Get the free T PROFIT CONNECTION - Andalusia Distributing Co Inc

Show details

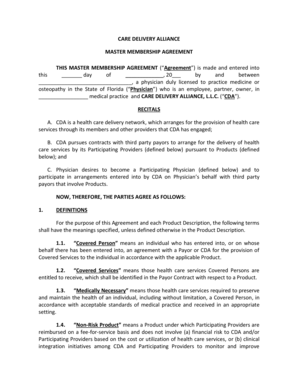

THE PROFIT CONNECTION Your Hotline to Extra Profits May 2010 Prices Good April 30 May 28 3342223671 or 18008488514 As of April 30, 2010, Item No. Description Pack 174223 Dutch Masters Palpably Three

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t profit connection

Edit your t profit connection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t profit connection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t profit connection online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit t profit connection. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t profit connection

How to fill out t profit connection?

01

Start by accessing the t profit connection website or application. You can either download the app from the app store or visit the official website on your computer.

02

Once you have accessed the platform, you will be prompted to create an account. Provide the necessary information such as your name, email address, and create a strong password. Follow the instructions and complete the registration process.

03

After successfully creating an account, you will need to link your bank account to t profit connection. This will allow the platform to track your income and expenses automatically. Follow the provided instructions to securely connect your bank account.

04

Once your bank account is linked, t profit connection will start analyzing your financial transactions. It will categorize your expenses and income, providing you with a clear overview of your financial situation. You can access this information through various reports and charts available on the platform.

05

Make sure to review and verify the categorized transactions regularly. Although t profit connection is designed to categorize transactions accurately, there might be cases where adjustments are needed. You can manually edit the categorization or add additional information if required.

06

Explore the different features of t profit connection that can help you optimize your financial management. You can set budget goals, track your spending habits, and receive alerts for upcoming bills or low account balances.

Who needs t profit connection?

01

Individuals who struggle with maintaining a clear overview of their personal finances can benefit from using t profit connection. It simplifies the process of tracking income and expenses, making it easier to budget and save money.

02

Small business owners or freelancers can also find t profit connection useful. It provides an efficient way to manage business expenses, track income, and generate financial reports for tax purposes.

03

Students and young adults who are starting to develop financial habits can benefit from using t profit connection. It offers a user-friendly interface and educational resources that can help them understand and manage their finances better.

In conclusion, t profit connection is a helpful tool for individuals, small business owners, and students looking to streamline their financial management. By following the step-by-step process of filling out t profit connection and understanding who can benefit from it, users can take control of their finances and make more informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send t profit connection for eSignature?

When you're ready to share your t profit connection, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete t profit connection online?

With pdfFiller, you may easily complete and sign t profit connection online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit t profit connection straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing t profit connection right away.

What is t profit connection?

t profit connection is a tax form used to report profits and losses from business activities.

Who is required to file t profit connection?

Business entities, self-employed individuals, and anyone earning income from business activities are required to file t profit connection.

How to fill out t profit connection?

t profit connection can be filled out manually or electronically by providing detailed information about income, expenses, and deductions related to business activities.

What is the purpose of t profit connection?

The purpose of t profit connection is to calculate the taxable income generated from business activities and determine the amount of tax owed.

What information must be reported on t profit connection?

Information such as income from sales, expenses, deductions, credits, and net profit or loss must be reported on t profit connection.

Fill out your t profit connection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T Profit Connection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.