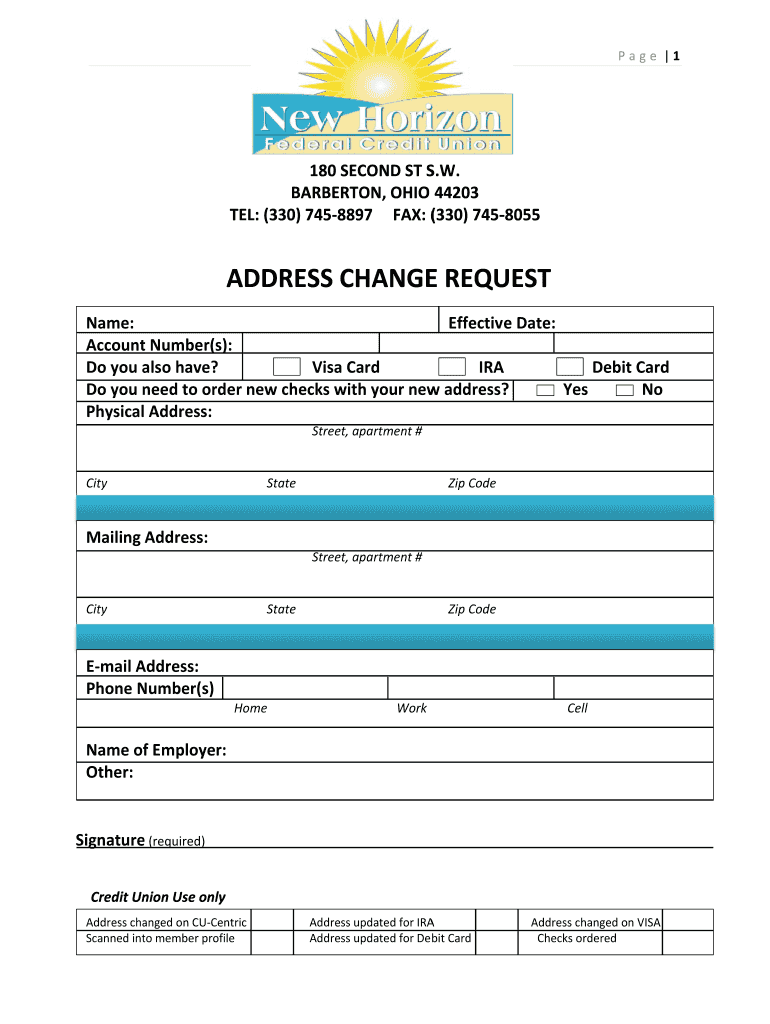

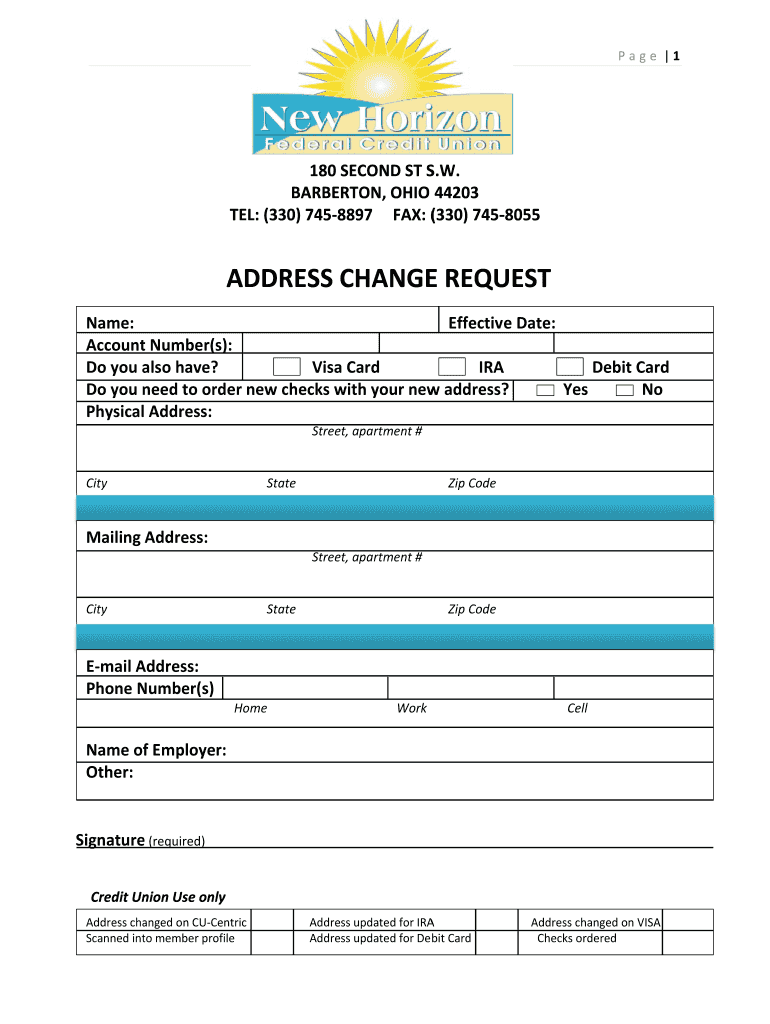

Get the free Credit Un Name: Account Do you a Do you n Physical City Mailing City E

Show details

Credit Un Name: Account Do you a Do you n Physical City Mailing City E?mail A Phone N Name of Other: Signature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit un name account

Edit your credit un name account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit un name account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit un name account online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit un name account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit un name account

Point by point, here's how to fill out a credit union account:

01

Research and choose a credit union: Start by researching different credit unions and selecting one that best suits your needs. Consider factors such as location, services offered, fees, and interest rates.

02

Gather necessary documents: Before filling out the application, gather all the required documents. This typically includes proof of identification (such as a driver's license or passport), proof of address (such as a utility bill or rental agreement), and proof of eligibility (such as a pay stub or membership card).

03

Complete the application form: Obtain the credit union's account application form either online or in person. Fill out the form accurately and completely, providing all the required information. This usually includes personal details such as your name, address, contact information, Social Security number, employment information, and financial details.

04

Choose the type of account: Determine the type of account you want to open, such as a checking account, savings account, or a combination of both. Consider your banking needs and preferences when making this decision.

05

Provide any additional documentation: Some credit unions may require additional documents or forms to be submitted along with the application. These could include signed membership agreements, beneficiary designations, or tax-related forms.

06

Review and sign the application: Before submitting your application, carefully review all the information you have provided. Make sure there are no errors or omissions. Sign the application form and date it, indicating your consent for opening the account.

07

Submit the application: Once you have completed all the necessary steps, submit your application to the credit union. You can either mail it, drop it off in person, or submit it electronically through the credit union's website, if available.

Who needs a credit union account?

01

