Get the free FIDELITY INSURANCE PROPOSAL - bLionb Assurance Insurance - lion co

Show details

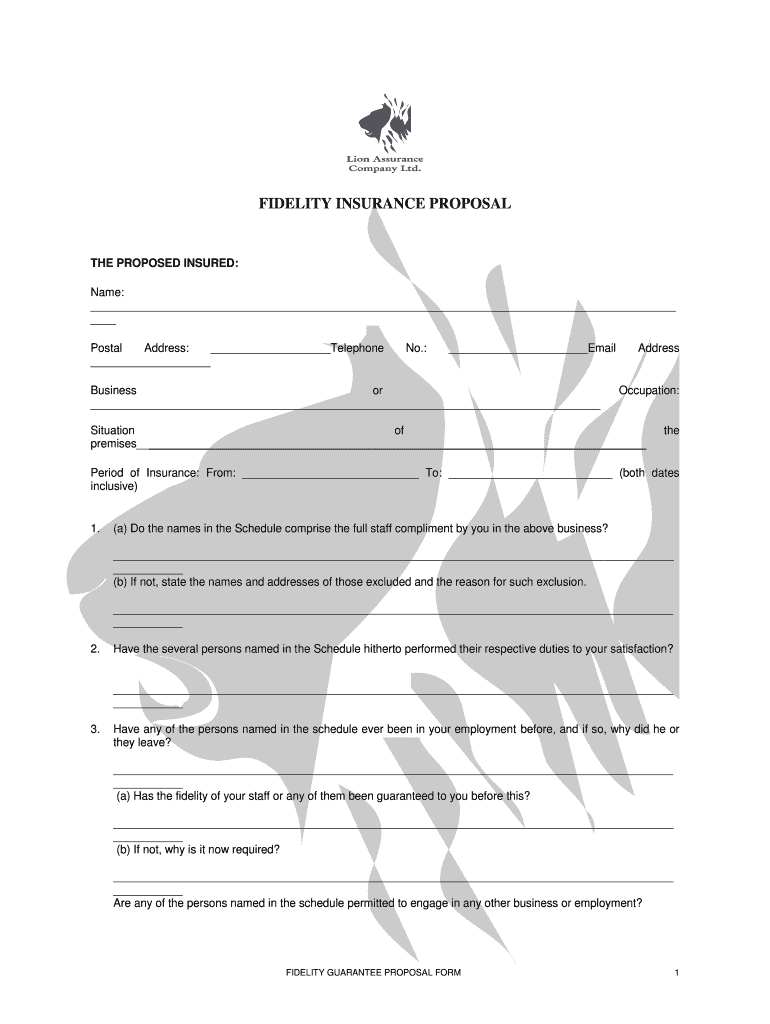

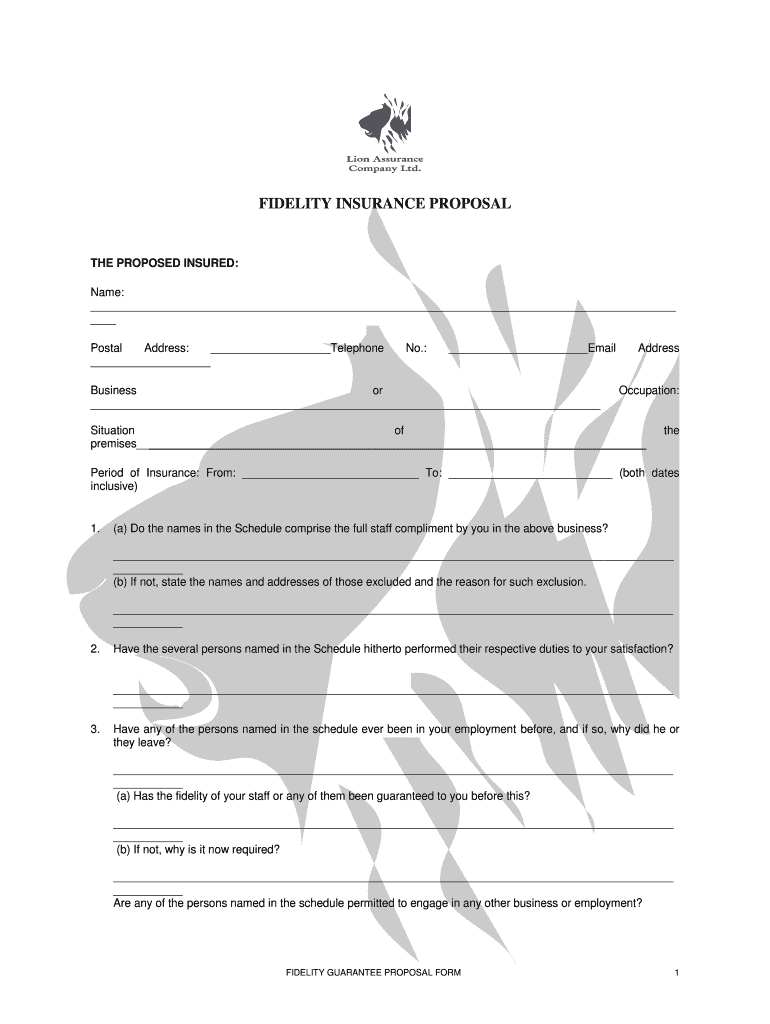

FIDELITY INSURANCE PROPOSAL THE PROPOSED INSURED: Name: Postal Address: Telephone No.: Email Business or Address Occupation: Situation of premises the Period of Insurance: From: To: (both dates inclusive)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity insurance proposal

Edit your fidelity insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity insurance proposal online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fidelity insurance proposal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity insurance proposal

How to fill out a fidelity insurance proposal:

01

Start by gathering all relevant information about your business, including its size, industry, and financial information. This will help determine the coverage you need and the associated costs.

02

Identify the specific risks your business faces that could result in employee dishonesty or fraud. This could include cash handling, access to sensitive information, or inventory management.

03

Research and select a reputable fidelity insurance provider that offers coverage tailored to your business needs. Read through their proposal form carefully to understand the information they require.

04

Begin filling out the fidelity insurance proposal form, providing accurate and detailed information about your business and its operations. This may include details about your assets, employees, financial controls, and any existing risk management measures in place.

05

Provide specific information about the coverage limits you require, including the maximum amount of coverage you need for employee dishonesty or fraud-related losses.

06

Include any additional endorsements or coverage options you may need, such as coverage for cyber fraud or third-party liability.

07

Consider consulting with an insurance broker or professional if you need assistance during the application process. They can help ensure you provide all necessary information and assist with any complex questions.

08

Review the completed fidelity insurance proposal form thoroughly for accuracy and completeness before submitting it to the insurance provider.

09

Keep a copy of the completed proposal for your records, along with any supporting documents or materials the insurance provider may request.

10

