Get the free Council Tax Class D discount Uninhabitable Property Application form

Show details

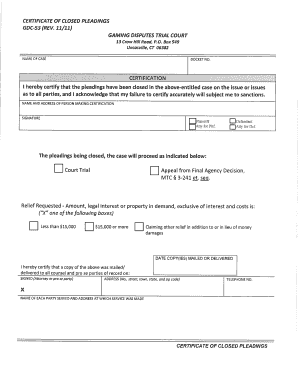

Application form for claiming a discount on Council Tax for properties deemed uninhabitable due to major repair works or structural alterations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign council tax class d

Edit your council tax class d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your council tax class d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing council tax class d online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit council tax class d. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out council tax class d

How to fill out Council Tax Class D discount Uninhabitable Property Application form

01

Obtain the Council Tax Class D discount application form from your local council's website or office.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide the address of the property for which the discount is being claimed.

04

Indicate the reason for the property being uninhabitable by detailing the relevant issues.

05

Attach any supporting documentation, such as photographs or reports from contractors indicating the condition of the property.

06

Review the completed form to ensure all information is accurate and complete.

07

Submit the form to your local council by the method they specify (online, post, or in person).

08

Wait for confirmation from the council regarding the status of your application.

Who needs Council Tax Class D discount Uninhabitable Property Application form?

01

Individuals who own or are responsible for a property that is classified as uninhabitable due to severe damage or necessary renovations.

Fill

form

: Try Risk Free

People Also Ask about

Can I refuse to pay Council Tax in the UK?

You can be sent to prison for up to 3 months if the court decides you don't have a good reason to not pay your Council Tax and you refuse to do so. If the court decides you have something to pay back you may be able to make an arrangement to pay your debt over time.

Who is eligible for Council Tax reduction in England?

You can claim Council Tax Reduction if you are already claiming other benefits such as Job Seekers Allowance, Income Support or Universal Credit. You may also claim it if you are working but on low income.

What is the Council Tax on an empty house in Fife?

Empty Home Council Tax charges If your property has been unoccupied for 12 months or more, a surcharge of 100% may be added to your council tax. This means your council tax charge could be 200%.

How long can a house be empty without paying Council Tax in Scotland?

Most empty and unfurnished homes are exempt from Council Tax for 6 months after someone last lived there. This means you do not have to pay Council Tax for them during this time. Homes that are undergoing repair or structural alteration may be exempt for up to 12 months.

Do you pay Council Tax on an empty property in Edinburgh?

Council Tax discount on empty properties If your property is empty, we may grant a discount for a limited period, depending on its status, and if it is actively marketed. A previous owner or occupier's use of the property may affect how much discount you get and for how long. A discount may be applied with time limits.

Who is eligible for UK tax relief?

Workers are usually eligible for tax relief if they're under the age of 75 (if they're 75 years or older, they aren't eligible) and fit under one of the following categories: they have UK earnings that are subject to income tax for the tax year. they're resident in the UK at some time during the tax year.

Do people over 70 pay Council Tax in England?

If you or your partner has reached State Pension age Council Tax Reduction (CTR) is calculated differently depending on your age and your circumstances. If you or your partner has reached State Pension age, the pension-age CTR rules will usually apply.

What qualifies for Council Tax reduction in England?

You could be eligible if you're on a low income or claim benefits. Your bill could be reduced by up to 100%. You can apply if you own your home, rent, are unemployed or working.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Council Tax Class D discount Uninhabitable Property Application form?

The Council Tax Class D discount Uninhabitable Property Application form is a document that property owners must complete to apply for a discount on their council tax due to their property being uninhabitable.

Who is required to file Council Tax Class D discount Uninhabitable Property Application form?

Property owners whose properties are deemed uninhabitable and wish to apply for a discount on their council tax are required to file the Council Tax Class D discount Uninhabitable Property Application form.

How to fill out Council Tax Class D discount Uninhabitable Property Application form?

To fill out the Council Tax Class D discount Uninhabitable Property Application form, property owners need to provide details about their property, including its address, the nature of the uninhabitable conditions, and any supporting evidence such as photographs or repair estimates.

What is the purpose of Council Tax Class D discount Uninhabitable Property Application form?

The purpose of the Council Tax Class D discount Uninhabitable Property Application form is to formalize a request for a reduction in council tax for properties that cannot be lived in due to significant disrepair or other qualifying conditions.

What information must be reported on Council Tax Class D discount Uninhabitable Property Application form?

On the Council Tax Class D discount Uninhabitable Property Application form, property owners must report information including the property address, the reasons for the property being uninhabitable, the date the property became uninhabitable, and any relevant evidence to support their claim.

Fill out your council tax class d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Council Tax Class D is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.