Individuals seeking local and personalized banking: Credit unions often prioritize personalized customer service and local community involvement. If you value having a close relationship with your financial institution and prefer banking locally, a credit union account might be suitable for you.

02

Those looking for competitive interest rates: Credit unions are known for offering competitive interest rates on deposits and loans. If you want to earn more on your savings or obtain lower interest rates on loans, a credit union account could be beneficial.

03

Individuals dissatisfied with traditional banks: Some people prefer credit unions over traditional banks due to various reasons, such as dissatisfaction with bank fees, lack of personalized customer service, or a desire to support a local, non-profit organization.

In summary, to fill out a credit union account, research and choose a credit union, gather necessary documents, complete the application form, choose the type of account, provide additional documentation if required, review and sign the application, and finally submit the application. Credit union accounts are suitable for individuals seeking personalized banking, competitive interest rates, or those dissatisfied with traditional banks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit un name account in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your credit un name account as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the credit un name account in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your credit un name account directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out credit un name account using my mobile device?

Use the pdfFiller mobile app to complete and sign credit un name account on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is credit un name account?

Credit union name account refers to an account held by a credit union in the name of a specific individual or entity.

Who is required to file credit un name account?

Credit unions are required to file credit union name accounts with relevant regulatory authorities.

How to fill out credit un name account?

To fill out a credit union name account, the credit union must provide information about the account holder, account details, and compliance with regulations.

What is the purpose of credit un name account?

The purpose of a credit union name account is to hold funds and assets on behalf of members and customers.

What information must be reported on credit un name account?

Information such as account holder name, account number, account balance, and transaction history must be reported on a credit union name account.

Fill out your credit un name account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Un Name Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.