Await the insurance provider's response, which may include further questions or requests for additional information before the policy is issued.

Who needs a fidelity insurance proposal?

01

Businesses that handle large amounts of cash, valuable assets, sensitive customer information, or have employees with access to financial transactions should consider a fidelity insurance proposal.

02

Companies that want protection against employee dishonesty, theft, or fraud-related losses should also explore fidelity insurance options.

03

Organizations that want to mitigate the financial risks associated with potential employee misconduct or fraudulent activities can benefit from fidelity insurance. This includes businesses in various industries, such as retail, finance, healthcare, and hospitality.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fidelity insurance proposal directly from Gmail?

fidelity insurance proposal and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my fidelity insurance proposal in Gmail?

Create your eSignature using pdfFiller and then eSign your fidelity insurance proposal immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out fidelity insurance proposal on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your fidelity insurance proposal, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is fidelity insurance proposal?

A fidelity insurance proposal is a document that outlines the terms and conditions of a bond that covers losses resulting from dishonest acts by employees.

Who is required to file fidelity insurance proposal?

Employers or businesses who want to protect themselves against losses caused by dishonest acts of their employees are required to file fidelity insurance proposal.

How to fill out fidelity insurance proposal?

Filling out a fidelity insurance proposal involves providing information about the company, the employees, the coverage limits, and any other relevant details.

What is the purpose of fidelity insurance proposal?

The purpose of a fidelity insurance proposal is to safeguard employers or businesses from financial losses due to fraudulent or dishonest activities of their employees.

What information must be reported on fidelity insurance proposal?

Information such as the name of the company, the names of the employees covered, the coverage limits, and any previous claims history must be reported on a fidelity insurance proposal.

Fill out your fidelity insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.