.

05

Specify the mode of transport being used for the import.

06

Attach any necessary documents, such as invoices, packing lists, and permits.

07

Review the form for accuracy and completeness.

08

Submit the completed Declaration for the Import to the Customs Department.

Who needs Declaration for the Import into Malaysia?

01

Individuals or businesses importing goods into Malaysia.

02

Freight forwarders or agents acting on behalf of importers.

03

Companies needing to clear items for commercial purposes.

Fill

form

: Try Risk Free

People Also Ask about

How to do an import declaration?

Import declarations can be lodged electronically through the Integrated Cargo System (ICS) or via a customs broker. The declaration must accompany payment of any applicable duties, GST (Goods and Services Tax), and other charges.

What to declare when entering Malaysia?

Customs Regulations Prohibited Items: Narcotics, weapons, and certain publications are strictly prohibited. Duty-Free Allowance: Limits exist on duty-free goods, including alcohol and tobacco. Currency Declaration: Declare if carrying more than USD 10,000 (or equivalent in other currencies) upon arrival.

How much to declare when entering Malaysia?

There is no limit for a resident and non-resident to carry into and out of Malaysia foreign currency notes and traveller's cheques but need to declare in Customs Form 22 (Borang Kastam 22) if total amount exceed USD 10,000 equivalent.

What to declare at Customs Malaysia?

Under Malaysian law, every person arriving in or leaving Malaysia must declare all dutiable or prohibited goods, and cash and/or BNI exceeding USD10,000 equivalent in his possession either on his person, in any baggage or in any vehicle to a Customs officer. Failure to make a declaration is an offence.

What are you allowed to bring into Malaysia?

Traveler's Guide DESCRIPTION OF GOODSQUANTITY New apparels Not exceeding 3 pieces New footwear Not exceeding one pair Food preparations Total value not exceeding RM150.00 New portable electrically or battery-operated appliances for personal care and hygiene Not exceeding 1 unit each2 more rows

How do I write a customs declaration?

How to fill out a customs declaration Currency. Category (e.g. gift or product sample) Quantity of products in the shipment. Country - ISO-country code for the country of origin. Content - description of the content. Tariff code. Unit weight. Unit value - the sum of the total value of the shipment.

What is the import declaration form?

The declaration form helps the customs to control goods entering the country, which can affect the country's economy, security or environment. A levy duty may be applied. Travellers have to declare everything they acquired abroad and possibly pay customs duty tax on goods.

Do I need to do anything before entering Malaysia?

You must complete a Malaysia Digital Arrival Card (MDAC) before arrival in Malaysia. The MDAC must be submitted through the Malaysian Immigration website. See the Malaysian Immigration website for further information, including exemption details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Declaration for the Import into Malaysia?

The Declaration for the Import into Malaysia is a formal document required by Malaysian customs authorities that provides details about goods being imported into the country. It helps in assessing duties and ensuring compliance with various regulations.

Who is required to file Declaration for the Import into Malaysia?

Anyone who is importing goods into Malaysia, including individuals, businesses, and freight forwarders, is required to file a Declaration for the Import into Malaysia.

How to fill out Declaration for the Import into Malaysia?

To fill out the Declaration for the Import into Malaysia, importers must provide accurate information about the goods, including description, quantity, value, origin, and applicable tariffs. It typically involves completing specific forms provided by Malaysian customs.

What is the purpose of Declaration for the Import into Malaysia?

The purpose of the Declaration for the Import into Malaysia is to facilitate customs clearance, ensure compliance with laws and regulations, assess duties and taxes, and keep track of goods entering the country.

What information must be reported on Declaration for the Import into Malaysia?

The Declaration for the Import into Malaysia must include information such as the importer's details, description of the goods, quantity, value, origin, shipping details, and relevant documentation related to the import.

Fill out your declaration for form import online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration For Form Import is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.