Get the free Electronic invoices

Show details

Electronic invoices

without scanning easy, fast and cost-efficient!

Now it is easier than ever to send and receive electronic

invoices. Fakturaportalen (the Invoice Portal) is an Internet based service

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic invoices

Edit your electronic invoices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic invoices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

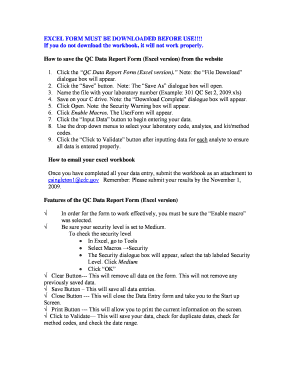

How to edit electronic invoices online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit electronic invoices. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electronic invoices

How to fill out electronic invoices:

01

Start by opening the electronic invoicing software or platform that you will be using. This could be a web-based platform or a dedicated software installed on your computer.

02

Enter your company's information, such as your business name, address, and contact details. This information will usually be required for the invoice header.

03

Add the recipient's information, including their name, address, and contact details. Make sure to double-check the accuracy of this information as it will ensure smooth communication and delivery of the invoice.

04

Include a unique invoice number. This is important for tracking and referencing purposes. Many electronic invoice systems automatically generate invoice numbers, but you may also have the option to manually input a specific number.

05

Specify the invoice date - the date when the invoice is issued. It is important to clearly indicate this date to avoid confusion and ensure timely payment.

06

Include a description of the goods or services provided. Write a brief but detailed description that accurately reflects what is being invoiced. This will help both parties understand the nature of the transaction.

07

Specify the quantity, unit price, and total price for each item or service. This breakdown will make it easier for the recipient to understand the cost breakdown and verify the total amount due.

08

Calculate any applicable taxes or discounts and add them to the total amount. If there are any applicable taxes based on your jurisdiction or any discounts that apply to the invoice, make sure to include them and clearly indicate their calculation.

09

Provide payment terms and methods. Specify the due date for the payment and the acceptable payment methods, such as bank transfer, credit card, or online payment systems. It is also helpful to include any late payment penalties or additional charges for overdue invoices.

10

Review the invoice carefully before sending or submitting it. Check for any errors or omissions in the information provided. Ensure that all calculations are accurate, and all required details are included.

Who needs electronic invoices:

01

Businesses of all sizes: Electronic invoices are beneficial for all types of businesses, whether small, medium, or large. They streamline the invoicing process, improve efficiency, reduce human errors, and save time and resources.

02

Freelancers and self-employed professionals: Freelancers and self-employed individuals who provide goods or services to clients can benefit from using electronic invoices. It allows for easy tracking of invoices, faster payments, and a more professional image.

03

Government entities and organizations: Many government entities, organizations, and institutions have adopted electronic invoicing as a way to improve financial processes, reduce paperwork, and increase transparency in financial transactions.

04

Suppliers and vendors: Suppliers and vendors who regularly issue invoices to their customers can benefit from electronic invoicing. It simplifies the invoicing process, improves communication, and allows for better tracking of invoices and payments.

05

Customers and clients: Customers and clients who receive electronic invoices benefit from the ease of payment, ability to track invoices, and reduced risk of lost paperwork. It also simplifies record-keeping and helps in maintaining clear financial records.

In summary, anyone involved in commercial transactions can benefit from electronic invoices. It provides a more efficient, accurate, and convenient way of invoicing and facilitates smoother financial processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in electronic invoices?

The editing procedure is simple with pdfFiller. Open your electronic invoices in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit electronic invoices in Chrome?

electronic invoices can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit electronic invoices on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing electronic invoices.

What is electronic invoices?

Electronic invoices are digital documents that contain the same information as traditional paper invoices, but are created, sent, and processed electronically.

Who is required to file electronic invoices?

Businesses and individuals who conduct electronic transactions are required to file electronic invoices in compliance with tax regulations.

How to fill out electronic invoices?

Electronic invoices can be filled out using specialized software or online platforms that allow users to input necessary information, such as invoice number, date, items sold, and amount due.

What is the purpose of electronic invoices?

The purpose of electronic invoices is to streamline the invoicing process, reduce paper waste, improve accuracy, and facilitate faster payment transactions.

What information must be reported on electronic invoices?

Electronic invoices must include details such as the seller's and buyer's names and addresses, invoice number, date of issuance, description of goods or services sold, and total amount due.

Fill out your electronic invoices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Invoices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.