Get the free Insurance Cover For Your Future - echoiceservicescomau

Show details

Insurance Cover For Your Future Income Protection, Life Insurance, TED, Trauma Insurance & Funeral Insurance Helping You Find The Right Insurance! Identify Whether You Need Insurance. Risk insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance cover for your

Edit your insurance cover for your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance cover for your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

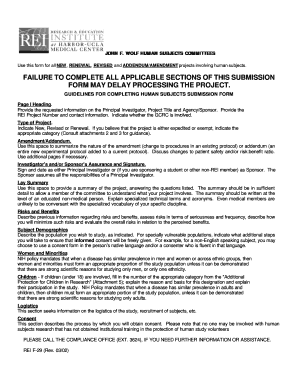

Editing insurance cover for your online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance cover for your. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

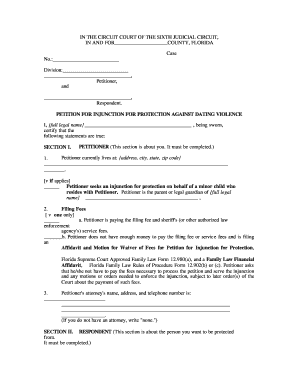

How to fill out insurance cover for your

How to fill out insurance cover for your?

01

Gather all necessary information: Before starting the insurance application process, collect important details such as personal information, contact information, current health conditions, and any relevant documentation. This will ensure that you have everything ready when filling out the insurance cover.

02

Choose the type of insurance cover: Determine the specific coverage you require based on your needs. This can include health insurance, life insurance, car insurance, property insurance, or any other type that suits your requirements. Understand the coverage options, benefits, and limitations associated with each type of insurance.

03

Research insurance providers: Explore different insurance providers and compare their policies, pricing, and customer reviews. Look for reliable companies with a good track record and positive customer feedback. Consider factors such as their financial stability, customer service quality, and claim settlement process.

04

Complete the application form: Fill out the insurance application form accurately and thoroughly. Provide all requested information truthfully and ensure there are no discrepancies or errors. Double-check the form before submission to avoid any potential problems in the future.

05

Understand the terms and conditions: Go through the terms and conditions of the insurance cover carefully. Familiarize yourself with the policy's inclusions, exclusions, deductibles, premiums, and the claims process. Seek clarification from the insurance provider if any aspects are unclear before finalizing the cover.

06

Review and submit the application: Once the form is complete and you have understood the terms, review the entire application to ensure accuracy. Make copies of the filled form and any supporting documents for your records. Submit the application to the insurance provider through the designated channel, whether it's online or in-person.

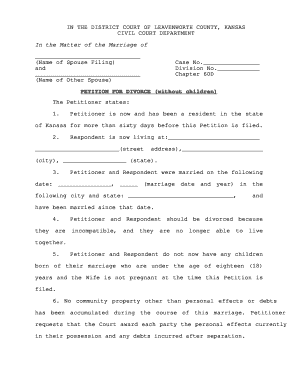

Who needs insurance cover for your?

01

Individuals: Anyone can benefit from insurance coverage. Whether you are a working professional, a student, a homeowner, or a parent, having insurance cover safeguards you against unexpected events and financial losses. It provides peace of mind knowing that you are protected in case of accidents, illnesses, or damage to your property.

02

Families: Insurance cover is especially important for families with dependents. Life insurance ensures financial stability for your loved ones in the event of your untimely demise. Health insurance protects your family's well-being by covering medical expenses. Additionally, home insurance and car insurance safeguard your assets and provide compensation in case of accidents or damages.

03

Business owners: Business owners require insurance cover to safeguard their enterprises. Commercial insurance can protect against property damage, liability claims, and other business-related risks. Workers' compensation insurance provides coverage in case of employee injuries. Professional liability insurance protects against claims related to professional services, while business interruption insurance aids in recovering from unforeseen disruptions.

In conclusion, filling out insurance cover involves gathering necessary information, choosing the appropriate coverage, completing the application diligently, understanding the terms, and submitting the form accurately. This process is essential for individuals, families, and business owners alike to protect themselves against unforeseen circumstances and secure their financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my insurance cover for your in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign insurance cover for your and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit insurance cover for your from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your insurance cover for your into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in insurance cover for your without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing insurance cover for your and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is insurance cover for your?

Insurance cover provides financial protection against specified risks, such as property damage or liability.

Who is required to file insurance cover for your?

Individuals or businesses who want to protect themselves against specific risks are required to file insurance cover.

How to fill out insurance cover for your?

To fill out insurance cover, you need to provide accurate information about the risks you want to protect against and the value of the assets you want to insure.

What is the purpose of insurance cover for your?

The purpose of insurance cover is to mitigate financial losses that may arise from unexpected events or risks.

What information must be reported on insurance cover for your?

Information such as the insured items, coverage amounts, premiums, and policy details must be reported on insurance cover.

Fill out your insurance cover for your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Cover For Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.